Using a credit card to access cash can be extremely expensive but there are cheaper ways to do it. The key is using the right card in the right way at the right place. Walking up to your nearest cashpoint and withdrawing money on your everyday credit card is generally a bad idea as it could end up costing you a lot of money. That being said, it doesn't mean that you cannot use credit cards to access cash. In this article, you can find all the key details you need to know to understand how to use a credit card for cash without being hit with huge interest charges or unexpected fees.

Using a credit card to access cash can be extremely expensive but there are cheaper ways to do it. The key is using the right card in the right way at the right place. Walking up to your nearest cashpoint and withdrawing money on your everyday credit card is generally a bad idea as it could end up costing you a lot of money. That being said, it doesn't mean that you cannot use credit cards to access cash. In this article, you can find all the key details you need to know to understand how to use a credit card for cash without being hit with huge interest charges or unexpected fees.

What is the best type of credit card for cash?

If you are in the UK, the best type of credit card for cash is a money transfer credit card. If you are travelling abroad, you should consider a top foreign spending card that lets you withdraw cash for free. With a money transfer credit card, you should first transfer the money you need to a current account. You will usually have to pay a percentage of the amount you transfer as a fee, which is often around 4%. You can then withdraw the money as cash or use your debit card to pay a bill or make a purchase that would not be possible with a credit card.

Using a credit card to withdraw cash abroad is more simple, as long as you have the right credit card. Multiple UK providers do not charge you for taking out cash while you are outside of the UK, even though they would if you were at home. You can head to the nearest cashpoint and withdraw the money you need, though make sure to select the local currency option and watch out for charges made by the ATM operator.

Taking out cash with a standard purchase credit card in the UK will usually be considered a cash advance. These charge a higher rate of interest than the amount charged for an equivalent credit card purchase, even if you have a 0% purchase credit card, and apply the interest straight away. There may also be a fee to pay on top of the interest charges. A cash advance is expensive because it involves getting instant money from your credit card provider, but a purchase does not. Credit card providers will not always immediately pay a retailer when you buy something with your card, but it will have to pay you immediately if you take out cash. This important difference is the reason why there are such hefty extra costs for a credit card cash advance.

Which credit card for cash is best for you?

We have teamed up with Creditec* to help you compare credit card deals and check your eligibility in minutes. You will be able to find out which credit cards you are most likely to be accepted for through a soft credit check, which will not affect your credit score. You can then tailor your personalised list to sort cards by the features that matter most to you. This could mean filtering for the type of credit card you want, sorting the list by the rate of interest or highlighting the cards you are most likely to be successful in applying for. You can click here to compare deals*.

Best credit card for cash – January 2025

These are our top 3 money-transfer credit cards, which is the best way to use a credit card for cash when you are in the UK.

| Name of card | Representative APR | Interest-free period | Money transfer fee | Perks | Extra information |

| MBNA Money Transfer Credit Card - Check eligibility | 24.90% variable | Up to 12 months | 4.00% | n/a | Interest-free period subject to status |

| Virgin Money Balance Transfer Credit Card - Check eligibility | 24.90% variable | 12 months | 4.00% | Offers through Virgin Group discounts | 12 months interest-free on balance transfer and purchases, as well as money transfer |

| Tesco Bank Balance Transfer Credit Card - Check eligibility | 24.90% variable | 9 months | 3.99% | Earn Tesco Clubcard points | Interest-free periods on balance transfer and purchases |

Best credit card for cash with longest interest-free period

- Best for: Those looking for the longest interest-free period with a low fee and reasonable APR

- Representative APR: 24.9% variable

- Interest-free period: Up to 12 months

- Transfer fee: 4.00%

- Perks: No specific perks

- Annual fee: No annual fee

- Why we like it: It's a good all-rounder, with the longest interest-free period currently available – although it is subject to status – as well as a reasonable transfer fee. Find out more on the MBNA website.

Best credit card for cash with balance transfer

- Best for: Those with an existing debt on a credit or store card that they'd like to transfer, as well as those needing money transfer

- Representative APR: 24.9% variable

- Interest-free period: 12 months

- Transfer fee: 4.00%

- Perks: Offers through Virgin Group discounts

- Annual fee: No annual fee

- Why we like it: A great combination of interest-free periods on money transfer (12 months), balance transfer (16 months) and purchases (13 months). Find out more on the Virgin Money website.

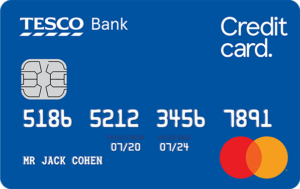

Best credit card for cash for rewards

- Best for: Those who regularly shop at Tesco

- Representative APR: 24.9% variable

- Interest-free period: 9 months

- Transfer fee: 3.99%

- Perks: Earn 5 Tesco Clubcard points when you spend £4 in Tesco, earn 1 point for every £4 spent on Tesco fuel (excluding Esso) plus 1 point for every 1 litre bought, and earn 1 Clubcard point when you spend £8 outside of Tesco

- Annual fee: No annual fee

- Why we like it: This card has a 9 month interest-free period for money transfers and an up to 22 months interest-free period on balance transfers. Cardholders can also collect extra Clubcard points when spending on the card. Find out more on the Tesco Bank website.

Best credit card for cash for travelling

- Best for: Taking out cash abroad

- Representative APR: 23.9% variable

- Interest-free period: 56 days

- Transfer fee: 3.00%

- Perks: Free to use your card abroad – purchases and cash withdrawals. Unlike with a money transfer credit card in the UK, you can use this card to withdraw cash directly from an ATM in a host of foreign countries without needing to make a transfer to a current account.

- Annual fee: No annual fee

- Why we like it: Use your card abroad for free, including purchases and cash withdrawals. You can find out more on the Halifax website. The Barclaycard Rewards Credit Card is also a good option, though free cash withdrawals are capped at £500 per day.

How to make the most of a credit card for cash

The key to making the most of a credit card for cash abroad is to ensure you are getting a top exchange rate and are not being charged by the ATM provider to get the cash. ATM fees can quickly erode the savings you have made through getting a top card, depending on how much you are taking out. Try to find a free ATM or bank to get your cash from.

Getting cash from a money-transfer credit card in the most efficient way is a little more complicated. These cards work by allowing you to transfer money into your bank account, but do not allow you to draw out cash for free directly. Instead, transfer the funds to your current account and withdraw the cash with your debit card.

The maximum amount you can transfer will depend on your financial situation and credit score and will be decided by your card provider when you apply. Once you’ve carried out your money transfer, you will make monthly payments to clear your debt, just as you would with any other credit card. The sooner you pay this off, the cheaper it will be. Clear your balance within your card's interest-free period and you will not be charged any interest.

What to consider before you get a credit card for cash

Think about how much it will cost you to use your credit card for cash. The exact fees for withdrawing cash from a credit card will depend on the fees you are charged by your provider as well as how much cash you take out. Providers start to apply interest as soon as you take the money out and charge a cash advance fee. The interest can be higher than what you would expect to pay for an equivalent cost purchase and the fee will usually be around 3% of the cash advance. While most credit card providers will give you at least 56 days to clear the balance you build up through direct purchases with retailers, this will not apply to a cash advance. Even if you only end up taking out £10 or £20 in cash on your credit card, it is likely to end up costing you a lot more.

A way to avoid this is to transfer the funds to your current account using a money transfer credit card, then use your debit card to take the money out.

Pros and cons of a credit card for cash

Here are the main advantages and disadvantages to consider before you get a credit card for cash:

Pros of a credit card for cash

- Borrow for payments that cannot be made on a credit card

- Pay off debt (including debt that cannot be transferred to a 0% balance-transfer credit card)

- Benefit from a limited-time interest-free period on the top money transfer credit cards

Cons of a credit card for cash

- The top money transfer credit cards have short 0% periods compared to the best balance transfer and purchase credit cards

- Money transfer credit cards usually charge a fee to transfer

- You must repay at least the minimum on your credit card balance

- You may not be able to borrow all the money you need

Alternatives to a credit card for cash

Using a credit card for cash may not be the right option to solve your problems, so here are a few alternative ways to accessing cash:

Current account overdraft

Overdrafts can charge very high interest rates in some cases, but are likely to be marginally cheaper than a cash advance. You will need to arrange an overdraft with your bank before you take the cash out and – like with a cash advance – you should try to pay back the amount you owe as soon as possible if it is growing with interest.

0% purchase credit card

Using your credit card to make a purchase with a retailer is usually much cheaper than a cash advance, especially if you have a 0% purchase period on the card. You can spread the cost and benefit from section 75 purchase protection. Unfortunately, not every purchase can be made with a credit card so you may require cash from a different source.

Check out our article 'Can you pay bills with credit cards?', as you may be surprised what you can pay for directly with a credit card.

Personal loan

You can use a personal loan for almost any purchase, including taking the money out in cash. If you need to borrow a significant amount of money over a longer period of time, a top personal loan usually trumps a credit card. We cover the key differences between credit cards and loans in our article ‘Is it better to get a credit card or a personal loan?’.

Don't get caught out by some short-term personal loan or payday loan providers that charge very high interest rates and should be avoided.

Help with paying essential costs

If you are struggling to pay your bills or meet existing debt repayments, consider getting some free advice. Organisations such as StepChange or Citizens Advice can help you plan out a better way to manage your finances, negotiate a new pay structure with whoever you owe money to and ensure you are getting any benefits or government help you are entitled to.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product.