Interactive Investor* (ii), one if the UK's biggest investment platforms, has announced the launch of a Managed ISA. Existing customers can access all 10 of its ready-made portfolios from 15th May with new customers being granted access from 20th May 2024.

Interactive Investor* (ii), one if the UK's biggest investment platforms, has announced the launch of a Managed ISA. Existing customers can access all 10 of its ready-made portfolios from 15th May with new customers being granted access from 20th May 2024.

In this article, we look at Interactive Investor's Managed ISA explaining how it works, the types of portfolios available and how much it costs.

How does the Interactive Investor's Managed ISA work?

Customers wishing to invest in Interactive Investor's Managed ISA will first need to answer a few basic questions about how much they wish to invest and the level of risk they’re comfortable with. They will then be matched with a recommended Managed ISA portfolio based on their savings goals and the level of risk they are comfortable with.

The Managed ISA can then be opened with an initial minimum lump sum of £250 or, if preferred, a regular monthly deposit of at least £50 by direct debit. There is no minimum investment period, however, ii stresses that its Managed ISA portfolios are designed for 'long-term growth', meaning investors should have an investment horizon of at least 5 years.

How much does the Interactive Investor Managed ISA cost?

There isn't a separate management fee for the Interactive Investor Managed ISA meaning it is available to all ii investors as part of the existing flat-fee subscription. As with any investment fund, investors will need to pay additional fund fees, market spread and variable transaction costs and these range from 0.13% to 0.29%.

Interactive Investor Managed ISA portfolios

Interactive Investor's Managed ISA portfolios offer two investment styles ('Index' and 'Sustainable'), each with five levels of risk, meaning there are 10 portfolios in total to choose from.

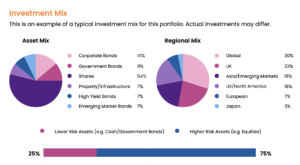

Interactive Investor Managed ISA portfolio asset mix example

Interactive Investor offers two investing styles; 'Index' and 'Sustainable'. Below we provide an example of the asset mix based on the Balanced Index Portfolio (Risk Level 3).

Interactive Investor Managed ISA options

ii Managed ISA Index Portfolios

The 'Index' investment style aims to keep costs low by avoiding frequent changes to the portfolio. It predominately invests in passively managed funds and provides exposure to a diversified range of investments. We provide a breakdown of each of the 5 index portfolios on offer below.

| Name | Risk Level | Lower Risk Assets % (Cash, Bonds etc) | Higher Risk Assets % (Equities etc) | Fee |

| Cautious Index Portfolio | 1 | 70% | 30% | 0.20% |

| Moderate Index Portfolio | 2 | 50% | 50% | 0.19% |

| Balanced Index Portfolio | 3 | 25% | 75% | 0.19% |

| Adventurous Index Portfolio | 4 | 10% | 90% | 0.17% |

| Very Adventurous Index Portfolio | 5 | 3% | 97% | 0.13% |

ii Managed ISA Sustainable portfolios

The 'Sustainable' investment style aims to keep costs low by predominately investing in passively managed funds. Additionally, it selects sustainable funds that consider Environmental, Social and Governance (ESG) criteria. It also invests in other assets including cash and bonds.

| Name | Risk Level | Lower Risk Assets % (Cash, Bonds etc) | Higher Risk Assets % (Equities etc) | Fee |

| Cautious Sustainable Portfolio | 1 | 70% | 30% | 0.25% |

| Moderate Sustainable Portfolio | 2 | 50% | 50% | 0.25% |

| Balanced Sustainable Portfolio | 3 | 25% | 75% | 0.28% |

| Adventurous Sustainable Portfolio | 4 | 10% | 90% | 0.29% |

| Very Adventurous Sustainable Portfolio | 5 | 3% | 97% | 0.27% |

How does it compare to Vanguard's Managed ISA?

Interactive Investor's fee structure means that there are cheaper alternatives when investing smaller sums. For example, it would only cost £30 per year to invest £5,000 in a Vanguard Managed ISA, compared to £78 with Interactive Investor. However, as Interactive Investor's subscription fee is flat, it becomes more competitive as you invest more, as shown in the table below.

| Number of portfolios | Platform Fee | ISA Management Fee | Fund Fees | Cost to invest £20,000¹ | |

| ii Managed ISA | 10 | £4.99 or £11.99 per month | N/A | 0.13% to 0.29% | £98 |

| Vanguard Managed ISA | 5 | 0.15% capped at £375 | 0.30% | 0.15% | £120 |

¹ Based on the ii Balanced Index portfolio

Is the Interactive Investor Managed ISA any good?

Interactive Investor's* Managed ISA provides a simple option for investors who are happy to let somebody else take care of the investment decisions. There are no management or administration fees meaning investors only pay fund fees of between 0.13% and 0.29% on top of the monthly subscription fee. This makes it one of the cheapest managed ISAs for those looking to invest their full £20,000 ISA allowance.

Check out our full independent Interactive Investor review for more details on the Interactive Investor platform, its flat-fee structure and how its products compare. Those specifically interested in Managed ISAs may want to check out our article 'Best Stocks & Shares ISAs in 2024' where we list our top picks for a number of different types of ISAs.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Interactive Investor