The concept of the "Efficient Frontier" was introduced by Harry Markowitz in 1952 and is an important part of modern portfolio theory. It can be used to help investors construct portfolios that offer the highest possible returns for a given level of risk.

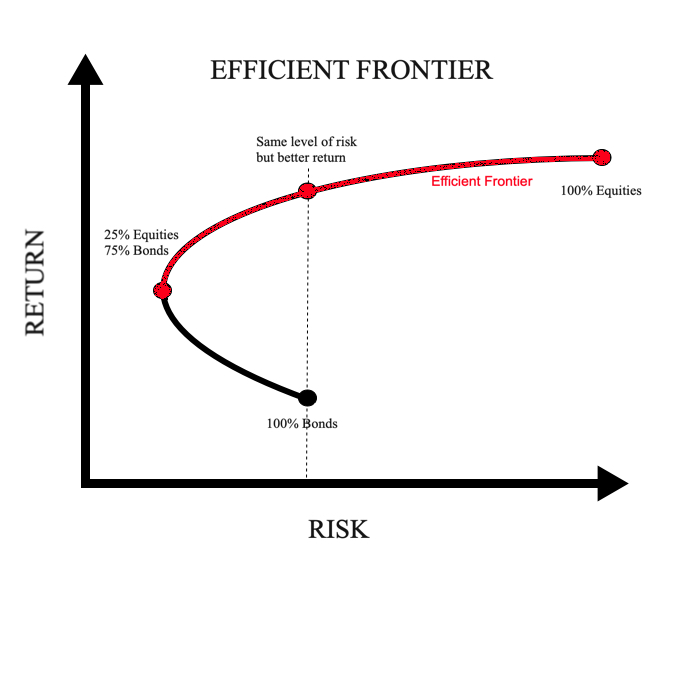

What is the Efficient Frontier?The Efficient Frontier is a graphical representation of the optimal portfolios that offer the highest expected return for a given level of risk based on historical evidence. In essence, it’s a curve on a graph where:

- The x-axis represents risk, typically measured by the portfolio’s standard deviation (or volatility). It shows increasing levels of risk as we move to the right.

- The y-axis represents return, usually measured as the annualised return of the portfolio over a period of time.

Here is a hypothetical example:

The image demonstrates the concept of the Efficient Frontier, where different portfolio combinations are plotted based on their risk and return characteristics.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in