The Cheapest fund platforms for Stocks & Shares ISAs for most people

If you want a professional to invest the money in your Stocks and Shares ISA investment for you then Wealthify provides one of the cheapest discretionary investment services in the market. Think of it like enjoying the cost savings available to DIY investors without having to run the money yourself. You can read our full unbiased Wealthify review.

If instead, you want to invest your money yourself (so-called DIY investing) then the cheapest fund platform will depend on the size of your investment, what you invest in and how many trades you make on an annual basis.

1 minute summary - Compare the cheapest and best investment ISA platforms

- There are a number of fees to consider when comparing fund platforms including dealing fees, management charges, transfer fees, admin fees and in some cases even exit fees

- While cost is important, remember to factor in investment fund choice, customer service, online functionality and tools when making your choice.

- Our overall best Stocks and Shares ISA is the Hargreaves Lansdown Stocks and Shares ISA*

- Our overall best buy Stocks and Shares ISA provider for beginners is Wealthify

- Use our purpose-built Stocks and Shares ISA comparison table below to see which is the best and cheapest investment ISA platform

Below I have calculated the cheapest fund platforms for an ISA investment assuming that you plan to invest the full annual ISA allowance of £20,000 into funds and make 10 fund switches a year. The top 5 cheapest ISA providers are:

Cheapest Stocks and Shares ISA providers – if you invest in funds yourself

| Stocks and Shares ISA provider | Year 1 cost |

| Vanguard Investor | £30 |

| InvestEngine | £50 |

| Charles Stanley Direct* | £60 |

| Fidelity* | £70 |

| AJ Bell Youinvest* | £80 |

Vanguard only offers its own tracker funds to invest in

Cheapest Stocks and Shares ISA providers – if you want to invest in investment trusts, ETFs & shares yourself

| Platform | Year 1 cost |

| X-O | £119 |

| Interactive Investor* | £140 |

| IG | £160 |

| Bestinvest* | £170 |

I have assumed a maximum of 10 annual trades (made of 10 buys and 10 sells).

Join ii and get 6 months free

Open an Interactive Investor ISA...

- Pay no account fees for 6 months

- That's a saving of up to £12.99 every month

- New customers only, other Fees and Terms apply, Capital at risk

- Offer ends 31st December 2024

Comparison of Stocks and Shares ISA & SIPP investment platforms

Of course, most investment platforms allow you to invest via a Stocks and Shares ISA as well as a SIPP. So there are cost and admin efficiencies from using the same fund platform for both. At this stage you may not know whether you want to invest your money via a SIPP or an ISA. Or you may plan to start saving into a pension (SIPP) in the future. So it may make sense to ensure that the platform you choose is the cheapest for investing in both an ISA and a pension. Below I compare investment platforms showing the cheapest investment platform for both Stocks and Shares ISA and SIPP investments.

To produce the table I compared both the SIPP charges and the Stocks and Shares ISA charges across the market assuming an initial lump sum investment of £20,000 into a Stocks and Shares ISA and an initial investment of £5,000 into a SIPP. I have allowed for a maximum of 10 fund switches per year:

Cheapest combined SIPP & ISA providers (investing in funds)

| SIPP & ISA provider | Year 1 cost |

| Vanguard | £38 |

| Fidelity* | £88 |

| Hargreaves Lansdown* | £113 |

Vanguard only offers its own tracker funds to invest in

5 steps to finding the cheapest Stocks & Shares ISA provider for you

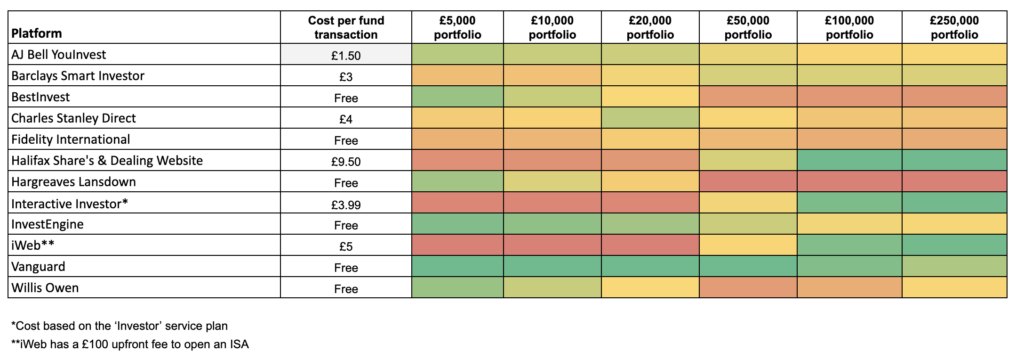

To find the cheapest Stocks and Shares ISA provider for your size of portfolio use our purpose-built Stocks and Shares ISA comparison table below. It quickly compares every major Stocks and Shares ISA provider out there to find the cheapest ISA provider for your investment size. Follow the steps below:

- Decide the size of your initial ISA investment you want to invest

- Click on the ISA comparison heatmap table below to enlarge it

- Look down the column of the amount you wish to invest. The colour scale runs from red (expensive) to green (cheap) and assumes you plan to invest in funds and make around 10 fund switches a year, which is typical.

- Choose a platform

- Be sure to bear in mind how your chosen platform compares at higher portfolio values if you plan to add more money to the account later

Stocks and Share ISA comparison table

Red indicates expensive and green indicates low cost (click to enlarge)

Best buys – Stocks and Share ISA providers

Of course, it's not all about the cheapest ISA as I explain later in the section ‘the things to consider when picking the best fund platform'. Below I provide a roundup of our best buys for ISA beginners and the best overall fund platform for your Stocks and Share ISA. If you are particularly interested in performance, then check out our Stocks and Shares ISA performance tables.

Overall best buy Stocks and Shares ISA

Hargreaves Lansdown Stocks and Shares ISA* – provides the best combination of cost, investment fund choice, customer service, online functionality and tools of all the providers out there. Unsurprisingly it's the most popular Stock and Shares ISA in the UK and has won numerous industry awards.

Best buy Managed Stocks and Shares ISA for beginners

Wealthify – provides one of the cheapest discretionary investment services (which means that they make the investment decisions for you) in the market for under £20,000 by mainly investing in Exchange Traded Funds (ETFs). Given that ETFs are the cheapest way to invest it's unsurprising that Wealthify is so cost-effective. Wealthify's investment performance to date has also been very strong in its ethical portfolios.

Important things to consider when picking the best fund platform

With the rise in DIY investing many investors are now looking to maximise the return from their investments by using a fund platform (also known as an investment platform) to manage their investments themselves.

What is an investment platform?

An investment platform (also known as a fund platform or a fund supermarket) is an online shop where you can buy, sell and hold all your investments in a tax-efficient wrapper such as a Stocks and Shares ISA or a SIPP (Self Invested Personal Pension).

Fund platforms will have their own Stocks and Shares ISA (often called an Investment ISA) as well as SIPP product. Think of these like boxes into which you place your investments (funds). While the way these products work are the same across the various investment platforms there are distinct differences, such as the number of funds available and the charges that are applied.

Therefore when selecting the best stocks and shares ISA provider that suits your needs it is important to read the below list of the things to consider. The best investment platform for one investor is not necessarily the best for another investor.

Two things to check to find the best Stocks and Shares ISA

Whether it is a wider choice of investment types, investment tools, research, model portfolios or ease of use on a smartphone every fund platform will offer something different. It makes sense, therefore, to do some research on a number of investment platform providers before you choose the right investment platform for your needs.

1 – Make sure the fund platform provides the investment choice you require

Many people will start looking for an investment platform when they want to invest in a stocks and shares ISA as they search for a better return on their investment. However, over time, the same person may want to invest beyond the limits of the annual ISA allowance and, say, start providing for their retirement by starting to invest in a SIPP or start a Junior stocks and shares ISA for their children. It makes sense, therefore, to use an investment platform which will be able to provide a service that can grow with your investment needs over time.

2 – Always check out the range of charges

The above Stocks and Shares ISA comparison heatmap calculates the cheapest ISA provider for you based on your ISA portfolio size as well as the assumption that you wish to invest in funds and make around 10 fund switches a year. However, it is worth familiarising yourself with the full range of charges that an investment platform will apply for the administration of your investments. Some will only be applied if you decide to move your money elsewhere.

Administrative charge

This is the basic charge for use of the fund platform and will either be a flat fee or a percentage fee, which is dictated by the amount of investment. Typically a flat fee approach is more cost-effective if you have over £50,000 in your portfolio. However, beware that most flat fee-based platforms charge dealing fees which can quickly negate the benefit of a flat fee over a percentage based fee.

Dealing fees

These are fees charged every time you buy and sell funds. The more you switch your investments between funds the more these fees will mount up. Most fund platforms don't charge for fund switches but make sure you check (although they are listed in the heatmap above).

Fund manager charge

This is strictly speaking not a fee charged by the fund platform but one charged by the fund in which you invest. Some of the larger investment platforms (such as Hargreaves Lansdown) will negotiate a reduced fee with a fund manager due to the high level of business that is transacted in that fund. So it is worth comparing the fees charged on your desired funds across different platforms.

Transfer fees

If you want to move your investments from one platform to another then the platform you are leaving may charge you a fee for doing this.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Fidelity, Interactive Investor, Hargreaves Lansdown, AJ Bell, Bestinvest, Charles Stanley Direct,