In this independent InvestEngine* review, I analyse how the investment platform compares to its peers. I also look at the platform's innovative features, its investment choice and whether it really is the cheapest way to invest, particularly in Vanguard funds. I also consider the pros and cons of InvestEngine as well as the alternatives.

In this independent InvestEngine* review, I analyse how the investment platform compares to its peers. I also look at the platform's innovative features, its investment choice and whether it really is the cheapest way to invest, particularly in Vanguard funds. I also consider the pros and cons of InvestEngine as well as the alternatives.

I suggest you read the review from beginning to end however you can use the links below to jump to key sections of the review.

- How does InvestEngine work?

- InvestEngine features/key features

- How much does InvestEngine cost?

- Is InvestEngine safe?

- Alternatives to InvestEngine

- Is InvestEngine any good?

InvestEngine Bonus Offers

Welcome Bonus - Get up to £100

Invest at least £100 with InvestEngine and receive a welcome bonus of up to £100*. Simply sign up to InvestEngine via the welcome bonus link. The bonus will be paid once you invest at least £100 in your portfolio. T&Cs apply. Capital at risk.

Pay no management fees (Exclusive offer) – Invest in a managed portfolio FREE for 12 months

InvestEngine will waive its management fees for a year* if you invest at least £100 in one of its managed investment portfolios. Offer applies to all managed portfolios, whether held in a general investment account, Stocks & Shares ISA or SIPP. ETF costs apply. T&Cs apply. Capital at risk.

InvestEngine features/key features

InvestEngine offers a number of key features:

- Welcome Bonus - Get a welcome bonus up to £100* when you sign up

- Free DIY investing service (no platform fee) - When you build and manage your own ETF portfolio there are no dealing fees, platform fees or set-up charges.

- ISA account - InvestEngine allows you to invest tax-free via a Stocks and Shares ISA.

- Pension (SIPP) - InvestEngine also offers a low-cost personal pension. In December 2024, InvestEngine removed its 0.15% SIPP fee.

- 10 Managed growth portfolios - InvestEngine only charges a 0.25% platform fee on its managed portfolios.

- LifePlans - Range of 5 actively managed portfolios built by InvestEngine's team of investment experts

- Fractional investing - Invest as little as £1 in any of its ETFs, no matter the share price, giving investors access to even the highest priced ETFs

- Savings Plan - Autoinvest a chosen amount into your portfolio weekly, fortnightly or monthly. Minimum investment of £10 per week.

- Access to 690+ ETFs - Including ETFs from Vanguard and iShares.

- Business accounts - InvestEngine allows business owners to invest cash held within their companies.

- App - An app is available on Apple App Store and the Google Play Store.

- One-click portfolio rebalancing - An innovative ability to rebalance your DIY portfolio back to your predetermined ETF allocations with a single click.

- Automatic portfolio rebalancing when adding/withdrawing lump sums - Another innovative feature is that if you request to add or withdraw funds from your DIY portfolio, InvestEngine implements the instruction while trying to maintain your portfolio’s investment allocation.

- £100 minimum investment

Welcome bonus of up to £100

Open an InvestEngine account.

- Receive a welcome bonus of up to £100 when you invest at least £100

- New customers only

- T&Cs apply, Capital at risk

Tax rules subject to individual status and may change.

What is InvestEngine?

InvestEngine* is an interesting proposition. Having launched in 2019 it claims to be “smarter, nimbler, far cheaper and more accessible than a normal investment manager”. In reality, InvestEngine is an investment platform that attempts to be a one-stop shop for DIY investors.

Normally investment platforms fall into one of two types. Firstly, there are the large investment platforms such as Interactive Investor* and Hargreaves Lansdown* which specialise in offering a wide range of unit trusts, investment trusts, exchange traded funds (ETFs) and share dealing services that allow investors to build their own investment portfolios. These are the true Do-It-Yourself investment platforms.

Then there are the robo-advice services such as Nutmeg, Moneyfarm and Wealthify that just offer discretionary managed portfolios at low-cost, usually with low minimum investment requirements. Such services do not offer the ability for investors to pick and choose individual investment funds or shares, which in part is why they are able to keep costs so low. Some of these so-called robo-advice platforms, or investment managers, go as far as making regulated portfolio recommendations from their limited range of portfolios.

InvestEngine is an interesting proposition because it is a hybrid of the two aforementioned types of platform. At its heart lies 10 low-cost diversified managed ETF portfolios, not dissimilar to the likes of those offered by Nutmeg and Moneyfarm. Investors can fill out a short questionnaire about their investment goals and the amount of risk they’re comfortable with and InvestEngine will recommend an investment portfolio that is best suited to them.

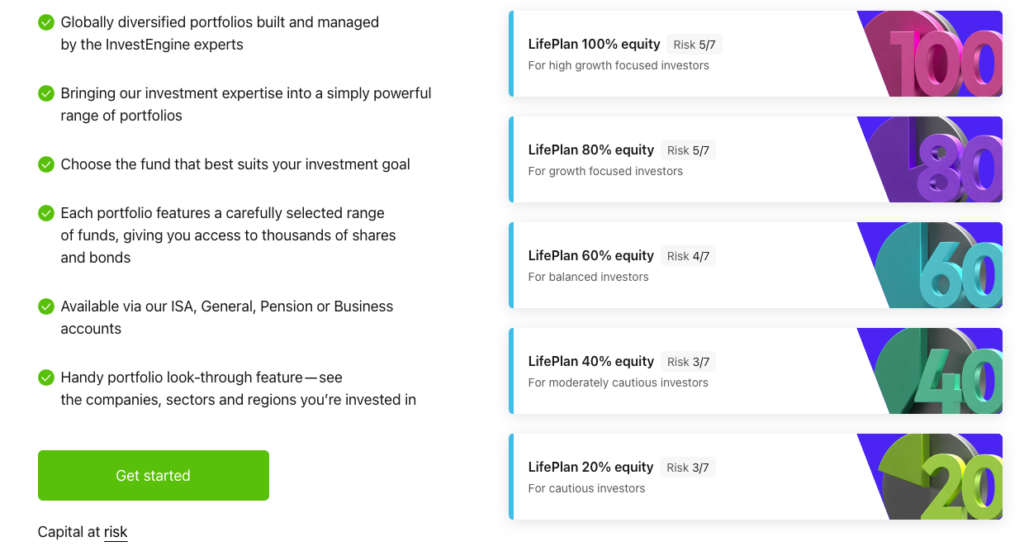

It also offers a range of 5 actively managed, globally diversified 'LifePlan' portfolios, similar to the Vanguard Lifestrategy range of funds, each with a carefully selected range of funds with a mix of equities and bonds. We explain how the managed and LifePlan portfolios work in more detail below.

InvestEngine also allows those investors wanting to take a more hands-on approach to pick their own investment funds too. This means that InvestEngine is able to combine managed portfolio options, offered by most robo-advice propositions, along with some of the DIY investment options offered by the larger investment platforms such as Hargreaves Lansdown. However, it typically manages to do so at a lower cost, albeit with less investment choice. Coupled with a number of InvestEngine’s innovations there is a sense that InvesEngine is trying to enter what is a competitive market by innovating rather than by simply replicating its competitors.

How does InvestEngine work?

InvestEngine enables investors to either build and manage their own investment portfolio themselves. Alternatively, for those who prefer someone else to make investment decisions on their behalf, they can choose one of the actively managed LifePlan portfolios or alternatively, they can complete a questionnaire in order to receive a recommended ready-made managed portfolio that best suits their investing style.

All options are keenly priced, with the DIY portfolio option being free of any platform charge if investing via its Stocks and Shares ISA, SIPP or General Investment Account.

Those who prefer to invest in one of the LifePlan or managed portfolios will pay an annual platform fee of 0.25% which is almost half of the most popular investment platform in the UK. I analyse the cost of investing via InvestEngine versus its peers later in this review.

While its low-cost charging structure is undeniably attractive to individual investors, business owners can also use InvestEngine to invest without taking cash out of their business. This is another feature that sets InvestEngine apart from its competitors.

InvestEngine LifePlan portfolios

In December 2024, InvestEngine launched 'LifePlans', a range of 5 globally diversified portfolios featuring a carefully selected range of funds with a mix of equities and bonds. LifePlans are, in essence, InvestEngine's answer to Vanguard's hugely popular range of LifeStrategy funds. Built with a similar investment strategy, its lowest risk portfolio (rated 3/7) is the LifePlan 20, which aims to have around 20% of the portfolio invested in equities and around 80% in bonds. Its highest-risk portfolio (rated 5/7) is the LifePlan 100, where 100% of the portfolio is invested in equities and is aimed at investors targeting long-term growth. Other options include the LifePlan 40, LifePlan 60 and LifePlan 80.

While the similarities with the Vanguard LifeStrategy funds are hard to ignore, InvestEngine has its own, clearly defined process regarding its portfolio construction methodology. Investors can read all about its investment philosophy, which explains this process in detail. In constructing its LifePlans, InvestEngine says that while the portfolio construction is largely based on diversified global market indexes, it also adopts a 'mean‑variance optimisation approach' to adjust investment exposures. For example, depending on its analysis of where the best value lies, it may decide to vary exposure to inflation‑protected bonds and duration levels.

InvestEngine managed portfolios

InvestEngine also offers 10 off-the-shelf Growth portfolios of varying risk levels. The good news is that you can see all of the funds within each portfolio if you register with InvestEngine*, and there is no obligation to invest any money. It is worth registering to see the suggested portfolio as it takes only a few minutes. The growth portfolio that I was recommended is shown below (click the image to enlarge).

With each growth portfolio you can view future projected growth charts as well as the underlying asset mix. It is not possible to see data on an InvestEngine portfolio's past performance, but that presumably is down to the recency of the platform’s launch and current regulation. However, as InvesEngine is transparent about which ETFs are included in each portfolio you can look at their individual past performance if you wish. InvestEngine's 0.25% management fee means that it is one the cheapest ways to invest in a managed portfolio in the UK., I analyse costs in more detail later in this article.

Disappointingly, InvestEngine does not currently offer managed ethical portfolios to invest in. That said, investing in ethical and ESG ETFs via InvestEngine’s DIY portfolio service is possible.

Free DIY portfolios

As stated, InvestEngine also allows customers to build and manage their own portfolios from a selection of over 690 ETFs. The list includes ETFs from the likes of UBS, Vanguard, HSBC, iShares, Xtrackers and L&G. The DIY portfolio’s user interface is straightforward to use, if a little basic, but it’s the fact that there is no account fee, dealing charge or set up fee that will grab most new and experienced investors’ attention. The absence of any platform fee and no upfront charge makes it an incredibly cheap way to build a DIY ETF portfolio, albeit from a limited choice of ETFs. Again, I compare the costs of building a DIY investment portfolio on InvestEngine against other investment platforms later in this article.

InvestEngine Savings Plans

InvestEngine launched its savings plans* in June 2023 which allows investors to regularly invest specific amounts into any one of its 690+ ETFs, benefiting from pound-cost averaging. The savings plans require customers to agree to Variable Recurring Payments (VRPs), a system that lets InvestEngine safely connect to their bank account, in order to make payments on their behalf in line with agreed limits. Investors can choose the amount and frequency of payments, choosing from weekly, fortnightly or monthly amounts. In theory, this means you could decide to invest your full £20,000 annual ISA allowance by setting up a weekly payment of £384.61, a fortnightly payment of £769 or a monthly payment of £1,666. The feature also allows customers to invest in fractional shares ensuring every penny of their chosen amount is invested each time. In order to use the savings plan, you'll need to agree to a minimum investment of £10 per week.

No fees for 12 months on managed portfolios

Open an InvestEngine account and:

- Pay no managed portfolio fees for 12 months

- £100 minimum investment

- SIPP Fee and ETF costs apply

- New customers only. T&Cs apply, Capital at risk

How to set up an InvestEngine account

InvestEngine’s sign-up process is quick and straightforward. While the minimalistic design won’t win any design awards it provides a clean and easy user journey. When you sign up you will be initially asked to choose whether you want to invest as an individual or a business, the latter plugging a gaping hole in the online wealth management landscape. Most digital wealth managers only offer accounts for individuals.

As an individual investor you are then asked whether you want to create your own Free DIY portfolio or invest in one of InvestEngine’s managed portfolios.

Whichever option you choose you are then given the option to open an ISA account, Pension (SIPP) or a General Investment Account (GIA). Unlike the GIA, investing via an ISA allows you to benefit from sheltering any profits from income tax and capital gains tax. InvestEngine can also accept transfers from existing Stocks and Shares ISA accounts held elsewhere.

If you chose to build your own portfolio then you are taken to a tool that enables you to select your desired ETFs from a list of over 690 and then set the percentage allocation for each fund.

For those taking out a managed growth portfolio, you are put through a short series of questions to determine your risk profile before you receive a suggested portfolio from InvestEngine’s stable of 10 growth portfolios. Each portfolio contains a mix of ETFs exposed to equities, bonds and alternative assets (such as gold). At this point, you can decide to increase or decrease the risk level within the suggested portfolio which will alter the asset mix, the projected growth rates accordingly. It must be stressed that the portfolio is not a formal regulated investment recommendation, merely a suggestion which you can accept or alter as you wish. Other robo-advice firms such as Nutmeg and Wealthify do make regulated portfolio recommendations following their investor questionnaires, the suitability of which is reviewed annually. With InvestEngine, the onus is on the customer to decide the suitability of the portfolio and the associated risks.

How much does InvestEngine cost?

One of the most exciting aspects of InvestEngine's proposition is its cost. There are no exit fees, so if you use InvestEngine and decide you want to transfer your money elsewhere at a later date then you won't be penalised for doing so. In terms of the ongoing investment charges it depends whether you invest in InvestEngine's managed portfolios or take the DIY route and build your own portfolio. The charges for each are detailed below.

LifePlan & Managed portfolio costs for InvestEngine ISA

- 0.25% per annum InvestEngine management charge - which is less than many of its competitors' equivalent fees including Nutmeg and Moneyfarm (see below).

- 0.15% - 0.25% ETF annual charge - according to InvesEngine the average ETF charge is 0.14% per annum within its growth portfolio

- 0.07% Market spread - InvestEngine estimates this to be 0.07% per annum on its ETFs. The market spread is the difference between an ETF buy and sell price.

This brings the total cost of an InvestEngine growth portfolio to approximately 0.47% per annum. The table shows how this compares to the leading digital investment managers (robo-advisers) in the UK.

| Charges when investing £10,000 | InvestEngine LifePlan & Managed portfolios | Nutmeg Fully Managed portfolios | Nutmeg Fixed Allocation portfolios | Moneyfarm Fully Managed portfolio | Moneyfarm Fixed Allocation portfolios | Wealthify |

| Management fee per annum | 0.25% | 0.75% | 0.45% | 0.70% | 0.45% | 0.60% |

| ETF charge per annum (average) | 0.14% | 0.20% | 0.17% | 0.20% | 0.15% | 0.16%* |

| ETF spread per annum (average) | 0.07% | 0.04% | 0.04% | 0.10% | 0.02% | - |

| Total | 0.46% | 0.99% | 0.66% | 1.00% | 0.62% | 0.76% |

*Wealthify quote a combined ETF annual charge and spread charge of 0.16% in total

DIY ISA portfolio costs

InvesEngine currently doesn’t charge any platform (administration) fee for its DIY investment portfolios for its Stocks and Shares ISA or General Investment Account.

The table below compares the cost of building and running an investment portfolio of ETFs on InvestEngine versus the market-leading DIY investment platforms.

| Charges when investing £10,000 in ETFs | InvestEngine DIY | Hargreaves Lansdown | Interactive Investor | AJ Bell | Vanguard Investor | iWeb |

| Account opening charge | FREE | FREE | FREE | FREE | FREE | £100 |

| Monthly platform fee | FREE | FREE* | £4.99 | 0.25% p.a. (max £3.50pm) | 0.15% (Capped at £375 per year) | FREE |

| Cost per trade | FREE | £11.95 | £3.99 | £9.95 | FREE | £5 |

*Hargreaves Lansdown does not charge its 0.45% platform fee on ETFs when invested via its Fund and Shares account. The charge is applied if you invest via an ISA or SIPP.

InvestEngine - the cheapest way to buy Vanguard funds?

Vanguard is gaining increasing traction with UK investors, because of its low-cost ETFs and unit trusts so understandably investors often want to access these low-cost funds as cheaply as possible. Now while Vanguard has launched its own platform, Vanguard Investor, it is not necessarily the cheapest way to buy and hold Vanguard ETFs.

If you simply want to buy Vanguard ETFs then InvestEngine is the cheapest way to do this as it does not charge any platform fee, transaction fee or account opening fee as shown above. However, it does not offer every Vanguard ETF and certainly does not offer the popular Vanguard Lifestrategy funds range, as they are unit trusts. However, as mentioned above, InvestEngine has launched its Lifeplan portfolio range which is its own equivalent to the Vanguard LIfestrategy range.

But, if you are looking for a wider choice of Vanguard ETFs and/or to invest in the Vanguard Lifestrategy fund range then using the Vanguard Investor platform would most likely be most cost-effective for most people. However, as I highlight in my Interactive Investor review, Interactive Investor is one of the cheapest ways to buy and hold Vanguard ETFs and the Vanguard Lifestrategy funds, within an ISA or SIPP, if you have at least £96,000 invested in Vanguard funds within your ISA, or £104,000 invested if you are using a SIPP. In addition, ii (Interactive Investor) offers access to thousands of investment trusts, ETFs, unit trusts and shares - not just access to Vanguard funds or ETFs.

While iWeb doesn't charge an ongoing platform fee if you invested in Vanguard funds (or indeed any other funds) it does charge £100 just to open an account, as shown in the table above, which is expensive. Furthermore, the user experience is far worse in my opinion. Similarly, Hargreaves Lansdown doesn't charge a platform fee for investing in Vanguard ETFs, if they are bought via its Fund and Shares Account but that would mean your investments are subject to tax. As soon as you want to either invest in unit trusts (such as the Vanguard Lifestrategy range) or use Hargreaves Lansdown's SIPP or ISA to buy ETFs or funds then it applies an annual charge of 0.45%.

Welcome bonus of up to £100

Open an InvestEngine account.

- Receive a welcome bonus of up to £100 when you invest at least £100

- New customers only

- T&Cs apply, Capital at risk

Tax rules subject to individual status and may change.

How does InvestEngine make money?

Like other online wealth managers/platforms InvestEngine makes its money from the 0.25% platform charge on its managed portfolios. However, InvestEngine does not charge any platform fee on DIY portfolios. There is a sense that InvestEngine will ultimately develop its DIY portfolio service under a freemium model, whereby eventually more advanced features and options will be available to premium-paying customers.

Is InvestEngine safe?

InvestEngine is authorised and regulated by the Financial Conduct Authority. So any investments held with InvestEngine are covered by the Financial Services Compensation Scheme (FSCS) up to a value of £85,000 should InvestEngine goes bust. Client cash is pooled and held at NatWest Bank Plc.

Alternatives to InvestEngine

For those who want to build their own DIY investment portfolio that contains investment trusts, unit trusts, ETFs or direct shares then Interactive Investor* and Hargreaves Lansdown* remain the market leaders, with both even offering their own ready-made income portfolios* (an offering that InvestEngine dropped from its product range in February 2023). Furthermore, both give access to Junior ISAs, pensions and trading accounts. Hargreaves Lansdown even allows you to invest via a Lifetime ISA. In addition, Hargreaves Lansdown allows you to invest from as little as £1, but if you want to invest in funds then the minimum is £100 or £25 a month.

If you are looking for a managed ethical portfolio then Wealthify allows you to invest from as little as £1. For more ethical options read our article 'Which are the best ethical Stocks and Shares ISAs?'.

If you want a service that provides a regulated off-the-shelf portfolio recommendation, with a performance track record then read our reviews of Nutmeg and Moneyfarm.

InvestEngine customer reviews

At present InvesEngine has an excellent rating (4.6 stars out of 5.0) on Trustpilot from over 1,100 reviews. Users that have posted reviews like InvestEngine's low-cost charging structure as well as its easy to use and uncomplicated website. In addition, many of the reviews are complimentary about the level of customer service provided by InvestEngine.

InvestEngine pros and cons

Pros

- Invest at least £100 with InvestEngine and receive a welcome bonus of up to £100* (Terms and conditions apply)

- Easy to use app and website

- No platform fee on DIY portfolios for ISA and GIA

- Auto invest regular amounts using its Savings Plan feature

- Managed portfolios only incur a 0.25% per annum platform fee making it cheaper than its competitors

- One-click portfolio rebalancing

- Business accounts

- Access to 590+ ETFs

- Can create a portfolio, without obligation to invest, simply by registering*

Cons

- No ethical managed portfolios

- No Junior ISA or Lifetime ISA available yet

- Flat fee structure - i.e it does not reduce the more you invest

- £100 minimum investment is in line with some of its robo-adviser peers but there are others with lower minimum

- Inability to invest in investment trusts or unit trusts, although this is planned.

Is InvestEngine any good?

Overall InvestEngine* is an innovative new entrant into the DIY investment market. By attempting to bring the best features from a number of existing market incumbents (i.e no platform fee on DIY portfolios, no exit fees, managed portfolios) while adding some new innovative features (such as one-click rebalancing and auto-invest via its savings plans) InvestEngine will gain traction with new and experienced investors. Its low-cost approach will add much-needed competition for established robo-advice propositions such as Nutmeg as well as established DIY investment platforms like Hargreaves Lansdown.

It's not perfect, lacking ethical portfolio options and no access to a Junior or Lifetime ISA, but with some of these planned in the future, it remains an interesting platform. Whether you invest or not the ability to explore its portfolios, simply by registering, will win it fans.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - InvestEngine, Hargreaves Lansdown. Interactive Investor.