**N26 no longer operates from the UK and is closing all UK accounts from 15th April 2020 (Users can still open a Euro account). Click here to find out what you need to do and for alternatives.**

What is N26 and is it a bank?

N26 was one of the first app-based banks, founded in 2013 and launched in 2015 by founders Valentin Stalf and Maximilian Tayenthal. N26 initially launched in Europe, acquiring over 2.5million customers from 24 markets, including the UK where it launched in late 2018. N26 aims to be the first global app-only bank and has raised over $683 million in funding from some of the worlds top investors. It has now launched in the USA and revamped it's N26 Black card to create N26 You.

N26 is a full UK mobile app-based bank account and users are currently only able to select a personal bank account. The bank claims to 'make sending, saving and managing your money easier than making a cup of tea'.

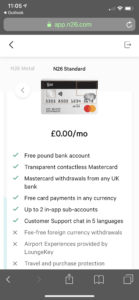

UK customers have the choice of opening 3 different account types, the N26 current account, the N26 You account or the N26 Metal account. We compare the features of each of the accounts in our table below.

How does the N26 bank card work?

Getting registered with N26 is relatively simple, you need to be a UK resident and over the age of 18. The application is completed via the smartphone app or the web app.

As N26 is a branchless bank the only way to use it is by downloading the app via the Apple Store or Google Play store. Although N26 does offer online banking for those who prefer desktop access, you do need a compatible smartphone to complete the set-up process first.

To create an account you will be asked to confirm personal details such as the country you reside in, your first and last name, your date of birth and your address.

(click on images to enlarge)

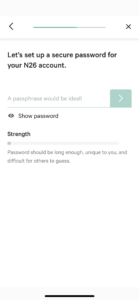

You are asked for your email address and you'll then need to create a secure password. Once you have completed the initial setup process, you are asked which N26 card you would like to open; the N26 Standard, N26 You or N26 Metal. You will then be asked to prove your identity by showing your passport or driving license via a photo or video.

To finalise the account set up process you will be asked to set up a 4 digit pin, which is your secure code that you'll need when setting up payees or making transactions. You should then expect to receive your new N26 bank debit card in the post in the next few days.

What are the different N26 accounts and features?

| N26 Current Account | N26 You | N26 Metal | |

| Pricing | FREE | £4.90 per month |

£14.90 per month

|

| Fee-free spending abroad | |||

|

Free Travel ATM withdrawals

|

|||

|

Extra Saving spaces

|

10 spaces | 10 spaces | |

|

Lounge Key Access

|

|||

|

Travel insurance and purchase protection

|

|||

|

Dedicated customer support

|

|||

| Partner offers |

*1.7% fee applies for cash withdrawn abroad

What are the N26 card fees?

N26 offers fee-free spending while abroad for all account holders and free worldwide cash withdrawal for N26 You and N26 Metal account holders. If you have an N26 current account then you can withdraw cash for free in the UK but any foreign currency is charged at 1.7% of the value of the cash being withdrawn.

N26 does not currently offer an authorised overdraft so if you go overdrawn you will be charged 14.9% EAR (equivalent annual rate). The interest is accrued on a daily basis but charged quarterly from your N26 account. N26 have an £80 limit on fees per calendar month. According to their UK website an overdraft facility is coming to N26 soon.

How much is N26 You and N26 Metal?

The N26 You card has a monthly fee of £4.90 which gives the cardholder additional features such as free worldwide cash withdrawals and 10 extra saving spaces. The N26 Metal card has a monthly fee of £14.90 which gives the cardholder all of the features of both the current and You cards as well as lounge key access in selected airports, travel and purchase protection insurance, dedicated customer support and partner offers.

N26 card features

Instant spending notifications

Get instant notifications after all transactions, withdrawals and outgoing transfers.

Spending breakdown

A breakdown of your spending, N26 uses artificial intelligence to categorise your transactions.

In-app support

N26 is an app-only bank and so has no branches. You can contact them in-app or by the web app chat function Monday to Friday 8am-8pm or Saturday 8am-7pm.

MoneyBeam transfers

Instantly send or receive money from any of your contacts stored within the app, all you need is an email or a phone number.

Spaces

A space is a sub-account that allows you to track your spending and save for goals, like a house deposit or a holiday, similar to a regular savings account. Each space allows you to set a spending goal and can notify you how close you are to each of your goals.

You get access to 3 spaces with the standard N26 current account and if you upgrade to the N26 You or N26 Metal account you can have access to an additional 10 spaces.

Discreet Mode

A feature that enables you to hide your balance and transaction details. it is available for both the mobile and web apps to enable your secure information stays safe from prying eyes when out and about.

Insurance

As an N26 Metal card member, your subscription entitles you to travel insurance and purchase protection insurance underwritten by Allianz Global Assistance.

- N26 Travel Insurance sees you protected in the event of medical expenses abroad, a medical emergency prior to travel that results in not travelling, expenses for a delayed flight and luggage delay over 4 hours and medical repatriation.

- N26 Purchase protection Insurance sees you covered in the event of a repair of a replacement of a qualifying item that is damaged or stolen, as long as the item was purchased with the N26 standard or Metal card and was insured in your home country or abroad.

Partnerships

With the N26 Metal card you can take advantage of partnership deals by receiving discounts from companies like Hotels.com, WeWork and Babbel. N26 continue to update the list of partnerships and so it will undoubtedly grow over time.

Is my money safe with N26?

N26 bank is based in Berlin and is regulated by the German financial regulatory authority. Your money is protected by the German deposit protection scheme for up to €100,000, which is currently the equivalent of £86,000 (almost identical to the protection of the FSCS in the UK.)

N26 is security conscious and protects your account with password and pin protection when setting up an account. It also offers Mastercard 3D secure as an additional layer of protection when making payments online. If you lose your card or it gets stolen you can block it immediately in the app and unblock it if you were able to find it.

Will my money still be safe with Brexit?

Whilst the fate of Brexit still looms it is difficult to say how things will play out, especially as your money is protected by the German financial authority and that the terms require the money to be held within the European Union. However, I used the N26 webchat service to ask them what their plans were for Brexit and this is what they said:

"Please be aware that if it does go ahead, we will inform our UK customers about any important updates. I do not have any further information on Brexit as we don't know if it will even happen and I am not a legal advisor. In the event that it does happen, we would work towards continually operating in the UK as it is such an important market for us".

There are many banks in the UK that operate from within the EU and so it is not a problem that N26 will face alone.

Pros & Cons of N26

Pros

- Easy to use app

- Online banking

- No branches - so less hassle

- Fee-free spending abroad

- Instant spending notifications

- Easily block/unblock card

- Apple/Google pay

- In-app customer support

- Mastercard 3D secure

Cons

- 1.7% charge for withdrawing cash abroad with the basic account

- No bank branches

- No telephone support and reduced hours chat support

- No guaranteed financial protection with Brexit

- No standing orders

- No overdraft facility

N26 Customer reviews

N26 has a customer rating of 'Great' on Trustpilot with a score of 4 out of 5 stars from over 8,000 reviews. Those who rated it as 'poor' cited long waiting times to open an account and account closures. Whereas those who rated N26 as 'good' commented on good customer service and an easy to use app.

N26 Bank alternatives

N26 vs Revolut

N26 Bank's closest competitor is Revolut, another European bank that is app-only and offers fee-free spending when abroad. N26 does however have a banking licence and although Revolut has had a banking licence approved, it is not yet able to operate as a fully-fledged bank. We have provided a summary of the main features to compare N26 and Revolut below:

| N26 Basic Account | Revolut basic Account | N26 You | Revolut Premium | N26 Metal | Revolut Metal | |

| Cost | FREE | FREE | £4.90 per month | £6.99 per month | £14.90 per month |

£12.99 per month

|

| Fee-free spending abroad | ||||||

| Cash withdrawal abroad | 1.70% charge | £200 free per month | FREE | £400 free per month | FREE |

£600 free per month

|

| Travel Insurance | ||||||

|

Purchase protection insurance

|

||||||

| Lounge Key | ||||||

|

Enhanced customer support

|

||||||

| Cashback |

N26 vs Monzo vs Starling Bank

Monzo and Starling Bank are big British rivals to N26. Both Monzo and Starling are similar to N26, so to understand the differences we have created a comparison of the main features below.

| N26 | Monzo | Starling Bank | |

|

Personal account

|

|||

|

Business account

|

|||

| Direct Debit | |||

| Standing Order | |||

| Overdraft | |||

| Loan | |||

|

Budgeting features

|

|||

| Fee-free spending abroad | |||

| Cash withdrawal Abroad | 1.7% charge | Free up to £200 p/month | FREE |

| Interest | up to 1.35% on select savings accounts | 0.50% up to £2,000 /0.25% over £2,000 |

Conclusion

When you consider that N26 was one of the first app-only banks to appear on the market it is surprising to discover that in terms of features they are still behind the likes of Monzo and Starling Bank. Attempting to conquer the UK market is ambitious and so it will be interesting to see if N26 offer more benefits over time, to rival the likes of Monzo and Starling.

As a bank, N26 fails to offer basic features such as standing orders and an overdraft facility. Although it competes amongst the other app-only banks for fee-free spending abroad, it charges for withdrawing cash at an ATM when abroad.

I think for a seasoned traveller N26 has an attractive offer, but unless it can add more features I can't see it trumping the app-only banks already on the market.