In this Hargreaves Lansdown Active Savings* review I look at how the service works, the HL active savings rates on offer and how it compares to other savings platforms in the UK. While I suggest that you read the article from beginning to end you can jump to particular parts of this review using the jump links below.

In this Hargreaves Lansdown Active Savings* review I look at how the service works, the HL active savings rates on offer and how it compares to other savings platforms in the UK. While I suggest that you read the article from beginning to end you can jump to particular parts of this review using the jump links below.

- How does Hargreaves Lansdown Active Savings work?

- Which savings products are available via Hargreaves Lansdown Active Savings?

- What are the Hargreaves Lansdown Active Savings fees?

- Is Hargreaves Lansdown Active Savings safe?

- Pros and Cons of using Hargreaves Lansdown Active Savings

- Alternatives to using the Active Savings platform

1 minute summary - Hargreaves Lansdown Active Savings review

- Hargreaves Lansdown* is the UK’s biggest investment platform. It services approximately 1.8 million customers and has around £142 billion assets under management. It is free to use and only takes around 10 minutes to sign up*

- Hargreaves Lansdown's Active Savings Platform enables customers to easily move between savings accounts, taking advantage of the best rates from a single online hub

- New rules mean users can spread their ISA allowance across different banks using Hargreaves Landown's Active Savings Platform. Users can also choose different account types including fixed-term, limited access and easy access.

- Minimum deposits start from just £1

What is a Hargreaves Lansdown Active Savings?

Hargreaves Lansdown is a FTSE 100 company and the UK’s biggest investment platform servicing 1.8 million customers with a total of around £142 billion in assets. While the company is best known for its investment platform, in 2018 HL launched its Active Savings platform in order to make it easier for consumers to shop around and take advantage of the best savings accounts rates, using a single online hub.

Hargreaves Lansdown Active Savings* was not the first cash savings platform in the UK. The other leading cash savings platforms include Raisin UK, AJ Bell, Flagstone, Saga and Insignis Cash Solutions. However, only Hargreaves Lansdown and Raisin UK are free to use as the other platforms levy an upfront charge and/or annual fee. Of course, these fees can negate the additional interest you may earn when using the alternative platforms. In fact, Octopus Cash, which was one of the most well-known savings platforms, closed its savings platform in September 2020 because it could no longer justify charging a fee to clients in an environment where savings rates are so low. It will be interesting to see how the other services that charge customers a fee cope going forward. Later in this review, I provide a link to an article where we directly compare the leading cash savings platforms in the UK against one another.

Hargreaves Lansdown's Active Savings platform is free to use because it charges the banks and building societies whenever a customer decides to open a savings account with the institution in question. Also, because Hargreaves Lansdown runs the UK's largest investment platform its Active Savings proposition can benefit from the economies of scale and revenues enjoyed by the wider company. Ultimately, the Hargreaves Lansdown savings platform serves a dual purpose of attracting new customers while servicing its existing investment platform customers who have cash sitting on deposit.

How does Hargreaves Lansdown Active Savings work?

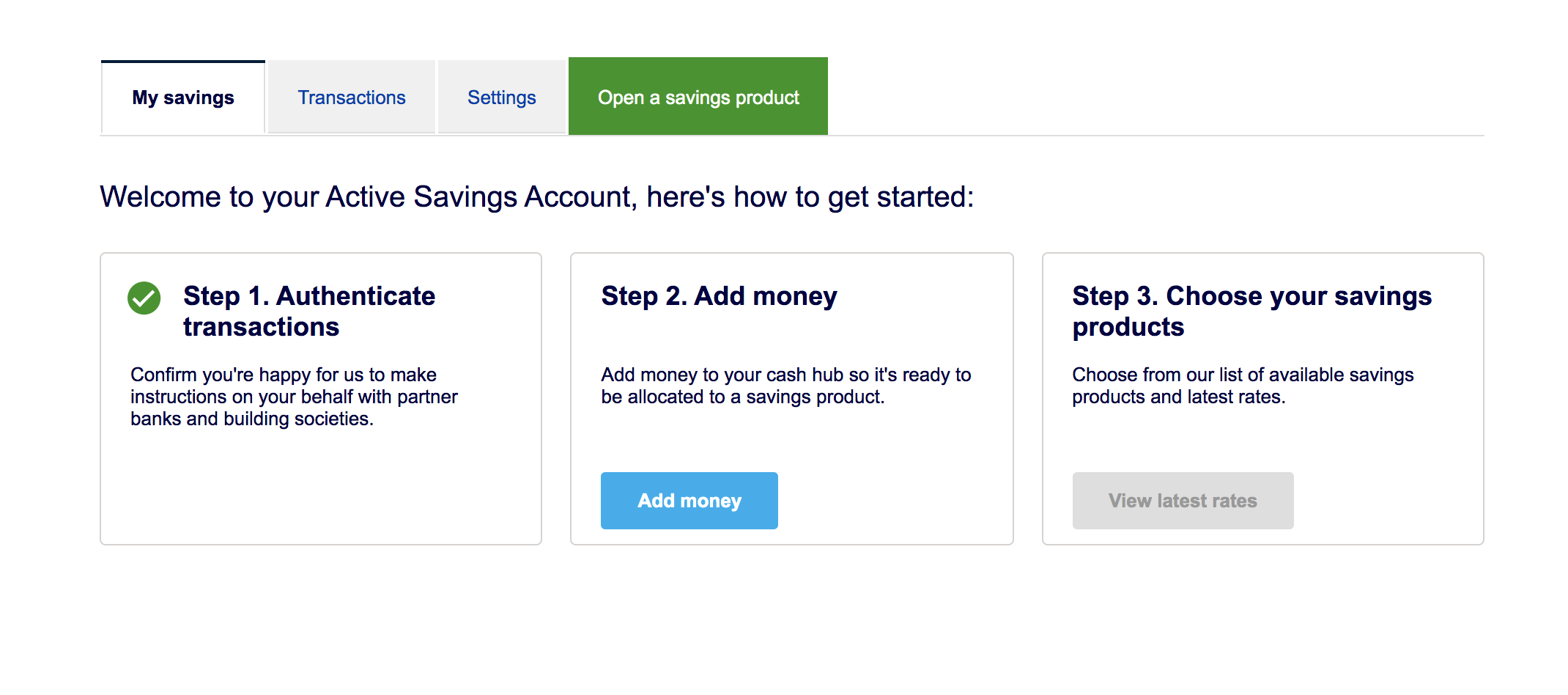

Active Savings* is open to new or existing customers of Hargreaves Lansdown. Opening an Active Savings account only takes 10 minutes online, but if you are already a Hargreaves Lansdown client (with online access) it will only take about 60 seconds. Once you've opened an account the next step is to agree to let Hargreaves Lansdown make transactions on your behalf so that it can move money to and from your chosen savings accounts as per your instructions. Once you've clicked the button to say you agree the next step is to add funds to your Active Savings hub account and then choose your savings products, as shown in the image below:

It's all very straightforward and the Active Savings service sits nicely within the existing Hargreaves Lansdown online user interface. That's good news given that Hargreaves Lansdown is the market leader when it comes to ease of use and customer service. It is even possible to view your Active Savings holdings via the HL iPhone app.

You can deposit money into your Active Savings hub account from a debit card with a minimum amount of just £1. Of course, you need to ensure that you have enough money in your account to meet the minimum deposit requirement of the savings products you are considering. At present, investors can only move money from an existing HL Fund and Share account into an Active Savings account, so long as the investments are sold and the trades settled. Investors cannot currently use the Active Savings proposition within an HL Stocks and Shares ISA, SIPP or general investing account. So for example, you can't move your Hargreaves Lansdown Stocks and Shares ISA into your Active Savings account. To all intents and purposes, the Active Savings platform and the wider Hargreaves Lansdown investment platform operate as two distinct and separate entities. If you want to move money between them you first have to withdraw funds into your personal current account and then add the funds back to the other platform via a debit card.

Like other savings platforms, Hargreaves Lansdown Active Savings is not a bank and as such all money is temporarily held within a hub account at Barclays. Your money is held with Barclays until you decide which savings product you wish to deposit into. If you do not make a choice within 30 working days your money may be returned to your nominated bank account. While your money is temporarily held with Barclays it will be protected under the Financial Services Compensation Scheme (FSCS) rules as explained in the section below titled ‘Is Hargreaves Lansdown Active Savings safe?'

In the same section, I also explain how your money deposited at any third party bank or building society is protected under the FSCS.

Once you have set up your Active Savings account and deposited money into it you can then choose from an array of savings products provided by the 21 partner banks/building societies on the Active Savings panel.

Hargreaves Lansdown Active Savings products

Active Savings offers savings products from 21 partner banks and building societies. The panel includes Aldermore, Allica Bank, Arbuthnot, BLME, Charter Savings Bank, Close Brothers, Coventry Building Society, Emirates NBD, GB Bank, ICICI Bank, Investec, Kent Reliance, LHV, Metro Bank, Oak North, Paragon, Ratesetter, Sainsbury's Bank, Santander International, United Trust Bank and Zopa Bank. At present the types of savings accounts on offer are:

- Cash ISA – Spread your ISA allowance across multiple providers

- Limited access savings account

- Easy access savings accounts

- 1 month fixed term accounts

- 2 month fixed term accounts

- 3 months fixed term accounts

- 6 months fixed term accounts

- 9 months fixed term accounts

- 1 year fixed term accounts

- 18 months fixed term accounts

- 2 year fixed term accounts

- 3 year fixed term accounts

- 4 year fixed term accounts

- 5 year fixed terms accounts

The interest rates often include market-leading rates and currently range from 3.05% per annum to 4.89% while the minimum investment amount varies and starts as low as £1. You can find out the latest interest rates and accounts available here*.

Hargreaves Lansdown Active Savings fees

One of the attractions of Hargreaves Lansdown Active Savings versus most other cash savings platforms is that it doesn't charge an annual management fee or any upfront costs. Active Savings is free to use and Hargreaves Lansdown achieves this by charging the partner banks and building societies. However, these charges may sometimes result in a lower interest rate offered by the partner bank than if you had gone to them directly.

Is Hargreaves Lansdown Active Savings safe?

When you hold money with a UK-authorised bank or building society your money is covered by the Financial Services Protection Scheme (FSCS) if the banking institution were to go bust. There are limits to the level of protection based upon the amount of money that you hold on deposit with the institution. The FSCS will protect up to £85,000 per person per bank or building society or £170,000 for a joint account. One thing to note is that the protection is offered per banking licence. Some banks and building societies are part of a larger organisation and have numerous brands which share one banking licence. An example of this is Bank of Scotland and Halifax. In such instances, if you were to hold more than a total of £85,000 in bank accounts in your sole name across both Bank of Scotland and Halifax then the FSCS only covers you for up to £85,000 in total if both banks were to go bust.

When using Hargreaves Lansdown's Active Savings your money is protected under the FSCS when it is placed with one of the partner banks or building societies. However, you still have to ensure that you keep within the FSCS limits, as described above, if you want all of your savings to be protected should a banking institution go bust.

As Active Savings is not a bank your money temporarily sits in a hub account before it is deposited with one of the partner banks, as described earlier, The hub account is provided by Barclays. That means that your money is protected under the terms of the FSCS even when it is in transition between savings products. Of course, you must be mindful that if you hold money with Barclays already, outside of the Active Savings platform, then you would need the total sum of money held at Barclays (via the Active Savings hub account or otherwise) to remain under £85,000, assuming the accounts are in your sole name, if you want to be fully protected by the FSCS against Barclays going bust.

Pros and Cons of Hargreaves Lansdown Active Savings

Pros

- Free to use (no charges)

- Spread your Cash ISA allowance across multiple providers

- Easy to set-up and only requires a single login

- Makes optimising the interest you earn on your savings simple with no administration headaches

- Slick online interface

- Existing Hargreaves Lansdown customers can see their savings alongside their investments

- Provides access to a range of savings product types

- Savings covered under the normal FSCS rules

Cons

- Doesn't give you access to the whole savings market

- Doesn't guarantee to offer the best interest rates in the market

- Can't be used by businesses or charities

- Some savings rates on offer can be lower than if you went directly to the bank or building society

Alternatives to Hargreaves Lansdown Active Savings

Active Savings is not the only cash savings platform in the UK. There are a number of other platforms each with their own panel of savings products and service offerings. While Active Savings requires you to decide where to put your savings yourself there are alternative platforms that will recommend savings products to you and manage the administration on your behalf. You can see a full comparison of the UK savings platforms in our article ‘The best cash savings platforms‘.

Alternatively, if you wish to simply shop around for the best savings account rates yourself then visit our regularly updated summary of the best savings accounts in the UK.

Is Hargreaves Lansdown Active Savings worth it?

Hargreaves Lansdown Active Savings will suit anyone who is looking to boost the interest they receive on money held on deposit. It's slick and easy to use and means that you can move money between accounts at a click of a button. Like most other savings platforms the panel of banks/building societies and associated savings products is limited and does not cover the whole of the market. Therefore it is possible to get a better rate of interest elsewhere if you shop around yourself. However, this is more time-consuming and given the fact that Active Savings is free to use, has a minimum deposit of £1 and is backed by the UK's largest investment platform it will continue to prove popular. Add to that the occasional market-leading savings rate, FSCS protection as well as occasional cashback offers* for new customers its appeal will only likely increase further.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Hargreaves Lansdown