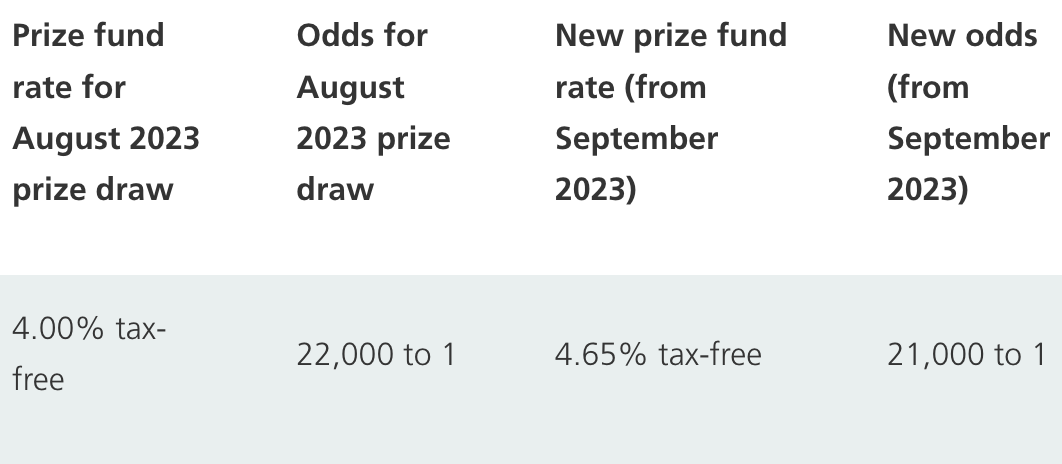

National Savings and Investments (NS&I), the government-owned savings bank has announced that it will be increasing the Premium Bond prize fund by an estimated £66m for the September 2023 draw, raising the prize fund rate from 4.00% to 4.65%.

The rate of return is referred to as a 'prize fund rate' or 'notional interest rate' because Premium Bonds do not pay interest in the same way as other types of savings products provided by banks and building societies. Instead, Premium Bonds work like a lottery, with each bond giving the owner a chance to win one of a number of monthly prizes between £25 and £1 million.

Premium Bonds cost £1 each but must be purchased in bundles of at least 25. The notional interest rate is worked out by dividing the total number of Premium Bonds purchased by the total prize fund.

The estimated £66m prize fund boost for September will ensure that there are an additional 269,000 extra prizes on offer, increasing the notional interest rate from 4.00% to 4.65%, its highest rate since 1999. It means that the chances of winning a prize have increased as the odds have reduced to 21,000 to 1 (down from 22,000 to 1 for August 2023).

This is the third month in a row where the notional rate has increased and while a higher rate is great news for Premium Bond holders, it is worth remembering that most will not achieve anywhere near that rate of return. You can read more about Premium Bonds and how they work in our article 'What are Premium Bonds and are they worth it?'

What are the odds of winning a Premium Bonds prize?

The total prize pool currently stands at £470m per month with almost 5.8 million winning prizes up for grabs. The recent prize fund boosts have meant that the odds of winning any given prize have shifted from odds of 24,000 to 1 in July 2023 and 22,000 to 1 in August 2023, down to 21,000 to 1 from September 2023.

Ultimately, the more Premium Bonds you hold, the more times you will be entered into the draw and the more chances you will have of winning a prize.

How to get a guaranteed savings rate

Premium Bonds do not offer a guaranteed rate of return, meaning Premium Bond holders that do not win a prize could see their savings eroded by inflation over time. Savings products such as fixed-rate bonds provide a fixed rate of return in exchange for locking money away, usually for 1, 2, 3 or 5 years and these can be good for those who are worried about the impact of inflation. Those requiring access to their savings could consider an easy-access savings account. Check out the best rates in our regularly updated article, 'Best Savings Accounts in the UK'.