Episode 433 - On this week's episode I discuss bond markets, highlighting the significance of bear steepening and its ripple effect on the global economy. Harvey sheds light on the misconceptions surrounding life insurance for individuals with pre-existing conditions, emphasising its accessibility and affordability. Finally we discuss the employment rights of children, examining the legal constraints on their working hours and what constitutes a fair wage.

Join the MTTM Community group, a friendly community that allows like-minded listeners to ask questions and chat.

You can also listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Listen on iTunes Listen on Android via RSS

Abridged transcript

Bear Steepener

In this part of the podcast I talk about a rare phenomenon in bond markets, known as the bear steepener, and why it's important. The phenomenon has recently been seen in the US Treasury market.

Bond Market Basics

- A bond is essentially a loan to a company or government. For example, treasuries are loans to the US government.

- The lender receives interest payments, known as coupons, and the principal amount back at the end of the loan.

- The length of the loan (known as the term to maturity) can vary (e.g. 1 year, 2 year2, 5 years, 10 years, 30 years).

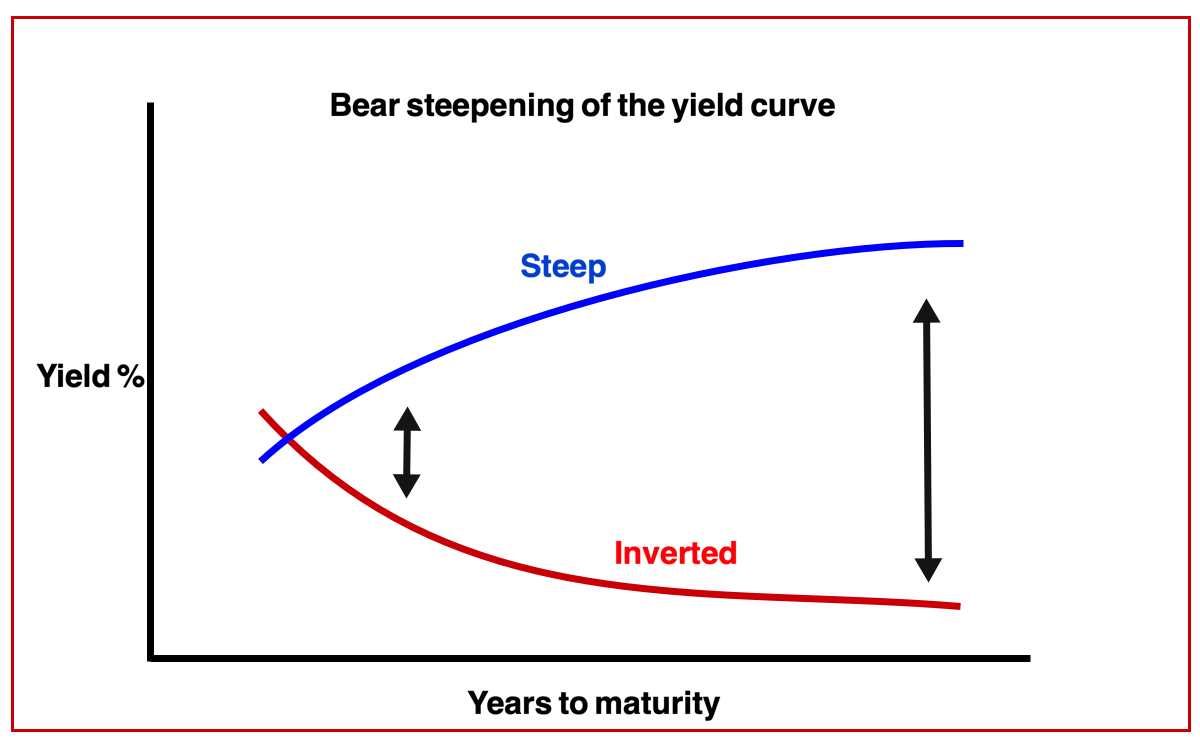

- The yield curve represents the yield available over different timeframes, as shown in the chart below.

Yield Curve Inversion

- Under normal conditions, the longer the term to maturity the higher yield - which results in the yield curve sloping upwards (see image below).

- Yield curve inversion occurs when the yield on shorter-dated treasuries are higher than those on longer-dated US treasuries.

- A potential reason for inversion is the anticipation of a recession and rising short term interest rates.

- A yield curve inversion has preceded domestic recessions on multiple occasions in the past, however it is not foolproof.

Bear Steepening

Bear Steepening occurs when yields on longer-dated US treasuries, for example, rise more quickly than those at the shorter end of the yield curve (see image below) and is a sign of the market's readjustment of interest rate expectations. Bear steepenings tend to occur when investors believe that central banks will continue tightening monetary policy (i.e. the Federal Reserve will continue raising predicted interest rates in case of the US) to tackle rising inflation. Investors who are worried about further rate hikes sell out of their long-term treasuries (which are more sensitive to hikes in interest rates) and buy short-term treasuries (which are less sensitive).

Importance of the Phenomenon

- Bear steepening after a yield inversion has historically predicted recessions more accurately than a yield curve inversion on its own.

- Since the mid-1970s, there have been five instances of bear steepenings following a yield curve inversion, all of which accurately predicted recessions.

- The latest bear steepening also comes after a yield curve inversion which suggests the possibility of a recession in the US, which would also affect other global economies ("if the US sneezes, the rest of the world catches a cold").

- A bear steepener is typically bad news for equity markets. The last two bear steepenings were in 2020 and 2007, before the pandemic and the financial crisis.

Life insurance with pre-existing medical conditions

During this section of the podcast we discuss the following medical conditions and their impact on life insurance premiums. For more information click on the condition name.

- High blood pressure

- Raised cholesterol

- Diabetes

- Epilepsy

- Asthma

- Cancer

- Crohn's disease

- Depression, stress, and other mental health disorders.

- Overweight

The podcast also touches upon other factors that can influence life insurance premiums, including age, smoker status, body mass index (BMI) and a family history of specific conditions.

How much can children work and earn?

Here are some of the edited highlights on our discussion about how much children can work and earn.

Working Age Rules:

- General rule: A young person under 16 can work part-time from the age of 14.

- From the age of 13, it depends on local council bylaws.

- Businesses need to check with local councils for specific rules on employing those under 14.

Nature of Work:

- Work should be "light", meaning it shouldn't affect a child's health, safety, or education.

- Examples of suitable jobs: delivering newspapers, working in a shop, office, salon, cafe, restaurant or hotel.

Working Hours:

- During school term:

- 13-14 year olds: Maximum of 12 hours/week. Up to 2 hours on school days/Sundays and 5 hours on Saturdays.

- 15-16 year olds: Same 12 hours/week. Up to 2 hours on school days/Sundays, but 8 hours on Saturdays.

- During school holidays:

- 13-14 year olds: Up to 25 hours/week. 5 hours on weekdays/Saturdays and 2 hours on Sundays.

- 15-16 year olds: Up to 35 hours/week. 8 hours from Monday to Saturday and 2 hours on Sundays.

Earnings:

- No official minimum wage for school-going children under 16.

- A "fair wage" is recommended: equivalent to the national minimum wage for 15-16 year olds, roughly around £5.28/hour.

- However, there is no legal requirement for businesses to pay this amount.

National Minimum Wage Overview:

- Current rates (at the time of podcast recording):

- Apprentices (16-18) or in their 1st year: £5.28/hour.

- Age 18-20: £7.49/hour.

- Age 21-22: £10.18/hour.

- Age 23 and over (national living wage): £10.42/hour.

Resources:

Links referred to in the podcast:

- Speak to a life insurance expert (Free, independent advice on life insurance, critical illness cover and income protection)

- NHS BMI calculator

- Ep 197 - Yield curve inversion