What is Bó?

Bó is a banking app launched in partnership with NatWest. The app is designed to 'help you spend less and save more' but stops short of operating as a full banking app such as challenger banks Monzo and Starling.

Launched in 2019, Bó is the high street bank's attempt at slowing the steady migration towards challenger banks. The mantra seems to be 'If you can't beat them, join them'.

Bó features

- Spending notifications - track your spending with instant notifications

- Spending categorisation - see how you spend your money with the spending categories

- Set spending budgets - set and stick to spending budgets

- Set saving goals in the 'piggy bank' - start saving small amounts with the saving goals

- Spend abroad with no fees - spend abroad with no additional transaction fees and only the Visa exchange rate

- Lock or cancel the card - easily manage the card within the app if it is lost or stolen

How does Bó work?

One of the issues with Bó is the fact that wages can't currently be paid directly into it. This is a major drawback in its attempt to rival the top challenger banks. It is for this reason that it works best as an addition to your current account, rather than as a stand-alone account. Bó is designed to manage your everyday money and to help you understand your daily spending habits, learn how to budget and start saving small amounts.

To open a Bó account you need to download the app from the Google Play or App store. Once downloaded you are introduced to the features of Bó and need to accept the terms and conditions. You are then asked to enter a few personal details such as name, DOB, and home address. To complete the setup process you need to provide photographic ID, such as your passport or driving license as well as some selfies. The bright yellow debit card will be issued and should be with you in the next 3 working days.

Once you download Bó a soft credit check is carried out. This is for fraud purposes and you should expect it to appear on your credit report.

Currently you are only able to open a personal account with Bó as joint and business accounts are not yet available. To be eligible to open a Bó current account you need to be over the age of 18 and be a UK and UK tax resident. Your mobile must be running on iOS 10 or above for iPhones or 6.0 Marshmallow and above for Android phones.

Once your Bó account is set up, you can start to keep track of your money. There is no overdraft facility with Bó and cheques cannot be deposited into the account. Closing a Bó account is as easy as opening one and you simply need to go to the 'Your Details' section of the Account tab and select 'Close Account'. Essentially, when you boil it down, Bó is, in its current iteration, nothing more than a money management app with a few fringe benefits.

Are there any limits with Bó?

- £20,000 - the maximum amount you can have in your Bó account

- £20,000 - the maximum amount you can have in your Piggy Bank

- £5,000 - the maximum payment amount

- £3,000 - the maximum you can spend on your card in one go

- £1,000 - the maximum you can withdraw in cash on a 30-day rolling period from the first withdrawal date

- £500 - the most you can withdraw in a day

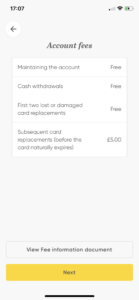

Is Bó free?

It is free to open a Bó account and there are no monthly account management fees. Withdrawing cash from Bó is also free (you may be charged by the cash machine operator) as well as spending abroad. Bó will not add any additional transaction fees when abroad and you will only be charged the Visa exchange rate.

If you lose or damage your Bó debit card you can request a replacement twice at no extra cost; subsequent requests will be charged at £5 each time. If your card is stolen or if a name change is required, the card will be replaced for free.

Is Bó safe to use?

Bó is FCA registered and your money is protected under the Financial Services Compensation Scheme (FSCS) for up to £85,000. However, if you have an account with both NatWest and Bó, your money will only be protected up to the combined value of £85,000 due to both accounts operating under the same banking licence.

Bó is protected with a 6 digit passcode every time you open the app. If entered incorrectly 3 times in a row the app will be disabled for 20 minutes. If it is entered incorrectly a further 6 times in a row then the account will be locked and you will have to contact Bó for further support. Bó has confirmed that it is working on adding face and fingerprint ID as an extra layer of security.

Bó allows you to lock the card from within the app if it is lost or stolen and if your phone is stolen you are advised to contact the Bó support team so that your account can be secured as soon as possible.

Bó customer reviews

Bó is a new app and so there are currently only two customer reviews. We will update this section in the coming months as customers rate their experience.

Bó alternatives

Bó vs Monzo vs Starling Bank

Bó offers many features that are similar to the likes of Monzo and Starling, such as instant spending notifications, a form of savings pot and detailed categorisation. Bó is partnered with the merchant Visa and Monzo and Starling are partnered with Mastercard. The main stumbling block when it comes to Bó, however, is that you cannot use it as your main account as it cannot accept salary payments and it doesn't allow you to pay bills via direct debit. Monzo and Starling are fully-fledged bank accounts and so it is difficult to compare them side by side.

For more information on Monzo and Starling, you can read our independent Monzo review and Starling Bank review.

Conclusion

Pros of Bó

- Spending categorisation

- 'Piggy bank' pot to help you save money

- Instant notifications

- Fee free spending abroad

- Contactless debit card

- Don't have to switch bank accounts

- Safe and secure (FSCS protected)

Cons of Bó

- Limited features

- Unable to pay salary into the account

- Unable to deposit cash or cheques

- Unable to pay by direct debit

- No overdraft facility

- Some spending limits

Bó is a good introduction to the world of app-only banking. It is good for customers who wish to try app-only banking without switching bank accounts and the ties to a high profile bank such as Natwest may be enough to sway some.

Overall, Bó is in the early stages of development and despite offering the features similar to that of other app-only banks I feel it is not yet in a position to be a direct competitor of its biggest rivals Monzo and Starling.

For now, the mantra 'if you can't beat them, join them' has fallen a little way short. Perhaps we will see similar ventures by other high street banks in the future and in fact, I wouldn't be entirely surprised if the mantra morphs into 'if you can't beat them, buy them!'