**Zing has announced it's shutting down. No new applications will be accepted. Members can continue to use the app as normal until April 2, 2025. The app will then shut down on May 22, 2025.**

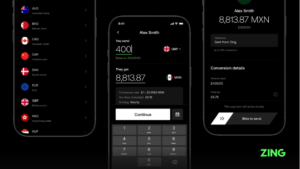

Zing* is a newcomer to the multi-currency app space. Launched in early January 2024, it's backed by HSBC and is designed to hold up to 22 currencies and can be used in more than 200 countries.

James Allan, CEO and founder of Zing, said: "We’ve built Zing as a fintech inside of the HSBC Group, focussed on delivering our audiences’ needs. Our new brand, tech stack, and teams, plus a parent company with over 150 years of international finance experience, give us unique opportunities to solve international money challenges." Allan added that the new app is going to support HSBC in meeting its goals to become a leader in the international payments market.

In this independent review, we explore everything Zing has to offer, including its key features, how much it costs, and how to open an account. We also look into alternatives to Zing, including Starling Bank* and Revolut.

Zing key features

Below we list some of the key features of the Zing multi-currency app:

- Transparent currency exchange fees - Fees for most conversions are set at 0.2%; all conversion fees and transfer fees are clearly displayed in-app.

- £500 free FX - Currency conversion fee will be waived when converting up to £500 (or equivalent currency) per calendar month. Offer ends 30th December 2024. T&Cs apply. Find out more at Zing*

- FX sweeping - Zing will automatically convert money from other wallets when you're running out of the currency you need, to ensure your payment isn't declined.

- Fee-free ATM cash withdrawals - Domestic ATM cash withdrawals in GBP are free.

- Fee-free spending abroad - If you hold the currency within your Zing wallet, it's free to spend abroad.

- 24/7 helpline - Customer service from "real humans", any time of the day.

- Hold up to £40,000 per currency - You can hold up to £40,000 in each currency held with Zing.

- Can hold up to 22 different currencies at once - These include popular options like USD, EUR, CAD, and AED.

- High ATM cash withdrawal limits - You can withdraw up to £500 per day, which is higher than some competitors.

- Track payments - All payments can be tracked in detail so you know exactly where your funds are at all times.

- Part of the HSBC group - Zing is HSBC-backed, but you don't need an HSBC current account to use the app.

- Safeguards your money - Zing isn't a bank, so your money isn't FSCS-protected, but it is safeguarded in a separate account.

- Free multi-currency accounts - Zing doesn't charge fees to open your account and there are no monthly fees either; instead, it's pay-as-you-go.

How does Zing work?

Zing is part of the HSBC Group, which serves more than 40 million customers worldwide. HSBC already has its own Global Money account, where customers can hold up to 18 currencies and spend money around the world fee-free. But, this account is only open to current HSBC customers and doesn't really offer the challenger bank experience Zing is seemingly trying to emulate.

Zing, on the other hand, is designed to be "radically transparent", giving you visibility over fees and real-time rates. You can also track international payments via the app.

There's currently only one type of account you can open with Zing: their multi-currency account. Once you've opened an account, you'll receive a multi-currency debit card to allow you to make payments in different currencies. The account is designed to be used internationally, allowing you to hold up to 22 currencies and "spend like a local". Some of the currencies you can hold in your Zing wallets currently include:

- GBP

- EUR

- SGD

- USD

- CAD

- JPY

- NZD

- HKD

- AUD

- AED

You can spend in any of your 22 currencies in more than 200 countries with Zing. You can also send money across the globe in more than 30 different currencies. Account limits apply, however. For example, you can only hold up to £40,000 per Zing wallet in the equivalent currency. The app also doesn't offer joint, children's, or business accounts right now.

The table below sums up some of the main Zing limitations you need to be aware of before deciding whether this is the right multi-currency account for you.

| Limit type | In GBP (or equivalent currency) |

| Wallet balance per currency | Up to £40,000 |

| Adding money via debit card | £1,000 for a single payment/ £3,000 per day/ £10,000 per month |

| Payments between Zing accounts | Up to £40,000 per transaction |

| Outgoing domestic payments | Up to £40,000 per transaction |

| Outgoing international payments | Up to £40,000 per transaction |

| ATM cash withdrawal | £500 per day |

| Card payments, including cash withdrawals | £10,000 over a 7-day rolling period |

Although some of these limits may be a little lower than what you're used to with a traditional bank account, Zing is designed to be used to manage money internationally rather than to serve as your primary bank account. In fact, Zing isn't actually a bank, so it doesn't have many of the features a traditional bank account would. We discuss this in more detail below.

Is Zing a bank?

Zing isn't a bank. It's an electronic money institution (EMI) which is regulated by the Financial Conduct Authority (FCA). This means your funds are not FSCS-protected and Zing doesn't offer features like overdrafts, loans, or interest on your balance.

That being said, your funds are protected via a process called safeguarding, where your money is kept in a separate account. If Zing goes out of business, you will need to contact the EMI administrator. The money you are owed should then be paid out from the separate account Zing held for this purpose before any creditors are paid.

How much does Zing cost?

Zing is free to download* and has no monthly fee. You'll receive a free debit card, and it's also free to make payments in the same currency between Zing accounts and for international transfers. Receiving bank payment is free as well, as is paying with the card online. If you need a new debit card before renewal, the first one is free and the second one is charged at £5.

Zing fees summary

| Feature | Fee |

| Bank transfer | Free |

| Spending abroad in currencies you hold within your Zing wallet | Free |

| Domestic ATM withdrawals | Free |

| International ATM withdrawals | First withdrawal per month is free, £2 per withdrawal after that |

| £500 free fx per month (or currency equivalent) | Currency conversion fee will be waived when converting up to £500 (or currency equivalent) per calendar month. Offer ends 30th December 2024. T&Cs apply. Find out more at Zing.me |

| Non-wallet currency transaction | 0.20% on top of the Visa exchange rate |

| Currency conversion fee (between Zing wallets and for payments involving currency conversion) | 0.20% |

Zing uses the Visa exchange rate for card payments in non-wallet currencies and charges a flat rate to convert money. It uses mid-market rates for currencies it holds and which are available for international payment. You'll be able to see the exact amount you'll get as well as any fees, via the Zing currency exchange calculator.

Can you use Zing abroad?

Zing is designed for international payments so you can use your card on your trips abroad. Outgoing international payment fees vary by destination, but you'll be able to see what you're likely to be charged in the app before you pay.

Conversion fees are set at 0.20% within Zing wallets. If you're making a non-wallet currency transaction - meaning a transaction in a currency you don't hold - you may be charged a 0.20% fee on top of the Visa exchange rate. Zing's currency calculator also shows you the real-time exchange rate so you know exactly what you're getting before you commit.

With Zing, you can hold up to 22 different currencies at the same time. This means that if you already hold a specific currency, you can go ahead and pay in that currency without incurring additional conversion charges. Your Zing debit card allows you to "spend like a local" using any currency you hold. This card will work anywhere in the world that accepts Visa payments.

How to open a Zing account

Zing is currently available via the Google Play Store and the App Store. You're eligible for a Zing account if you're a UK resident over the age of 18. Although Zing is part of the HSBC Group, you don't need to have an HSBC account to use the app. It's free to open a Zing account, and there are no monthly fees either.

We tried opening an account to check how straightforward the process is. You will need identity documents and proof of address, as well as other information to complete the application process. On downloading the app, you'll be asked to complete several steps, including:

- Create a passcode to use with the Zing app - This is currently a five-digit passcode of your choosing.

- Verify your e-mail address - You'll get an email with a "confirm email" button.

- Verify your phone number - You'll get a code to put into the application form on the app.

- Add your home address - If you're at home, you can enable location sharing and verify your address via geolocations.

- Verify your identity by scanning your passport or driving licence - If you're a non-UK national, you'll also need to provide proof of your right to reside here.

- Record a video of yourself to verify your identity - Zing scans your face for 15 seconds and matches it up to your identity documents.

- Answer regulatory questions - You'll need to answer a series of questions about your income level, how you plan to use the account, and how you plan to fund the account.

Depending on your circumstances, Zing may need a few days to review your application after you complete these steps. If everything checks out, you should be able to open an account with them and start using the app.

Zing customer reviews

Zing has a rating of 4.1 out of 5.0 on the independent customer review site TrustPilot based on more than 300 reviews. On the App Store, the app has 4.7 out of 5 stars based on more than 2,000 ratings. And on the Google Play store, Zing has a rating of 4.8 out of 5 based on more than 1,000 reviews. Users across the three review platforms mentioned the app's competitive rates and transparent pricing structure. A small number of reviews mentioned issues with the application process and a lack of customer support.

Alternatives to Zing

If you're not sure whether Zing's right for you, you may want to consider alternatives like Starling Bank* and Revolut. They both work well as travel cards. Revolut is a multi-currency account, while Starling is a challenger bank that comes with fee-free international spending.

Starling Bank

Starling is an app-only challenger bank offering various bank account options to suit your personal and business needs. While Starling's personal account doesn't offer multi-currency options, you can use your card abroad. Starling Bank uses the Mastercard interbank exchange rate and doesn't charge additional transaction fees when paying abroad. You also get fee-free cash withdrawals abroad. These features make Starling a popular travel card choice.

The challenger bank is rated "Excellent" on Trustpilot with a 4.3 out of 5 score based on more than 42,000 reviews. You can read our Starling review here if you're wondering whether it might be right for you.

Revolut

Revolut allows fee-free payments in more than 150 currencies based on the interbank exchange rate. This makes it a popular choice for travelling abroad. Some limits do apply, however. For example, you can only withdraw up to £200 per month fee-free after which a 2% charge applies. Additional fees apply on weekends when making international payments too. Still, Revolut often offers some of the best exchange rates on the market.

It's rated "Great" on Trustpilot with a 4.2 out of 5 score based on more than 165,000 reviews. You can read our independent Revolut review here to decide whether this account is right for you.

How do Zing's exchange rates compare to Starling and Revolut?

To give you an idea of how Zing's exchange rates compare to competitors like Starling Bank and Revolut, see the table below for an indication of how much Zing, Starling, and Revolut were offering to convert £1,000 into EUR and USD on October 23, 2024.

| £1,000 to USD | £1,000 to EUR | ||

| Zing | $1,295.40 | €1,201.69 | |

| Starling Bank* | $1,293.48 | €1,200.90 | |

| Revolut | $1,293.48 | €1,201.43 |

Zing's conversions are inclusive of a 0.20% conversion fee. It therefore costs £1 to convert £1,000 to Euros or USD. This is reflected in the table above.

Starling Bank doesn't typically charge additional fees, but the Mastercard exchange rate applies. Revolut doesn't charge fees for the first £1,000 converted each month. Above this limit, you're charged a 0.60% fee for any exchanges. There are higher limits, or no limits at all if you opt for one of their paid plans. Everyone is also charged a 1% fee on weekends, regardless of your plan.

Based on current exchange rates and fees, Zing is one of the most competitive options. It's the cheapest for converting GBP to USD and GBP to EUR.

Zing vs Starling Bank vs Revolut

The table below provides a summary of how Zing compares to Starling and Revolut to help you decide which works best for you.

| Zing | Starling Bank* | Revolut | |

| UK registered bank account | |||

| FSCS protection | |||

| Multi-currency account | |||

| Fee-free spending abroad | |||

| Fee-free cash withdrawals abroad | |||

| Exchange rate | Mid-market rate applied for held currencies

Visa rate applied for non-wallet currencies and card payments |

Mastercard | Revolut exchange rate |

| Interest on current account balances |

The table above summarises some of the core features offered by the apps, but it's worth keeping in mind that certain limits apply in some cases. For instance, while all three bank accounts offer fee-free spending and cash withdrawals abroad, limits apply in certain circumstances. Revolut's free plan allows you to convert up to £1,000 every month without incurring additional fees as long as it's not a weekend. Zing offers fee-free spending in currencies that you hold in your wallet as well as one fee-free cash withdrawal abroad per month, after which you'll need to pay the flat £2 fee.

Summary

Zing* is a brand new international payments app that has lots of potential. It has a transparent fee structure, offers multi-currency accounts in up to 22 currencies, as well as limited free cash withdrawals abroad. It's also backed by HSBC, a banking giant keen to develop its international payments presence in the fintech space. Its conversion fees are competitive and it rivals the likes of Starling and Revolut.

It also offers nifty features like the ability to track international payments via the app and withdraw up to £500 per day. The account opening process involves several steps but is fairly straightforward and seamless.

It's very early days for Zing and so it remains to be seen whether it can truly compete with the likes of Starling Bank*, Revolut, Monzo, and Wise*.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Zing, Starling Bank, Wise