There are a number of alternative apps available that offer similar features to Money Dashboard and more information on these apps can be found in our article, 'Best budgeting apps in the UK'.

Our article has additional information on the Money Dashboard app closure, including what this means for existing customers and how to delete your account.**

Money Dashboard is a personal finance and budgeting tool, available on desktop and smartphone. Founded in Edinburgh in 2010, it now boasts over 600,000 registered users.

In this independent review, we look at how Money Dashboard works, how to set up an account with Money Dashboard and how safe it is.

What is Money Dashboard?

In the world of personal finance management, Money Dashboard could be considered as something of a pioneer. Launched in 2010, a time when open banking didn't exist, Money Dashboard helped its users to understand their finances, adding more and more features and eventually a mobile app. In 2022 The ClearScore Group acquired Money Dashboard with the view of building on ClearScore's position in the open banking market.

The introduction of open banking in 2018 and advances in the mobile app industry saw a surge of rivals enter the personal finance management space which had two main advantages over Money Dashboard. Firstly, they were built 'mobile-first', a huge advantage in a world that is dominated by the use of smartphones. Secondly, they used secure API's in order to connect to the banks (via open banking), rather than using a process known as 'screen-scraping', which required users to hand over their online login details to a third-party provider. Money Dashboard has since made the switch to API integration and in fact, championed its introduction from the start. Money Dashboard also took the opportunity to make a technology overhaul. The result is Money Dashboard Neon, a new 'mobile-first' app, built from the ground up and able to handle the fast-paced environment of personal finance.

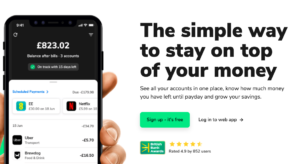

The original Money Dashboard app has since been renamed Money Dashboard 'classic' and remains a legacy product reserved for customers who created an account prior to July 2020 only. One of the stand out features from the original Money Dashboard app when we reviewed it back in 2019 was the dashboard itself. It provided a customisable set of tools that allowed users to dissect their finances in granular detail, some of which are missing from the stripped-down Money Dashboard Neon app. That said, Money Dashboard Neon benefits from a simplified menu system and uncomplicated design. It has none of the gimmicks or distractions associated with some of its rivals (in particular Emma app) and so it is no surprise that it has been voted the best personal finance app at the British Bank awards multiple times.

Money Dashboard features

- Connect your bank accounts - connect all of your accounts to see all of your money in one place

- Categorise your spending - track and categorise your transactions across your accounts

- Custom categories - personalise your spending categories

- Spending history - keep track of your spending and how it has changed over time

- Create an offline account - budget using a manual account if you are unable to connect to a specific investment or bank account

- Balance notifications - get notified if your account balance is low and you still have outstanding bills

- Set budgets - set budget goals and track how close you are to achieving your goals

- Pay cycle - set up your payday in the app so that you can track your spending and budgets from payday to payday

- Online dashboard - log in to your Money Dashboard account and manage your account from your laptop

- Transfer money - create a transfer request to transfer money between your accounts

- Track subscriptions - see all of your regular payments across all of your accounts in one place

- Predicted balance - see your predicted balance at the end of the month based on your current budget and spending

- See your balance after bills - Money Dashboard tells you what your balance will be after your bills have come out of your account

- FCA regulated - Money Dashboard is authorised and regulated by the Financial Conduct Authority

How does Money Dashboard work?

Money Dashboard is designed to be a personal finance assistant in your pocket. By connecting all of your accounts to Money Dashboard it categorises all of your transactions so you can see where your money is going each month. Over time Money Dashboard recognises transactions you make and gets better at categorising them, until then you may need to amend a few of the categories.

Who is Money Dashboard good for?

Money Dashboard is good for anyone wanting to take control of their finances, those that are keen to see the bigger picture and who are willing to take the time to make the tweaks in order to make it work for them. More importantly, it is for those who want a FREE service that they can tailor to their needs. Those looking for something that is quick and easy to set up and provides a basic overview of their finances may be best looking at the likes of Emma. However, you will have to pay to unlock Emma's advanced features, features that are free with Money Dashboard.

5 steps to getting the most out of Money Dashboard Neon

One of the minor criticisms I have with the Money Dashboard Neon app is that there isn't enough help or guidance available within the app. Once your account is set up, you are pretty much left to try and work it out for yourself and some of the best features can be difficult to spot. So, in this part of the review, I will walk you through the setup process so that you can get the most out of your Money Dashboard Neon account. If you follow these steps you'll soon realise the app's potential to transform your finances and why it outshines its competitors.

Step 1 - Connecting your bank accounts

Once your account is set up it is time to connect your accounts. Money Dashboard allows you to connect many different types of accounts, including bank accounts, credit card accounts, investment accounts, pension accounts and even store card accounts. Open banking has made connecting an account easier than ever and the process is totally secure, meaning Money Dashboard will never get to see your login details. The connection process will be slightly different depending on who you bank with, however, those who bank using their smartphone should find that the connection process only requires a couple of clicks. One slight frustration (although not unique to Money Dashboard) is that you will need to re-authenticate your connected accounts every 90 days, otherwise, you will lose connection. This is another added layer of security and is the same for every budgeting app and so should be seen as a positive rather than a negative.

Which banks are supported by Money Dashboard?

Many of the major UK banks and credit card providers are supported on Money Dashboard Neon via open banking and new providers are being added each week. These include American Express, Bank of Scotland, Barclays, HSBC, Halifax, Lloyds, MBNA, Nationwide, NatWest, RBS, Starling and Monzo. To see the full list of supported banks, click here.

Step 2 - Categorising your spending

Once your accounts are connected your data will automatically begin importing and the Money Dashboard app will do its best to correctly categorise your spending. When we originally reviewed the Money Dashboard 'classic' app, we found that there was quite a lot of manual manipulation needed in order to categorise the spending, however, the automated categorisation with Money Dashboard Neon seems far more intuitive, with around 95% of the transactions being correctly categorised. If you need to re-categorise your spending, for example, if Money Dashboard Neon categorised a purchase as 'Shopping', whereas in fact, it was a gift and so should be showing in 'Giving', you can simply click on the transaction, click on the edit icon and select the correct category. Once you select the new category, you will be asked if you want to change the category for all previous purchases at this retailer or just one transaction. This is especially handy when you want to change the category for all transactions as it saves you from having to change each one manually. Once the categorisation process is complete, clicking on the 'Overview' option at the bottom of the screen will enable you to see exactly what you have spent in each category, as well as your total income received. To compare the current month against previous months, simply swipe the bar charts at the top to cycle through each month.

Step 3 - Setting up your pay cycle

In order to budget correctly and get the most out of the Money Dashboard Neon app, you should consider editing your pay cycle so that it syncs correctly with how and when you get paid. The app's default setting is based on a calendar month so will run from the 1st to the 31st of each month, however, you can set it so that the first day is set to your payday, making budgeting far easier. To change the pay cycle simply click on the three horizontal lines in the top right-hand corner of the 'Overview' tab and click on the edit icon on the word 'Payday'. Select the day you get paid and the app will automatically make the changes.

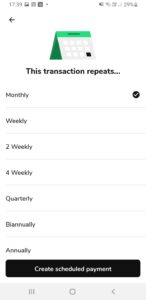

Step 4 - Setting up Scheduled payments

Step 5 - Setting up a budget

Once you have set up your scheduled payments you should consider setting up some budgets. Setting budgets allows you to monitor your transactions in various categories and can help to control your spending.

By setting an individual budget for each spending category you can keep a closer eye on your spending, making it easier to see where you may be wasting money or where you can make cutbacks. To set up individual budget categories click on 'Home', then the plus icon and then 'Add Budget'. Now click on a category, such as 'Groceries' and select 'Continue'. The Money Dashboard app will automatically provide you with a suggested amount based on your average spend, however, you can edit this amount to whatever you wish. Once you have set your budget amount, click 'Continue'. Finally, you can edit the budget name and once you are happy select 'Create budget'. Repeat this process for each budget category until you are happy. This process does take a little longer but it allows you to see at a glance exactly how much you have spent and how much you have left in each category.

3 hidden features we like about Money Dashboard Neon

Create your own custom category

This feature allows you to create your own custom category. One of the criticisms we have of the Emma app is that the 'custom category' feature is only available if you upgrade to Emma Pro, which costs £9.99 per month. With Money Dashboard Neon you can create as many custom categories as you like, perfect for those who want to truly understand where their money is going. I have created a custom category titled 'Pets' which allows me to see exactly how much I spend on my pets each month including food, accessories and insurance.

Adding a manual account

This is another feature that Money Dashboard offers that is only available as a 'paid' feature on the Emma budgeting app and is useful for being able to see the bigger picture. Unfortunately, not every account is supported on Money Dashboard, however, it does allow you to create your own 'offline' account which you can update manually. Simply go to 'Accounts', click on the Plus icon in the top right and then select 'Create offline account' and complete the details.

Transferring money directly from the app

Money Dashboard Neon allows you to transfer money between your accounts via the app, saving you from having to close the app and log in to your online bank accounts separately to complete the transfers. You can't truly transfer money directly from the app itself, the app effectively allows you to create the transfer request and then provides a shortcut to your own online bank account where you will need to provide secure login details. We had mixed success when testing this feature, however, it should get better as technology improves.

How much does Money Dashboard cost?

Money Dashboard is free to download and use.

How does Money Dashboard make money?

Money Dashboard makes money by offering products and services that it may receive a fee for if you take out the product based on its suggestion.

Money Dashboard also makes money by anonymously selling your spending data to third parties. It says, 'Money Dashboard also provides insight and market research services to help companies better understand trends in consumer behaviour. We identify shifts in consumer preferences using anonymised spending information from groups of Money Dashboard users.'

Is Money Dashboard safe?

Money Dashboard is authorised and regulated by the Financial Conduct Authority (FCA). It uses the same security practices as many of the leading banks and uses a secure access environment that uses an extended validation security certificate with 256-bit encryption. Money Dashboard has integrated with Token, a registered Payment Initiation Services Provider meaning users can safely make transfers within the Neon app.

Money Dashboard uses open banking in order to access your financial details, a government-backed initiative that puts you in control of your financial data. By using open banking, you have ultimate control over who sees your data and for how long.

Alternatives to Money Dashboard

Money Dashboard Neon has been built from the ground up to be 'mobile-first' meaning it can finally rival the likes of competitors such as Emma.

One of the criticisms we had of Emma, in particular, is the childlike feel of the app and the desire to promote deals that earn it money. Money Dashboard is far more subtle and benefits from a clean and simple black and white design, meaning you can get the information you need with little distraction. The absence of a 'refer a friend' feature does come as a surprise, especially as Emma goes one stage further by providing a handy 'Scramble' feature that enables users to demonstrate the app to friends and family without having to show account balances.

Money Dashboard vs Emma

In the below comparison table, we compare Money Dashboard to its competitor Emma. More information on the alternate budgeting app can be found in our independent review:

| Money Dashboard | Emma | |

| Monthly Cost | FREE | FREE (Pro versions available) |

| Categorised spending | ||

| Budgeting tools | ||

| Payment transfers | ||

| Custom categories | ||

| Offline accounts |

Money Dashboard customer reviews

Money Dashboard has a rating of 2.8 out of 5.0 on Trustpilot from over 160 reviews. 45% of customers rate it as 'Excellent' citing the app as safe and easy to use as well as great customer response. 14% rated it as 'Bad' with some users expressing disappointment on being unable to migrate from Money Dashboard Classic to Money Dashboard Neon without recreating an account.

Money Dashboard Pros and Cons

Pros of Money Dashboard

- Free to download and use

- Access to features that other apps charge for

- Ability to create custom categories

- Transfer money between accounts

- Available on desktop

- Much more customisable than competitors

Cons of Money Dashboard

- Not enough help/guidance is available within the app

- Requires manual manipulation to get the most out of the app, particularly at the start

- Unable to see actual pending transactions which some competitors provide (it shows you suggested transactions based on spending history)

Summary

Money Dashboard Neon is a shining example of how Fintech is helping to reshape the world of personal finance. Built for smartphones from the ground up, Money Dashboard Neon stands alone in offering fee-free access to its advanced features. With its simple, clutter-free design and the promise of additional features on the horizon, Money Dashboard Neon has quickly become a 'go-to' personal finance app. Those who stick with it through its initial setup phase will be rewarded. To see how Money Dashboard Neon compares against the likes of Emma and other budgeting apps, check out our article 'The best budgeting apps in the UK - how to budget without trying'.