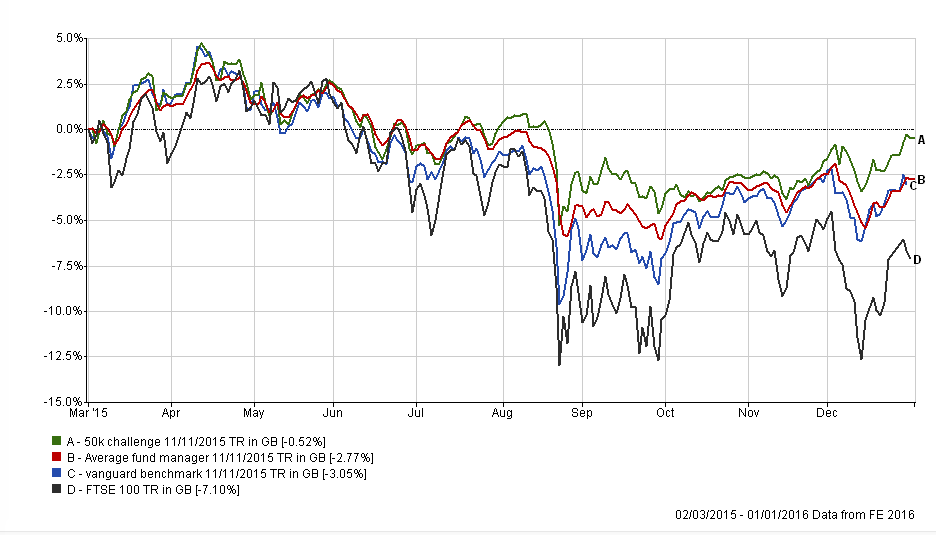

In my last update I promised to review my portfolio this week. If you recall at the start of the year my portfolio was almost back to profit as shown in the chart below (click to enlarge):

But as you know stock markets have had their worst start to a year ever! So many of you are wondering how my portfolio is doing. Well the table below gives you the total return since I launched my portfolio back in March 2015. The big thing you will notice is that my portfolio weathered the market sell-off better than the professional fund managers and the passive benchmark. That means that my portfolio is outperforming even more after the market slump!

Portfolio Return % since March 2015 My portfolio -3.05 Average fund manager -5.64 Passive Vanguard benchmark -6.50 FTSE 100 -12.60 My current portfolioAt present my portfolio looks like this:

Fund % of portfolio Aberdeen Property Trust 10 Aberdeen European High Yield Bond 18 Jupiter European 17 Rathbone Global Opportunities 18 Fundsmith Equity 10 JPM UK Smaller Companies 16 CF Miton UK Value Opportunities 11 My portfolio's existing asset allocationMy portfolio has the following asset allocation:

- UK Equities 35%

- European Equities 20%

- US Equities 15%

- Global Fixed interest 9%

- UK Fixed interest 9%

- Property 7%

- Cash 5%

- Alternative strategies 0%

- Other international equities 0%

- Japan Equities 0%

Over the equivalent period the 80-20 Investor portfolio has just dipped back into negative territory with a total return since March 2015 of -1.38%.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in