Listen to Episode 475

In this week's episode I provide an overview of the mortgage market following the Bank of England's decision to keep the base rate at 5%, including the latest predictions of when rates will be cut further. Next, following HMRC's decision to allow fractional share trading within an ISA, I provide an update on the providers that allow you to trade them as well as those that don't. Finally, Andy highlights the best pension tracing services in the UK, explaining how they can help to locate and consolidate old pension pots.

Support the podcast

Remember to like, subscribe and follow us on all our socials. You can also support the Money to the Masses podcast by visiting our dedicated podcast page.

Every time you use a link on the page we may earn a small amount of money for our podcast. We only use affiliate links that give you an identical (or better) deal than going direct. Thank you for being an incredible part of our community. Your support means the world to us.

Watch the video version of the podcast below:

https://youtu.be/s3bXProBX14

You can also listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Listen on iTunes Listen on Android via RSS

Support the podcast!

You can now support the Money To The Masses podcast by visiting this page when making any financial decision

- Save money

- Earn cashback

- Exclusive offers for listeners

Podcast summary

Mortgage Market Overview

Summary:

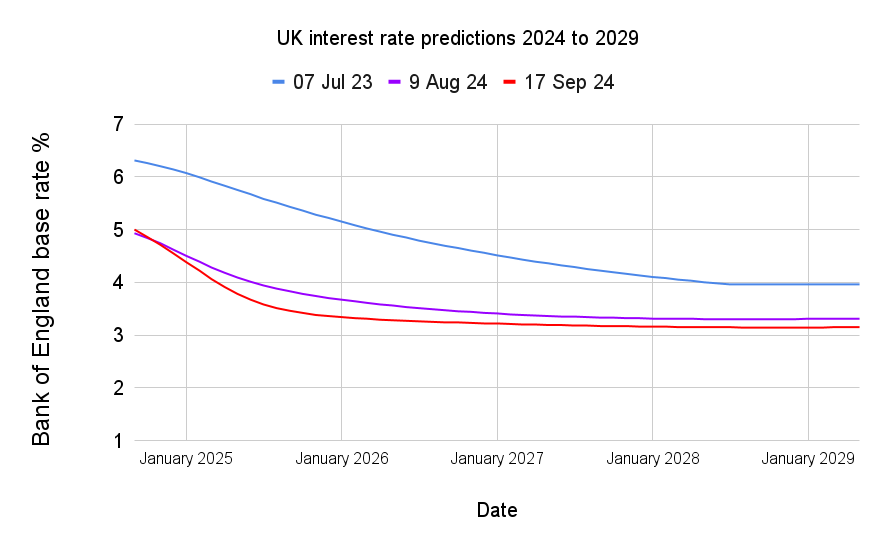

An in-depth analysis of the current mortgage market, focusing on the Bank of England’s recent decision to maintain the base rate at 5%. Despite expectations of a potential rate cut to 4.75%, the rate remained unchanged. However, market predictions indicate that the base rate may decrease to 4.38% by early 2025 and further to approximately 3.14% by 2028, which is favourable for mortgage borrowers. This anticipated decline in base rates suggests that fixed mortgage rates may also decrease, offering opportunities for refinancing at lower rates.

Key Insights:

- The Bank of England held the base rate steady at 5%, contrary to market expectations of a cut to 4.75%.

- Future base rate predictions suggest a downward trend, reaching around 3.14% by 2028.

- Lower base rates are expected to lead to decreased fixed mortgage rates, benefiting borrowers looking to refinance.

- The best current two-year fixed mortgage rate for a 60% LTV is 3.99%, with ongoing downward movement in rates.

- Economic factors such as inflation and potential recessions will influence future rate decisions.

Fractional Shares

Summary:

In this section we discuss the increasing accessibility of fractional shares for UK investors, especially now that fractional shares can be held within ISAs. This change allows investors to purchase smaller portions of expensive stocks, such as those in the US tech sector, thereby enabling greater diversification with smaller investment amounts. Several platforms now support fractional shares, including EToro, Trading 212, and Freetrade, while traditional platforms like Hargreaves Lansdown do not. However, investors should be mindful of associated fees and the potential limitations on voting rights.

Key Insights:

- Fractional shares can now be held within ISAs, making them more accessible to a broader range of investors.

- Platforms offering fractional shares include EToro, Trading 212, Freetrade, and others, whereas some major platforms like Hargreaves Lansdown do not.

- Investing in fractional shares allows for diversification with smaller amounts, reducing the barrier to entry for investing in high-priced stocks.

- Investors should consider trading fees and FX charges, as these can impact the overall cost of investing in fractional shares.

- While fractional shares offer flexibility, not all shares are available in fractional form, and voting rights may vary by platform.

Pension Tracing Services

Summary:

The final segment of the podcast focuses on pension tracing services, which are essential for individuals who have worked multiple jobs and may have lost track of their pension schemes. The UK government offers a free Pension Tracing Service that provides contact information for pension administrators, but it requires users to follow up themselves. In contrast, private companies like PensionBee and MoneyFarm offer comprehensive pension tracing and consolidation services, handling much of the legwork and some companies provide additional benefits such as guidance on suitable pension portfolios. These services simplify the process of locating and managing multiple pension pots, making it easier for individuals to consolidate their pensions into a single, manageable account.

Key Insights:

- The UK government’s Pension Tracing Service provides contact information for pension administrators but requires manual follow-up.

- Private companies like PensionBee and MoneyFarm offer more comprehensive services, including tracing and consolidating pensions.

- MoneyFarm provides additional benefits such as guidance on suitable pension investment portfolios, aiding users in making informed decisions.

- Consolidating pensions can simplify financial management, but users should be aware of fees and the nature of their pension schemes (e.g. defined benefit vs. defined contribution).

- Seeking professional financial advice is recommended, especially when dealing with complex pension schemes or significant pension pots.

Episode quiz

Test yourself on the topics covered in this week's show.

1. What was the Bank of England's base rate decision at its September meeting ?

-

- A) Cut to 4.75%

- B) Kept at 5%

- C) Increased to 6%

- D) Cut to 5.25%

2. What is the market's prediction for the Bank of England base rate in early 2025?

-

- A) 4.75%

- B) 3.14%

- C) 4.38%

- D) 5.0%

3. What is the current best two-year fixed mortgage rate for a 60% loan-to-value (LTV)?

-

- A) 5.56%

- B) 4.99%

- C) 3.99%

- D) 6.7%

4. What is one potential advantage of investing in fractional shares?

-

- A) No voting rights required

- B) Diversification with smaller amounts

- C) Guaranteed dividends

- D) No fees involved

5. What is the purpose of the UK government’s Pension Tracing Service?

-

- A) To automatically consolidate all pensions

- B) To provide contact information for pension administrators

- C) To offer investment advice on pensions

- D) To estimate pension values

Answers

- B) Kept at 5%

- C) 4.38%

- C) 3.99%

- B) Diversification with smaller amounts

- B) To provide contact information for pension administrators

Resources

Links referred to in the podcast:

- Will interest rates continue to fall in 2024?

- What are fractional shares and where best to buy them?

- Best mortgage rates in the UK

- What are fractional shares and where best to buy them?

- Join our community group and help test a brand new MTTM product

- Pension Tracing Service on GOV.UK

- Should I transfer my final salary pension?

- Best pension tracing services in the UK

- MTTM Deals Page

- Sign up to the Money to the Masses Newsletter

UK interest rate predictions 2024-2029