At the start of the year I said that I would periodically update you with how my portfolio is doing, even if I have not made any fund switches.

You may recall that at the start of March (which also coincided with the first anniversary of my portfolio) I made a number of changes to bring the portfolio back in line with the 80-20 Investor Best of the Best Selection.

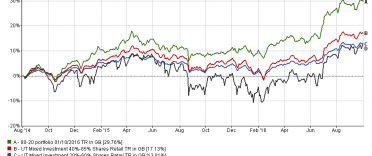

The table below shows that my portfolio has performed brilliantly since the fund switches in March:

Name Total Return % 50k challenge (my portfolio) 3.8 Passive Vanguard benchmark 1.58 Average fund manager 1.23 FTSE 100 -0.30This is a great result and means that the portfolio is once again in profit at £50,709, a gain of 1.41% over the last 13 months (since I began the challenge). By comparison over the same period:

- The average managed fund manager has lost 2.8 %

- The passive Vanguard benchmark has lost 0.8%

- The FTSE 100 has lost 7.5%

In fact I am outperforming 90% of fund managers running equivalent managed portfolios (as represented by those in the Mixed Investment 40%-85% Shares Sector

That is an excellent result and the spike in performance in the last month reinforces why you should review your portfolio regularly.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in