The Bank of England (BoE) announced a rate rise of 0.50%, taking it from 4.50% to 5.00%. It is the 13th consecutive base rate rise since December 2021 and it is now at the highest level since 2008. In this article, we explain the impact that the latest base rate rise will have on both borrowers and savers. We also include some additional resources and tools that can help those that are due to remortgage soon.

The Bank of England (BoE) announced a rate rise of 0.50%, taking it from 4.50% to 5.00%. It is the 13th consecutive base rate rise since December 2021 and it is now at the highest level since 2008. In this article, we explain the impact that the latest base rate rise will have on both borrowers and savers. We also include some additional resources and tools that can help those that are due to remortgage soon.

What is the Bank of England base rate?

The Bank of England base rate refers to the interest rate at which the Bank of England lends money to banks, building societies and other lenders. An increase in the Bank of England base rate usually signals an increase in the rate that banks and other lenders charge in order to maintain profitability. On the flip side, savers should be able to access improved savings rates, however, some providers can be slow to pass on the rise (if they do at all) and so it is worth comparing the best savings rates on offer.

Why has the Bank of England base rate increased again?

The nine-person Monetary Policy Committee (MPC) has decided to raise the Bank of England base rate by a further 0.50%, voting with a majority of 7-2. A rise had been predicted, with most analysts expecting an increase of 0.25%, however, a rise of 0.50% was always a possibility, especially given that recent base rate increases have failed to reduce inflation to anywhere near the official target rate of 2%. The current rate of inflation in the UK as measured by CPI is 8.7%. The hope is that the latest increase will prompt a slowdown in spending, reduce demand and bring inflation under control. As a result of the latest base rate increase, consumers are likely to see further increases in mortgage interest rates as well as other credit products, while savers should benefit from increased savings rates from banks and building societies, although they can take time to trickle through.

Prior to the latest rise, the average 2-year fixed-rate mortgage deal had already surpassed 6.00%, a figure which could rise further following the latest base rate announcement. Pressure is mounting on the government and mortgage lenders to help borrowers who find themselves unable to afford their mortgage payments due to rising interest rates. A number of suggestions have been put forward including subsidies and tax breaks while some have asked that lenders make it easier for customers to switch to an interest-only mortgage or extend their mortgage term in order to lower the monthly mortgage repayments.

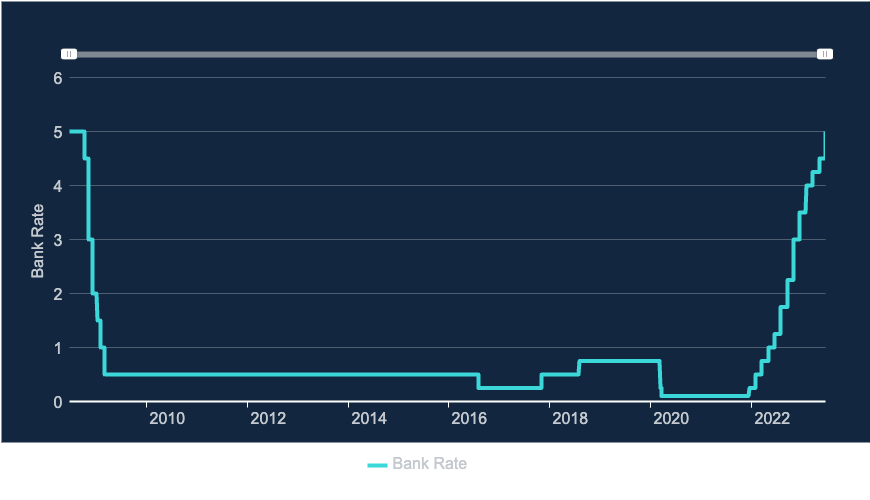

The following graph shows how the Bank of England base rate has increased over time.

(Source: Bank of England)

Rate rises and how they impact you: December 2021 - June 2023

The latest Bank of England base rate increase is aimed at reducing inflation. Below, we provide a summary of the Bank of England base rate rises since December 2021, which was when the BoE began its series of aggressive increases.

| Date | Interest rate rise | Previous interest rate | New interest rate | Increase to average monthly mortgage repayments per £100k borrowed* |

| 16th December 2021 | +0.15% | 0.10% | 0.25% | £8 |

| 2nd February 2022 | +0.25% | 0.25% | 0.50% | £13 |

| 17th March 2022 | +0.25% | 0.50% | 0.75% | £13 |

| 5th May 2022 | +0.25% | 0.75% | 1.00% | £13 |

| 16th June 2022 | +0.25% | 1.00% | 1.25% | £13 |

| 4th August 2022 | +0.50% | 1.25% | 1.75% | £26 |

| 22nd September 2022 | +0.50% | 1.75% | 2.25% | £26 |

| 2nd November 2022 | +0.75% | 2.25% | 3.00% | £39 |

| 15th December 2022 | +0.50% | 3.00% | 3.50% | £26 |

| 2nd February 2023 | +0.50% | 3.50% | 4.00% | £26 |

| 23rd March 2023 | +0.25% | 4.00% | 4.25% | £13 |

| 11th May 2023 | +0.25% | 4.25% | 4.50% | £13 |

| 22nd June 2023 | +0.50% | 4.50% | 5.00% | £26 |

| TOTAL | £255 |

*assumed mortgage term is 25 years

How does the BoE interest rate rise affect you if you have a mortgage?

Fixed-rate mortgage customers

Around three-quarters of mortgage customers are on a fixed-rate deal which will protect them from the latest interest rate rise for now. However, if your existing fixed-rate mortgage deal is ending in the next 6 months then it would be wise to read our article 'Remortgaging in 2023 – is now the right time to fix & for how long?'. Our latest YouTube video on mortgage rates explains the importance of acting quickly, especially if you are in the last six months of your current fixed-rate deal.

To provide some basic calculations, the 0.50% rise will mean that your monthly mortgage repayments, based on a 25-year mortgage term, could increase by approximately £26 per month for every £100,000 borrowed. It is worth remembering, however, that these figures only take into consideration the latest base rate rise, so if your existing fixed-rate deal was in place prior to December 2021 (when rates first started to rise), then you should factor in all of the interest rate rises combined. This equates to a rise of around £255 per month, per £100,000 borrowed, based on a 25-year mortgage term as shown in the table above.

Variable rate or tracker mortgage customers

Those with tracker or variable rate mortgages are likely to see their mortgage payments increase in line with the latest Bank of England base rate announcement, however, lenders often take time to implement the increase, so exactly when you will see the change will depend on your lender. You can work out what the impact will be on your mortgage payments by using our interest rate rise calculator. You'll need to know your initial mortgage term, the amount borrowed at the start of the deal and your current mortgage rate.

Anyone worried about the impact that the latest base rate rise will have on their finances should speak with an independent mortgage adviser* as they can easily explain the likely impact on your finances and also provide advice on remortgaging. They will be able to weigh up your options and compare what mortgage rates and deals are available to you. Always check to see if there are any Early Repayment Charges (ERC) when remortgaging and check to see how long is left on your current deal. Also, you can take a look at the best mortgage deals yourself by using our mortgage best buy calculator.

How does the BoE interest rate rise affect you if you have credit cards, loans or overdrafts?

Credit cards

It is likely that your credit card provider will increase the Annual Percentage Rates (APR) on your credit card. However, if you have an existing credit card with an agreed interest-free period or promotional interest rate you won't notice any immediate impact from the Bank of England rate rise. However, if your promotional period is due to end, or you are applying for a new credit card in the future, you will likely notice that the APR increases. One way to avoid a rise in interest on your credit card is to complete a balance transfer, by moving your existing credit card balance to a 0% balance transfer credit card. To ensure you pay no interest on your repayments, the balance needs to be repaid within the promotional interest-free period. Be aware that most (not all) balance transfer credit cards charge a balance transfer fee, usually between 2% and 5, and of course, you will be credit checked during the application process. Find out more in our article, 'Best 0% balance transfer credit cards'.

Loans

If you already have a loan in place and it has a fixed interest rate then you are unlikely to be affected by the latest base rate rise. Those looking for a new loan are likely to see higher APR deals entering the market.

Overdrafts

The interest rate charged on your overdraft could be impacted by the latest rise in the Bank of England's base rate and so your overdraft rate could go up. You should receive advanced notification from your Bank or Building Society if this is the case, giving you time to consider your options.

How does the BoE interest rate rise affect you if you have savings?

Savings rates are likely to go up as a result of the latest Bank of England base rate rise, however, it is up to the individual bank or building society as to when/if they increase their rates. Some will take weeks or even months to increase rates following a Monetary Policy Committee announcement and others may not increase rates at all, as they are under no obligation to do so. If you are looking for the best savings rates then you should always shop around for the best deal. Check out the best savings rates using our Savings Best Buy tables. Right now you can get as much as 5.43% interest on a 1 year fixed-rate savings bond.

Help if you're unable to afford your mortgage payments

If you're having trouble paying your mortgage or are worried about how you will afford your mortgage following the latest interest rate rise then you should get in touch with your lender as soon as possible. Your lender may be able to provide support and it is in their interest to find a solution to ensure that repayments are not missed. Potential solutions could include allowing you to take a mortgage payment holiday or extend the length of your mortgage or convert part of a repayment mortgage to interest-only in order to reduce your monthly repayments.

You may also find additional support from the following organisations helpful:

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - VouchedFor