The Bank of England (BOE) has taken the decision to raise the base interest rate by 0.50%, taking it from 3.00% to 3.50%. It is the 9th consecutive base rate rise since rates started increasing last December. In this article, we reveal the impact the latest base rate rise is likely to have on both savers and borrowers. We also provide some resources and tools to help those that are considering remortgaging.

The Bank of England (BOE) has taken the decision to raise the base interest rate by 0.50%, taking it from 3.00% to 3.50%. It is the 9th consecutive base rate rise since rates started increasing last December. In this article, we reveal the impact the latest base rate rise is likely to have on both savers and borrowers. We also provide some resources and tools to help those that are considering remortgaging.

What is the Bank of England base rate?

The Bank of England base rate - often referred to as the 'Bank rate' or 'the interest rate' - is the rate that the Bank of England charges commercial banks and other lenders when they borrow money. The knock-on effect causes the banks and other lenders to raise the interest rate for borrowers in line with the increase to the Bank of England base rate, to ensure they cover their costs. Savers are likely to see savings rates increase, although this isn't guaranteed and the rate offered is often lower than the rate charged to borrowers to ensure the lender makes a profit.

Why has the Bank of England base rate increased?

The Monetary Policy Committee voted to raise the Bank of England base rate by 0.50% in its latest effort to combat spiralling inflation. With the base rate now standing at 3.50%, it is hoped that borrowing and spending will slow, encouraging more people to save. Inflation currently stands at 10.7%, down 0.4% from October and it is hoped that the latest interest rate rise will help to curb inflation as we move into 2023.

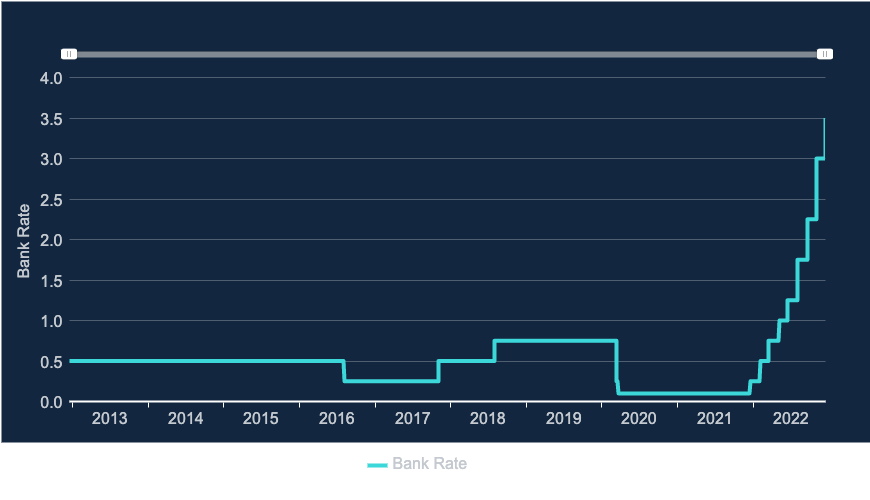

The following graph shows how the Bank of England base rate has increased over time.

(Source: Bank of England)

Rate rises and how they impact you - 2021-2022

The latest Bank of England base rate increase is expected to help slow down inflation, with fears that the UK could be entering the longest recession for 100 years. Below, we provide a brief summary of the Bank of England base rate rises since December 2021.

| Date | Interest rate rise | Previous interest rate | New interest rate | Increase to average monthly mortgage repayments per £100k borrowed* |

| 16th December 2021 | +0.15% | 0.10% | 0.25% | £8 |

| 2nd February 2022 | +0.25% | 0.25% | 0.50% | £13 |

| 17th March 2022 | +0.25% | 0.50% | 0.75% | £13 |

| 5th May 2022 | +0.25% | 0.75% | 1.00% | £13 |

| 16th June 2022 | +0.25% | 1.00% | 1.25% | £13 |

| 4th August 2022 | +0.50% | 1.25% | 1.75% | £26 |

| 22nd September 2022 | +0.50% | 1.75% | 2.25% | £26 |

| 2nd November 2022 | +0.75% | 2.25% | 3.00% | £39 |

| 15th December 2022 | +0.50% | 3.00% | 3.50% | £26 |

| TOTAL | £177 |

*assumed mortgage term is 25 years

How does the BOE interest rate rise affect you if you have a mortgage?

Fixed-rate mortgage customers

Around 75% of mortgage holders are on a fixed-rate mortgage deal, protecting them, for the time being at least, from the latest interest rate rise. If your fixed-rate deal is coming to an end in the next 6 months then you may wish to read our article "Remortgaging in 2022 – is now the right time to fix & for how long?". Those on a fixed deal that is coming to an end would be wise to work out the impact that the latest rise has on them and budget accordingly. As a rough guide, the 0.50% increase will mean the monthly mortgage repayments on a 25-year mortgage will rise by around £26 per month for every £100,000 you owe. It is worth noting that this is just based on the latest base rate rise, so if your current fixed-rate deal was in place before December 2021, you will need to include the cost of all of the rate rises combined. This works out at an increase of roughly £177 per month, per £100,000 borrowed, based on a 25-year mortgage term.

Variable rate or tracker mortgage customers

Those with tracker or variable rate mortgages will see their mortgage payments rise in line with today's announcement, but lenders usually take some time to implement the increase, so exactly when you will see the increase will depend on your lender. Working out what effect the increased base rate will have on your monthly mortgage payments is simple by using our interest rate rise calculator. All you will need is your mortgage term, mortgage balance and the current interest rate figures.

Anyone worried about the impact that the latest base rate rise will have on their finances should speak with an independent mortgage adviser* as they can explain the likely impact as well as the best way to remortgage. Always check to see if there are any Early Repayment Charges (ERC) when remortgaging and check to see how long is left on your current deal. They will be able to weigh up your options and compare what mortgage rates and deals are available to you. Alternatively, you can take a look for yourself by using our mortgage best buy calculator.

How does the BOE interest rate rise affect you if you have credit cards, loans or overdrafts?

Credit cards

If you have an existing credit card with an agreed interest-free period or promotional interest rate you will not be impacted by the latest Bank of England base rate rise. However, if the promotional period is set to end, or you are a new applicant, it is likely that your credit card provider will increase the Annual Percentage Rates (APR) for the card. A good way to avoid a hike in interest on your credit card is to do a balance transfer, by transferring your existing credit card balance to a 0% balance transfer credit card. Remember, however, that to ensure you pay no interest on your repayments, the balance needs to be repaid within the interest-free timeframe. Also be aware that most (not all) balance transfer credit cards charge a balance transfer fee, usually between 2% and 5%. Find out more in our article, 'Best 0% balance transfer credit cards'.

Loans

If you already have a loan in place and it has a fixed interest rate then you are unlikely to be affected by the latest base rate rise. Those looking for a new loan are likely to see higher APR deals entering the market.

Overdrafts

The interest rate charged on your overdraft may be impacted by the rise in the Bank of England's base rate and so could go up. You should receive advanced notification from your Bank or Building Society if this is the case, giving you time to consider your options.

How does the BOE interest rate rise affect you if you have savings?

Savings rates are likely to increase as a result of the latest Bank of England base rate rise, however, there isn't a typical time period in which a bank or building society will increase its savings rates. Some will take weeks or even months to increase rates following a Monetary Policy Committee announcement and others may not increase rates at all, as they are under no obligation to do so. If you are looking for the best savings rates then it would be wise to shop around. Check out the best savings rates using our Savings Best Buy tables

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Habito