Episode 283 - On this week's show we celebrate hitting 1 million downloads by revealing some interesting podcast stats, including some personal highlights such as my favourite episodes.

Taking inspiration from the 'million' theme, I decided to crunch some numbers in order to see, depending on your age, how much you would need to invest in order to become a millionaire.

Join the Money to the Masses Facebook community group, a friendly community that allows like-minded listeners to network and chat.

Click on either media player below to listen to Episode 283 of the MoneytotheMasses.com podcast.

You can also listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Resources

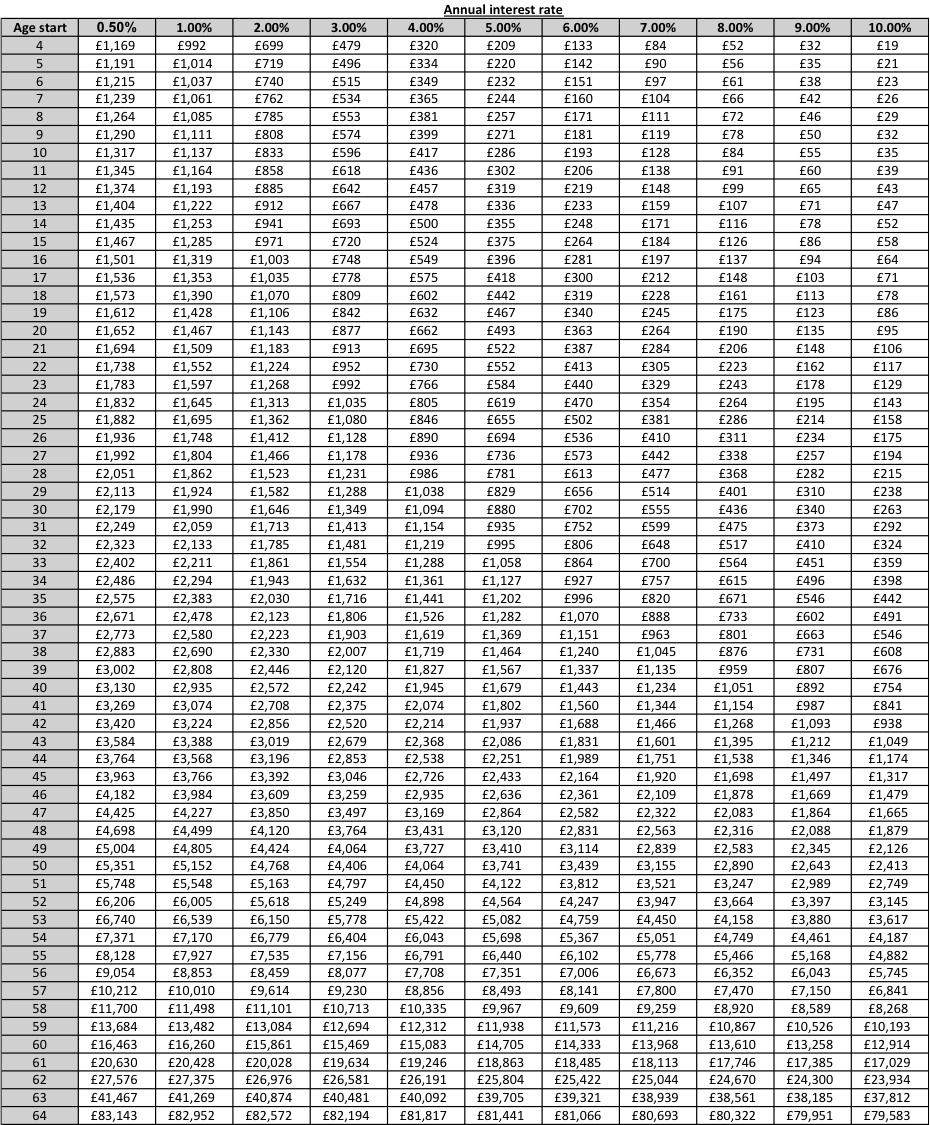

Cribsheet showing you the fixed amount you need to put away every month (assuming you have no existing investments or savings) from any given age to be a millionaire by age 65, ignoring inflation. Click on the image to enlarge it.

Past podcast mentioned in this week's show

Inspirational! I’m not a Maths geek, so I appreciate those who are able to do the numbers and willing to share their knowledge.

I really appreciate the way Damien presents different scenarios and options. It’s a bit late for me to benefit from compounding but I will definitely put this to use for my child- JISA will be opened this week.

Thank you.

Great podcast this week. The price on compound interest and contribution levels was very interesting (fellow Maths weirdo). It made me think about my children’s investing strategies now that they are becoming adults and taking over the baton managing their Stocks & Shares ISAs & LISAs.

The way Damien broke down contribution levels for those auto-enrolled in company pensions was extremely powerful & insightful. It worries me that we are storing up a pension problem in the future because people can opted out of the company pensions. A podcast like this would show people how a small contribution today will mean a reasonable pension in the future.

Thanks Richard