Listen to Episode 464

In this week's episode I discuss the growing trend of people opting to self-fund private medical care due to long NHS waiting times. I then discuss the importance of considering unknown risks when it comes to all aspects of your personal finances. Finally, Andy provides an update on the latest energy prices and whether now is the right time to fix based on long-term energy price predictions

Support the podcast

Support the Money to the Masses podcast by visiting our dedicated podcast page

Every time you use a link on the page we may earn a small amount of money for our podcast. We only use affiliate links that give you an identical (or better) deal than going direct. Thank you for being an incredible part of our community. Your support means the world to us.

You can also listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Listen on iTunes Listen on Android via RSS

Support the podcast!

You can now support the Money To The Masses podcast by visiting this page when making any financial decision

- Save money

- Earn cashback

- Exclusive offers for listeners

Podcast Episode 464 Summary

The first main segment of the podcast addresses the increasing trend of individuals opting for private medical care due to long NHS waiting times.

Damien outlines the cost of various private medical procedures, such as MRI scans (£200-£500), CT scans (£400-£800), and hip replacements (£12,000). He also highlights the two main ways to access private care: through insurance or self-funding. For those who cannot afford to pay upfront, he mentions that private hospitals offer credit options and payment plans. He stresses the importance of considering private medical insurance, which typically ranges from £25 to £100 per month, and suggests a middle-ground policy like Benenden Health for those seeking a more affordable option.

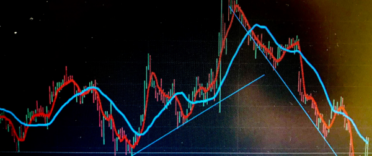

The second segment focuses on investing and risk management, inspired by Morgan Housel's book "Same as Ever." Damien reflects on the concept of risk, noting that the most significant risks are often unknown and unforeseen, such as the COVID-19 pandemic. He suggests listeners to assess their risk tolerance and adjust their investment portfolios accordingly. For those uncertain about their risk profile, he recommends using risk assessment questionnaires (see resources section) or using robo-advisers onboarding journeys which assess customer your risk.

Damien emphasises the importance of being prepared for unknown risks by having a larger emergency fund than one might think necessary. He suggests aiming for 12 months of expenses instead of the traditionally recommended six months, to better cope with unexpected events. This suggestion ties back to the earlier discussion on private medical care, highlighting the need for financial preparedness in all aspects of life.

The final segment of the show revisits the topic of energy prices,. Andy explains that the energy price cap, set by OFGEM, is adjusted quarterly and will decrease by 7% on July 1st, bringing the average energy bill down to £1,568. He notes that energy prices are expected to rise again in the autumn, according to predictions by Cornwall Insight.

Andy advises listeners to consider fixing their energy tariffs now, as current deals might be more favorable than future rates. He mentions flexible tariffs that track the energy price cap, such as those offered by EDF, which can provide some protection against rising prices.

Multiple Choice Questions

- What payment options are available for those who can't pay for private medical care upfront?

- A. Loans only

- B. Credit cards and payment plans

- C. Government grants

- D. Charity funding

- What type of policy is Benenden Health described as?

- A. Comprehensive

- B. Basic

- C. Limited

- D. Premium

- What is the typical premium range for private medical insurance?

- A. £10 - £50 a month

- B. £15 - £75 a month

- C. £25 - £100 a month

- D. £50 - £150 a month

- What is the predicted trend for energy prices in the autumn according to Cornwall Insight?

- A. Prices will stay the same

- B. Prices will decrease

- C. Prices will increase

- D. Prices will be unpredictable

- Having a bit more money in your emergency fund than you are comfortable with could help to what?

- A. Avoid taxes

- B. Prepare for unknown risks

- C. Increase interest earnings

- D. Cover luxury expenses

Answers

- B. Credit cards and payment plans

- C. Limited

- C. £25 - £100 a month

- C. Prices will increase

- B. To prepare for unknown risks

Resources:

Links referred to in the podcast: