A number of the largest mortgage lenders have increased their mortgage rates this week even though the Bank of England voted to cut the base rate for the second time this year. The mortgage rate hikes will concern borrowers who may have been waiting for rates to fall further and especially those who are remortgaging from relatively low rates arranged before mortgage rates spiked 2 years ago.

A number of the largest mortgage lenders have increased their mortgage rates this week even though the Bank of England voted to cut the base rate for the second time this year. The mortgage rate hikes will concern borrowers who may have been waiting for rates to fall further and especially those who are remortgaging from relatively low rates arranged before mortgage rates spiked 2 years ago.

What is happening to mortgage rates?

Mortgage interest rates fluctuate due to a number of factors - significant among these is a change to the Bank of England’s (BoE) base rate and as such, a cut to the base rate is usually mirrored by similar reductions in the mortgage rates charged and offered by banks. However, in spite of the Monetary Policy Committee’s (MPC) decision to cut the base rate by 0.25% in November, the market has seen a number of lenders subsequently increase mortgage rates across dozens of mortgage deals.

High street lenders, including Virgin Money, Santander and TSB, raised interest rates earlier this week, with Barclays, NatWest and First Direct following suit with hike rates across a large range of mortgage products. Market-leading sub-4% mortgage deals that were available to borrowers with higher deposits or greater equity in their homes have all but disappeared.

Barclays’ interest rate on a 60% LTV mortgage deal over 2 years has increased from 3.96% to 4.30% while NatWest increased its rate for the same deal from 3.99% to 4.22%. Santander has increased residential fixed mortgage rates across purchase, remortgage and green products by up to 0.29%. You can search a variety of mortgage deals on offer in our regularly updated article, “Best mortgage rates in the UK” or use our mortgage rate comparison tool to search the market for the best deals based on your specific circumstances.

Tracker rate customers will have seen a 0.25% reduction to their rate of interest in line with the base rate cut providing a silver lining for those on these types of mortgages and Nationwide bucked the trend by reducing rates for first-time buyers with low deposits seeking a 2-year fixed rate mortgage deal.

Instant free mortgage advice

Our partner Habito is a leading online mortgage broker and will recommend the best mortgage for you

- Habito checks over 20,000 mortgages from 90 mortgage lenders

- 5-star rating on Trustpilot from over 5,000 customer reviews

- Can register online

Why are mortgage rates rising?

There is no one reason why interest rates have risen this week; however, swap rates will be an important factor for lenders. This is the rate at which banks lend money to one another - meaning banks’ costs are going up, and customers are seeing the effects of this.

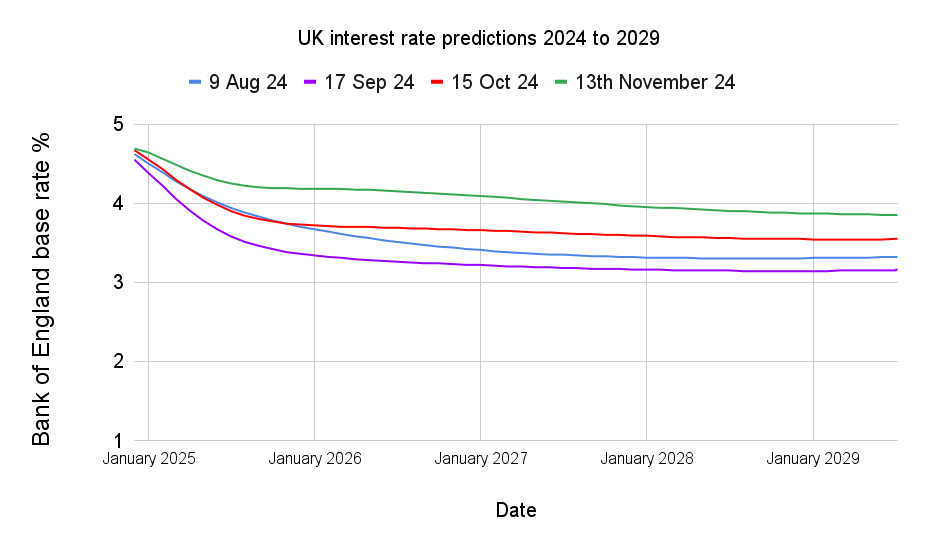

Spending commitments and changes to taxation, revealed by the Chancellor of the Exchequer, Rachel Reeves at the Autumn Budget have helped to push swap rates higher. The Office for Budget Responsibility (OBR) anticipates that following the Budget, inflation will increase in the short to medium term before returning to the BoE’s target of 2%. This has meant that predictions for how much and how quickly the BoE would cut the base rates have been dampened. The chart below shows the difference between how the base rate was expected to fall over the next few years at various points since August this year. You can read more about this in our article, "Will interest rates continue to fall in 2024?".

Interest rates are also susceptible to global market uncertainty meaning the recent election of Donald Trump as President of the US will also be playing a part in the picture that we see. It is unclear how the new presidency will influence conflicts in the Middle East as well as between Ukraine and Russia; areas that are crucial supply paths for goods and energy to the UK. Disruption of these paths could mean that supply chains are hindered, causing inflation to rise again, as was seen during and for some time after the pandemic. Global market uncertainty is likely to continue for the coming weeks, with many hoping for more clarity once President Trump is inaugurated on the 20th of January 2025.

Who will the mortgage rate rises affect?

As the increase in rates can be seen across purchase and remortgage deals, both homebuyers and those looking to remortgage from an existing mortgage deal are likely to be adversely affected.

Homebuyers who have secured a rate with their lender but have yet to complete the purchase of their home should check how long the mortgage interest rate will be held - most lenders lock in the interest rate offered once a mortgage application has been fully submitted, but this does vary, and some lenders may not offer similar assurances.

With rates rising, it is usually best to find and secure the best mortgage deal for your needs so that further rate increases do not increase your costs.

In the same way, mortgage borrowers whose mortgage deals are about to expire may be wise to secure a rate, even if the expiration is not imminent. Lenders often allow customers to secure a remortgage deal ahead of time and you can start the process up to 6 months before your mortgage deal comes to an end, giving you time to search the market for the best remortgage deals. Once you have locked in a remortgage deal, you can usually still switch to a better remortgage offer if one becomes available before you formally switch deals, while gaining the peace of mind that any further rate increases won’t adversely affect you. You can read more about product transfers in our article, "Mortgage product transfer window - when to speak to your lender".

Speak to your mortgage broker to plan the best course of action based on your specific circumstances. Mortgage deals vary significantly across lenders, and using a mortgage broker to arrange your mortgage will allow you to find the best mortgage deal and secure it against any further changes in rates. If you do not have a mortgage broker, you can search for one by using the online professional directory service Vouchedfor* - the service lists mortgage professionals in your area based on your preferences, and you can select based on the customer reviews shared on the website. Alternatively, contact the online mortgage broker, Habito* where the advisers can help mortgage customers nationwide without paying a fee for the service provided. Habito’s mortgage advisers have access to over 90 lenders’ mortgage deals and will be able to access some deals that are only available through an intermediary.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Habito, Vouchedfor