The Bank of England base rate has been cut from 5% to 4.75% after the Monetary Policy Committee voted 8-1 in favour of a 0.25% reduction. The committee members' decision will be welcome news for many mortgage borrowers as this is only the second rate cut since the base rate peaked at 5.25%. However, the BoE did warn that the base rate will now likely take longer to fall, than previously predicted, because inflation is forecast to rise following the Autumn Budget.

The Bank of England base rate has been cut from 5% to 4.75% after the Monetary Policy Committee voted 8-1 in favour of a 0.25% reduction. The committee members' decision will be welcome news for many mortgage borrowers as this is only the second rate cut since the base rate peaked at 5.25%. However, the BoE did warn that the base rate will now likely take longer to fall, than previously predicted, because inflation is forecast to rise following the Autumn Budget.

What is the Bank of England base rate?

The Bank of England base rate determines the rate of interest it pays to commercial banks for holding their money. In turn, the base rate affects the interest rates that are charged when commercial banks lend money to their customers as well as the rate of interest that they pay on savings deposits. Although base rate changes affect interest rates for bank customers, the effect may not be immediate for those who have fixed-rate products. For those customers a change in interest rates is not seen until the fixed-rate term expires. Customers with savings accounts or loans and mortgages that are on a variable rate of interest will find that these usually go up or down in line with the base rate.

Why has the Bank of England base rate been cut?

The Bank of England uses base rate changes in order to control inflation while ensuring that the economy does not suffer as a result. UK annual inflation soared to over 11% in 2022 due to a combination of increases in energy costs as well as food prices. The BoE raised the base rate from 0.1% in December 2021 to 5.25% over the course of the next two years in an attempt to bring the rate of inflation back to its target of 2%.

Inflation eventually fell to 1.7% for the year to September 2024. While members of the Monetary Policy Committee (MPC) will have been encouraged by the recent fall in inflation, they will have had to balance this with the projected effects of government spending increases outlined in the Autumn Budget announcement from the Chancellor of the Exchequer, Rachel Reeves. The BoE expects that although the overall effects of the commitments made in the Budget may result in a 0.5% increase in inflation, this will be offset by 0.75% growth expectations in GDP.

The BoE points out that inflation is expected to increase into 2025, rising to around 2.75% but predicts it will return to 2% after this time. It states, “If inflation remains low and stable it’s likely that we will reduce interest rates further. But we have to be careful not to cut interest rates too quickly or too much. High inflation has affected everyone, but it particularly hurts those who can least afford it.”

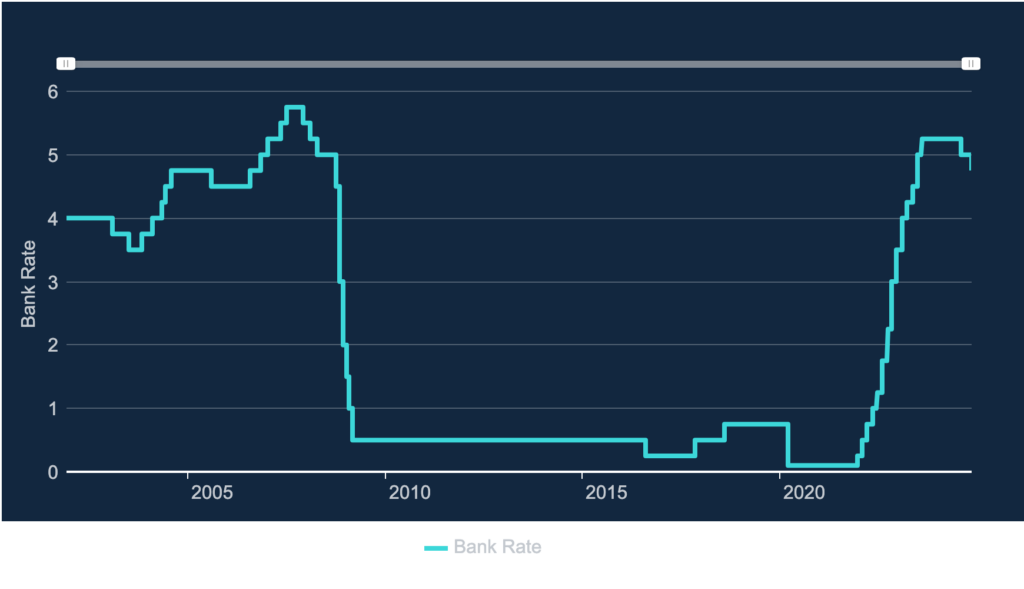

How has the bank rate changed over time?

The graph below shows how the Bank of England base rate has dramatically dipped and soared over recent years, on either side of long periods of stability.

(Source: Bank of England)

Base rate changes and how they impact you: December 2021 - November 2024

The Bank of England last cut the base rate in August 2024 following a series of successive rises which began in December 2021 and ended in August 2023.

| Date | Interest rate change | Previous interest rate | New interest rate | Change to average monthly mortgage repayments per £100k borrowed* |

| 16th December 2021 | +0.15% | 0.10% | 0.25% | +£8 |

| 2nd February 2022 | +0.25% | 0.25% | 0.50% | +£13 |

| 17th March 2022 | +0.25% | 0.50% | 0.75% | +£13 |

| 5th May 2022 | +0.25% | 0.75% | 1.00% | +£13 |

| 16th June 2022 | +0.25% | 1.00% | 1.25% | +£13 |

| 4th August 2022 | +0.50% | 1.25% | 1.75% | +£26 |

| 22nd September 2022 | +0.50% | 1.75% | 2.25% | +£26 |

| 2nd November 2022 | +0.75% | 2.25% | 3.00% | +£39 |

| 15th December 2022 | +0.50% | 3.00% | 3.50% | +£26 |

| 2nd February 2023 | +0.50% | 3.50% | 4.00% | +£26 |

| 23rd March 2023 | +0.25% | 4.00% | 4.25% | +£13 |

| 11th May 2023 | +0.25% | 4.25% | 4.50% | +£13 |

| 22nd June 2023 | +0.50% | 4.50% | 5.00% | +£26 |

| 3rd August 2023 | +0.25% | 5.00% | 5.25% | +£13 |

| 1st August 2024 | -0.25% | 5.25% | 5.00% | -£13 |

| 7th November 2024 | -0.25% | 5.00% | 4.75% | -£13 |

| TOTAL | £242 |

*assumed mortgage term is 25 years

How does the Bank of England interest rate cut affect mortgages?

Fixed-rate mortgage customers

Anyone with a fixed-rate mortgage will not see a change to their rate until the mortgage deal term ends. If your deal is due to end soon, you should consider how mortgage rates might change in the coming months. Our article 'Will interest rates continue to fall in 2024 & how low will they go?' provides some insight into remortgaging and what to do if you are due to remortgage soon.

It is worth remembering that although interest rates have been cut, if your current fixed-rate deal was in place prior to December 2021 (when rates first started going up), then you should factor in all of the interest rate rises (and cuts) combined in order to budget for remortgaging. As shown in the table above, this equates to a rise of around £242 per month, per £100,000 borrowed, based on a 25-year mortgage term.

Get a FREE mortgage review

Our partner Vouchedfor will help you get the best mortgage rate with a free mortgage review

- From a 5-star rated mortgage adviser

- Typically save £80 per month per £100,000 of your mortgage

- No obligation

Variable rate or tracker mortgage customers

Those with tracker or variable rate mortgages should see a change to their monthly mortgage payments. Our interest rate calculator can be used to work out the potential impact that the rate cut will have on your monthly mortgage payments. You'll need to know your initial mortgage term, the amount borrowed at the start of the deal and your current mortgage rate.

Anyone wanting to know more about how rate rises and cuts impact their finances should speak with an independent mortgage adviser* as they can provide specialist advice. When considering remortgaging, always check to see if there are any Early Repayment Charges (ERC) and check to see how long is left on your current mortgage deal. Take a look at the best mortgage deals by using our mortgage rate comparison tool or checking out our article 'Best mortgage rates in the UK' which is updated regularly.

Help if you're unable to afford your mortgage payments

Even with today's rate cut, many homeowners will face increased mortgage costs when their current deal comes to an end. If you are worried about how you will afford your mortgage, then you should get in touch with your lender as soon as possible. Your lender should be able to find a solution that can help ensure no repayments are missed.

Potential solutions can range from extending the length of your mortgage to converting part or all of your repayment mortgage to an interest-only mortgage to allowing you to take a mortgage payment holiday.

Check out our article 7 tips for dealing with mortgage arrears, or alternatively, you may find additional support from the following organisations helpful:

How does the Bank of England base rate cut affect you if you have credit cards, loans or overdrafts?

Credit cards

If you have an existing credit card with an agreed interest-free period or promotional interest rate you shouldn't notice any impact from the latest Bank of England base rate announcement.

Keep in mind that 0% credit cards are one way to avoid any base rate fluctuations, by not paying interest at all. For example, by moving your existing credit card balance to a 0% balance transfer credit card, you ensure you pay no interest on your repayments if the balance is repaid within the promotional interest-free period. Be aware that most (not all) balance transfer credit cards charge a balance transfer fee, usually somewhere between 2% and 5%. Find out more in our article, 'Best 0% balance transfer credit cards'.

Alternatively, if you clear your credit card balance at the end of each month you won't pay any interest, regardless of the interest rate applicable to your card.

Loans

If you already have a loan with a fixed interest rate then you are unlikely to be affected by changes to the base rate. If you are looking for a new loan then you can compare the best loan deals in our article, 'Best personal loans'.

Overdrafts

The interest rate charged on your overdraft should go down in line with the Bank of England's base rate cut. If your bank or building society is going to change the rate of interest charged you should receive a notification in advance, giving you time to consider your options.

How does the Bank of England base rate cut affect you if you have savings?

Interest rates on savings accounts are likely to fall as a result of the base rate cut, and much more quickly than they rose when the base rate was increased. In fact, you may have already received a message from your bank informing you that the rate on your account is going down.

This means that it is possible that we may have already hit the peak of high interest rates on savings accounts, so now might be a good time to secure the best rate on your savings. Our article, 'How to get over 5% on your savings' summarises some of the best rates on the market and our regularly updated article, 'Best savings accounts in the UK' provides a summary of the best savings rates for personal and business accounts.

Looking for the best savings rates should always involve shopping around for the best deal. You can check out the best savings rates using our Savings Best Buy tables. Right now you can get as much as 8.00% interest on a Regular Saver account.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Vouchedfor