However, doing so almost certainly means paying an early repayment charge (ERC), in order to escape the lender's current fixed-rate deal. In this article I look at how high interest rates might go and how to work out whether it’s worth remortgaging early.

How high will mortgage rates go?

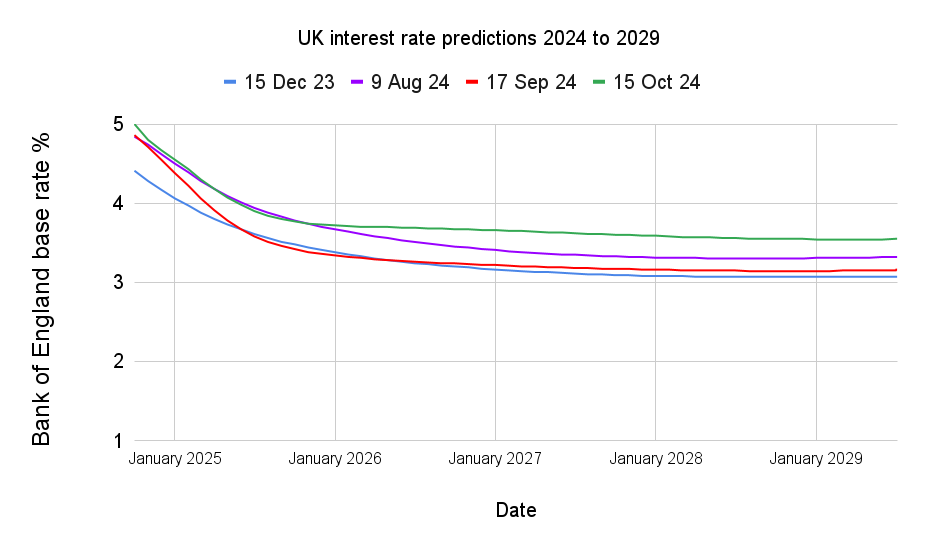

In my regularly updated article titled “When will interest rates rise (or in fact be cut)?” I detail where the market is predicting the Bank of England base rate is likely to be in the coming months, as well as up to five years in the future. The chart below shows where financial markets currently believe the Bank of England base rate will be in the future. Remember, that the best fixed-rate mortgage deals tend to offer rates that are often around the Bank of England base rate. However, the rate of interest you will be charged if you were to remortgage will depend on your personal circumstances as well as the type of mortgage that you are considering.

Get a FREE mortgage review

Our partner Vouchedfor will help you get the best mortgage rate with a free mortgage review

- From a 5-star rated mortgage adviser

- Typically save £80 per month per £100,000 of your mortgage

- No obligation

Is it worth remortgaging early and refixing?

Follow the steps below to assess your options and work out whether it might be worth remortgaging early:

1 - Find your existing mortgage details

You will need to know the interest rate you currently pay on your existing fixed-rate mortgage, the outstanding loan amount as well as how long is left on your mortgage (i.e. the term). You should be able to find all of these details on your latest mortgage statement.

If you don’t have the details to hand you can work them out as long as you know the monthly amount you pay each month in pounds and pence. Simply use this mortgage amortisation calculator and enter the original loan and term when you first took out the mortgage. Then alter the interest rate until the “Monthly Pay” amount displayed matches your monthly mortgage payments.

If you look at the table titled “Annual Amortization Schedule” and in particular the “Monthly Schedule" tab you can work out how much you have outstanding on your mortgage.

2 - Find out your potential early repayment charge (ERC)

It’s important to find out whether your existing mortgage lender will apply an early repayment charge (ERC) if you remortgage early. Have a read of my article “How to avoid mortgage early repayment charges & how they work” for more background information.

Ultimately if you do want to remortgage early when you are already on a fixed-rate deal then you will may have to pay an ERC. The level of early repayment charge will vary depending on the period of time your mortgage rate is fixed for (the fixed-rate period) as well as the lender and mortgage product you currently have. An ERC is usually between 1% and 5% of the outstanding mortgage loan and often reduces the closer you get to the end of your fixed-rate period, but not always.

The good news is that the ERC can be added to your new mortgage, but that will mean that you must borrow more money from a new lender to cover the charge, plus your existing mortgage loan. Bear in mind that if you go down this route you will end up paying interest on the amount (equivalent to the ERC) over the long term under the terms of a new mortgage deal.

You can find out the ERC on your existing mortgage, as well as the date after which the early repayment charge is no longer applied, on your original mortgage agreement or it may be on your latest mortgage statement. If you no longer have the documents then contact your lender to ask for full details.

3 - Find the best mortgage rates available now

Use this mortgage comparison tool to research the best fixed-rate deals for various fixed-rate periods.

If you are concerned about how high mortgage rates can go in the future then you will want to pay particular attention to the 2, 3 and 5-year fixed-rate mortgage deals available in the market. Don’t just focus on the best rates available, as you may not be accepted by the lender, but instead look at a range of products. Also, make sure you take note of any legal fees or products on each deal and whether they can be included when remortgaging or whether you have to pay them upfront yourself. Also note any ERC charges on any potential future mortgage deals in case you want to incorporate flexibility into your future plans.

If you plan on adding the ERC to your new mortgage then make sure you include it in your loan amount when researching. Depending on the value of your home the additional borrowing could potentially mean that you are offered a worse mortgage rate if your loan-to-value (LTV) ratio alters significantly as a result.

Make a note of the potential rates available at the moment as well as the monthly mortgage repayments.

4 - Calculate whether you will be better off refixing your mortgage now or later

Here is a handy remortgage calculator which will work out whether you will be better or worse off paying your early repayment charge and refixing your mortgage now versus staying with your current deal and remortgaging at the end of your fixed-rate period, as you normally would.

The previous steps should have given you all the information you need to use the calculator including:

- Your current mortgage rate and term

- Your early repayment charge

- The potential interest rate you’d be charged on a new fixed-rate deal as well as the term

- Any future product fees

The calculator results are based on a number of assumptions including the market’s current prediction of where mortgage rates might go. You can tweak this to be much more pessimistic or optimistic about the mortgage rate you will pay in the future if you were to stick on your current deal until the end of its fixed-rate period.

The calculations are only indicative and for information purposes but they do give you a steer of whether it is worth seeking advice about remortgaging early.

One drawback is that the calculator assumes that you pay the ERC and mortgage product charges yourself from cash and do not add them to the new mortgage. If you want to get a feel for what the situation might be if you instead went down the latter route, enter zero under product charge and the ERC in the calculator. Then in a separate spreadsheet or notebook modify the monthly repayment amount shown in the results under "Option A" to the figures from step 3 above, where you searched for the best mortgage rates assuming your ERC and legal fees were included in the new mortgage amount.

5 - Consider other options: Get a FREE mortgage review

Whether you decide to further explore refixing your mortgage or not, based upon your calculations, it is worth noting that tracker mortgages (and discount mortgages) are currently offering mortgage rates that are unusually higher than the best fixed-rate mortgage deals on offer.

Currently, the best 2-year tracker mortgage for £200,000 borrowed over 25 years offers a rate of 4.59% which equates to a monthly mortgage repayment of £1,121. The best 2-year fixed-rate mortgage offers a rate of 3.94% which equates to a monthly mortgage repayment of £999.

Of course, if the Bank of England raises its base rate the tracker mortgage rate will rise, as will the monthly repayments. The interest rate and the monthly repayments of the fixed-rate mortgage will remain the same for the first two years. On the other hand, if fixed-rate deals reduce further, you may regret tying yourself into a higher interest rate for a while.

Also bear in mind, that there is no certainty that you will be offered the mortgage rates shown on mortgage comparison sites when you come to apply for a mortgage. That's because lenders will make an offer based upon your personal circumstances, including your credit history. That is why it's important to speak to a qualified mortgage adviser who can advise you on the best option for you and help you secure the best mortgage rate given your personal circumstances.

If you don't already have a mortgage adviser that you trust then you can get a free mortgage review* from a vetted FCA regulated mortgage adviser:

- Click the link above

- Complete 6 simple questions about your situation

- Enter your contact details

- You will then be matched with a reputable FCA regulated mortgage adviser

The mortgage adviser will give you a free consultation with no obligation on your part.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Unbiased, Vouchedfor