Errol Damelin could be in line for a £100m windfall four years after helping to create Wonga, the short-term loans firm. It is understood that plans are under way to float the business on the US stockmarket with a potential value of £1bn, Damelin is understood to own around 10% of the company.

Recently Wonga have had adverse publicity -

- They have been accused of trapping customers in a spiral of debt, a typical interest rate on loans are between 0.3% and 2% which could result in an APR of over 4,ooo

- In May the OFT ordered Wonga to improve it's debt collection practices, when it emerged that it had sent customers letters accusing them of committing fraud

- Recently announced the launch of short-term loans to businesses as well as individuals which was widely condemned

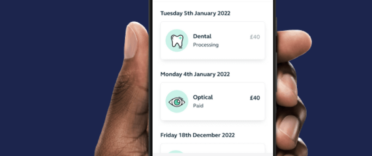

Wonga operates over the internet using automated risk processing software which can approve an application in 5 minutes and have money in the customer's account within 30 minutes.

The payday loan market has grown from 300,000 borrowers in 2006 to 1.9m in 2010 with Wonga making profits £16.6m in the year to December 2010

A recent Which? report found that a third of customers, using payday loans, experienced greater financial problems as a result.