Saving a deposit to buy a property can be challenging for many reasons and could delay aspiring homeowners from getting onto the property ladder. With rental costs increasing and causing concern amongst tenants about affordability, buying a property has moved up the priority list but can feel out of reach without a cash sum towards a deposit.

Saving a deposit to buy a property can be challenging for many reasons and could delay aspiring homeowners from getting onto the property ladder. With rental costs increasing and causing concern amongst tenants about affordability, buying a property has moved up the priority list but can feel out of reach without a cash sum towards a deposit.

It is clear why homebuyers ask if 100% mortgages are coming back and whether they are a good idea.

Although 100% mortgages were common before the 2008 financial crisis, the Financial Conduct Authority (FCA) tightened lending rules in a bid to prevent further lending practices that put borrowers at higher risk of defaults.

In this article, we explain what a 100% or no-deposit mortgage is, how it works and how homebuyers can get one. We also look at the pros and cons of buying a property with no deposit and share how to get expert mortgage guidance* in arranging your property purchase with 100% loan-to-value (LTV).

What is a 100% mortgage?

A 100% mortgage is one where the mortgage loan amount is equal to the property purchase price or the value of the house. 100% mortgages offer all of the money that you will need to buy a property without any need for you to contribute a deposit. Although it is rare to get a 100% mortgage there are some options available through a few specialist lenders. These are sometimes referred to as zero-deposit mortgages, no-deposit or 100% loan-to-value (LTV) mortgages.

100% mortgages tend to appeal to first-time buyers who have little to no deposit to put towards the purchase of their first home but they may also be of interest to remortgagers whose homes may have dropped in value leaving them with little to no equity when they come to the end of their mortgage deal period.

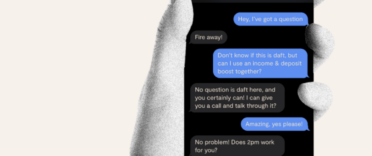

Specialist mortgage advice for first-time buyers

Our partner Tembo is a specialist mortgage broker that offers tailor-made mortgage solutions for people with smaller deposits including Guarantor, LTV and first-time buyer schemes.

How does a 100% mortgage work?

Essentially, 100% mortgages work on the premise that you will own no equity in the property upon purchase. Instead, you will build this slowly as you reduce your mortgage balance through repayments and naturally, when your property price increases. It is unusual for lenders to offer a 100% mortgage loan due to the risks involved.

Ultimately, if you, as the borrower, were unable to make your repayments, the lender would want to ensure they could recoup the loan through the sale of the property once the property is repossessed.

Although you may not need a deposit to get a 100% mortgage, you should consider the other costs involved in purchasing a property. These will include stamp duty, mortgage fees, legal or conveyancing fees as well as the costs associated with carrying out a property valuation or obtaining a homebuyer's report.

100% loan-to-value (LTV) mortgages are usually only available on a repayment basis and not on an interest-only basis. This means that your monthly mortgage payments will consist of the capital that you will repay each month in addition to the interest that accrues on your mortgage balance. A repayment mortgage balance will eventually begin to reduce and your equity in the property will grow.

How to qualify for a 100% mortgage

Unfortunately, very few lenders are willing to offer a 100% mortgage so you may have to work a little harder to find a deal that works for you. Below, we have listed some of the areas that you will need to address to prepare for your 100% mortgage application.

Cost of arranging a 100% mortgage

Importantly, you must have enough savings to cover the costs of arranging your mortgage and completing the house purchase. These can include stamp duty, lenders' fees, mortgage broker's fees, legal conveyancing fees, valuation costs, and the costs of obtaining a homebuyer's report.

You can find more information about these costs in our article, 'How to buy a home - a guide for first-time buyers'.

Affordability checks for a 100% mortgage

Besides the costs involved, you should also be prepared to meet affordability criteria that will test that your income can support the monthly mortgage payments, taking into account your existing financial commitments.

All lenders must ensure that you can afford your new mortgage payments and may stress test your affordability to check that there is room in your budget to cushion any increase in your outgoings.

Depending on whether your mortgage will be supported by one income or a joint income, your lender will use an income multiple that limits the amount that you can borrow and these limits are likely to be more restrictive at a 100% LTV. If you are unsure about how much you will be able to borrow based on affordability rules, you should speak to an independent broker* who will guide you to work out how to maximise your borrowing power.

Do you need a good credit history for a 100% mortgage?

Lenders request credit reports to check how well you manage your current financial commitments so you should consider checking your own credit file before embarking on your homebuying journey. Lenders are hesitant to lend to mortgage applicants who have a history of late and missed payments on their credit file but vary in their tolerance of adverse credit events so you shouldn't assume that you won't get a mortgage if these show up on your report.

More serious financial misdemeanours such as county court judgments (CCJs), bankruptcies or individual voluntary arrangements (IVAs) on your credit file may pose a greater obstacle to getting a no-deposit mortgage. If there are misrepresentations on your credit file, checking early will give you time to address these so that your credit file accurately reflects your risk to the lender.

Evidence to support your 100% mortgage application

You will be required to evidence the information that you share about you and your finances and it can help to collect this in advance. Mortgage lenders usually require original or certified copies of any documentation that is requested and won't normally accept photographs of documents, so do bear this in mind. You will need documentation to prove your:

- Identity - passport or driver's licence for all mortgage applicants including any guarantors

- Income - payslips if you are employed as well as your employment contract, accounts for self-employed mortgage applicants including a SA302 tax form,

- Outgoings - bank statements for the last 3 to 6 months that evidence your income and outgoings

- Financial commitments - agreement contracts for any loans, credit cards or other financial products you hold

Can I get a no-deposit mortgage?

There are ways to get a no-deposit mortgage including specific mortgage deals from specialist lenders, guarantor/family mortgages and renter's mortgages.

Currently, options include the Skipton Track Record mortgage which can offer a 100% mortgage to renters with a good track record of paying rent on time. The interest rate charged on this type of mortgage will inevitably be slightly higher than the more competitive rates available in the general mortgage market. At the time of writing, Skipton's interest rate is 5.82% on the Track Record mortgage and this would be fixed for 5 years with early repayment charges if you were to remortgage within the fixed term. The best 5-year fixed rate on a 95% LTV mortgage is 4.98% - you can check for current mortgage deals with a minimum 5% deposit using our mortgage rate comparison tool.

Another way to get a mortgage without a deposit is to look at boosting your affordability or your deposit with the help of a friend or family member willing to support you in buying your home. A number of lenders will consider financial support from someone else as long as the lending criteria can be met overall - Lloyds Bank, Halifax and Barclays are among the lenders that may consider lending on this basis.

Sometimes, it may take a combination of solutions to get a no-deposit mortgage. Although this may seem daunting, there are mortgage brokers that specialise in arranging a no-deposit mortgage using a combination of mortgage schemes and specific mortgage products from lenders.

At Money to the Masses, we have vetted the mortgage broking service provided by Tembo* - you can read our full review of Tembo. The advisers at Tembo search over 90 lenders' mortgage products to find the one that will suit your needs and circumstances best. If you are unable to get a 100% mortgage there may be other ways in which you can realise your ambitions of owning a home. Tembo will explore options like rent-to-own, guarantor mortgages and government-shared ownership schemes.

Should I get a 100% mortgage?

It is important to consider the pros and cons of arranging a 100% mortgage to be sure it is right for you, as there may be other mortgage options that suit you better.

Advantages of a 100% mortgage

- You don't have to save a deposit

- You could own your own home sooner

- It could prevent you from receiving increases to your rent or no-fault evictions

Disadvantages of a 100% mortgage

- You may have to pay a higher interest rate

- If your house value decreases you could fall into negative equity

- You may struggle to remortgage at the end of your mortgage deal

Alternatives to a 100% mortgage

If you are unable to arrange a 100% LTV mortgage then the next best thing may be to consider saving a small deposit as there are a few options that could allow you to borrow at 99% LTV. We describe these options below.

£5,000 deposit mortgage - this mortgage product will allow a person buying a house to secure a mortgage with a £5,000 deposit which would work out at 99% LTV if you were buying a £500,000 property and if your property costs less, your LTV will reduce. This may appeal to a first-time buyer who has a small deposit saved and is willing to pay a higher rate of interest on your mortgage, but it is not without its risks, so you should follow the link to read about it in detail.

Mortgage rate reducer scheme mortgage - this mortgage product is designed to help first-time buyers secure borrowing at 99% LTV for new build properties. It is limiting as the new-build property scheme must be signed up to the finance company that arranges this type of lending so you can't choose any new-build property. You can read more about this mortgage scheme by following the link.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Tembo Money