Reader Question:

Hi There,

I have just sold my house and gone into rental because the new house sale fell through. I have £110,000 in the bank and a mortgage offer in place at 3.6% and looking at buying a house at around £425,000.

So with all the doom and gloom should I buy now or wait and see if the house prices drop like most "experts" predict.

Many thanks.

My response:

It's an interesting question but unfortunately it requires a bit of crystal ball gazing. The short answer is no one knows for sure.

Where are house prices headed?

First of all if we look at house prices - then yes they are likely to continue to fall, if you believe most analysts, but it depends on where you are buying. As you know London prices have stabilised while prices in other parts of the country prices have plummeted. One thing for certain is that you will never catch the bottom of the market.

However, if you really want to know what's going on in the UK housing market there is one, rarely reported, statistic that you should keep a close eye on - housing transaction volumes.

Why are housing transaction volumes a good indicator of property price trends?

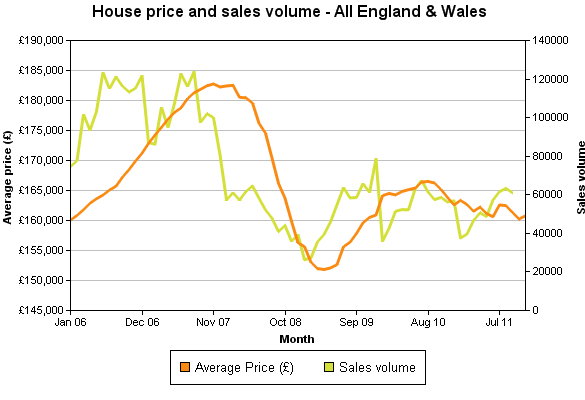

Basically it boils down to supply and demand. When demand for property increases due to, say, easy credit or an improvement in the general economy then prices will start to rise. When demand drops due to credit restrictions or a recession then prices will start to fall, or at the least tread water. And as the graph below indicates housing transaction volumes have historically been a good indicator of the house price trends. The graph charts up until the end of 2011. But to give you an idea on where we are now, transaction levels for January and February were little over 43,000.

You don't need to call the bottom of the housing market

But why obsess over calling the bottom of the market? You are a chain free purchaser which gives you massive bargaining power which you should use to your advantage. By negotiating down the price of your next house you will already protect yourself from any house price downturn. While of course you don't want to overpay for your house, ultimately you are purchasing a home to live in. Unless you plan to downsize or unlock the future equity in a property, house price movements are a paper loss/gain for most people.

Also you need to be aware that your mortgage offer will inevitably expire and there is no guarantee that a similar offer will be back on the table. In the face of increased borrowing costs (mostly the result of the eurozone crisis) lenders could put up their rates or tighten their lending criteria.

I hope that helps

Good luck

Damien

Money to the Masses

Website: www.moneytothemasses.com

Twitter: money2themasses

The material in any email, the Money to the Masses website, associated pages / channels / accounts and any other correspondence are for general information only and do not constitute investment, tax, legal or other form of advice. You should not rely on this information to make (or refrain from making) any decisions. Always obtain independent, professional advice for your own particular situation. See full Terms & Conditions and Privacy Policy.

I was looking in the Winchester area, an area known for relative price stability. There are bargains to be had if you look/work hard enough and be prepared to walk away if you don’t get the price you want. I am in the process of buying a property, it was on the market for 500 and have agreed on 425. The owners were willing to take a bit of a hit and the house they were buying were also willing to do the same so got it for a good price. Hopefully will be a little future proof to any dip in the market..

Most owners are unrealistic especially in current times!

A couple of other data points:

* UK house prices have risen by 101% since 1983

* the historical ratio of average house price to average earnings is 4.1; the current ratio is around 5.2

On that basis, it does sound like UK house prices are too high. The question though is will house prices go down, or will income go up (with house prices constant, i.e. inflation)? With the former, you’re better off waiting; with the latter, you’re better off buying now.

Having been through this process myself (back in 2006), I found the question to be: would I be happier owning my own place? For me, the answer was ‘yes’, so I ended up buying. It may not have been the best decision financially, but I’m happy I’m not still waiting for the house prices to go down.

(data source: Nationwide http://www.nationwide.co.uk/hpi/historical/Mar_2012.pdf)