[…] guidance include Pension Wise, the Citizens Advice Bureau and the Money Advice Service. Find out more information in our guide […]

Search results

Search results for "money tip #"[…] event of damage as it can cost a lot of money to replace them all at once. How much does […]

[…] be refunded to your employer within 10 working days. The money should then be returned to you in your next […]

[…] is the likelihood that a particular investment will lose you money over a period of time, or not return as […]

8 things you need to check before buying critical illness insurance

[…] suitable recommendation. Level of Cover (£) Consider what difference the money will make. Is it enough to cover an interruption […]

[…] – This policy covers you for a set amount of money for each condition. Once the limit is reached you […]

[…] comes to retirement, as they can try to ensure your money grows enough so that you can retire at the […]

[…] expected 12 months, the insurance company does not expect the money to be returned. This type of benefit within a […]

[…] if you haven’t checked to see if you can save money on your life insurance policy in the last few […]

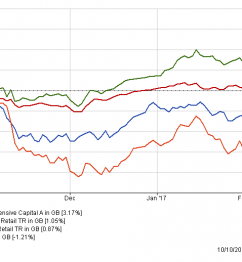

[…] March 2015) I decided to invest £50,000 of my own money using 80-20 Investor. The purpose was firstly to show […]