Car insurance is an insurance policy that will cover the financial costs if your vehicle, another vehicle or someone else's property is damaged. There are three main types of car insurance and exactly what you are covered for will vary depending on the policy type you choose. How much your car insurance costs will also vary depending on the policy type, but can depend on a number of other factors.

The average car insurance premium in the UK between April and June 2024 was £622 a year, according to the Association of British Insurers (ABI), in this article, we look at why the cost of car insurance goes up and what affects the cost of car insurance. We also look at whether an accident affects the cost of car insurance. We then look at how to reduce the cost of your car insurance and how you can compare quotes from over 120 UK car insurance providers with Quotezone* - you could save you up to £523**.

Why does car insurance go up?

You may be wondering why the cost of your car insurance is so high but the cost of car insurance is actually determined by numerous factors including your age, the car that you drive and your occupation. In addition, costs to your insurer can also affect how much you pay for your car insurance premium. These costs can include the number of claims being made as well as the cost of repairs, labour and replacement parts. As a result, if any of these factors change, you are likely to see a difference in the cost of your car insurance premium.

Why does car insurance increase at renewal?

If you have had to make a claim on your policy or you have had any driving convictions since the last time you renewed you may see an increase in your policy premium at renewal. You may also see an increase in your car insurance premium if there has been a rise in vehicle theft or accidents in your local area. Insurers price car insurance based on their own interpretation of risk and often the best way to save money on your car insurance is by shopping around to see if you are getting the best deal before letting your car insurance policy auto-renew. We have partnered with Quotezone* so that you can search and compare quotes from over 120 UK car insurance providers to help you save money on your insurance.

What affects the cost of car insurance?

How much you pay for your car insurance is based on your level of risk and other factors such as costs incurred by insurers. Below, we list some of the risk factors that can affect the cost of your car insurance policy. Other economical factors such as Insurance Premium Tax (IPT) - a tax on general insurance policies enforced by the government - can also affect the cost of your premium. If you want to know how you can reduce the cost of car insurance, we share some tips later in the article.

Age

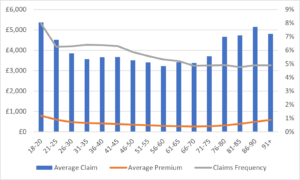

Your age affects how much you pay for your car insurance and according to the ABI, older and younger drivers pay the most for their car insurance premiums. Drivers aged between 31 and 75 pay the least for their car insurance premiums. Amongst these, drivers aged between 66 and 70 years old have the cheapest policies priced at around £261 a year on average, which according to the ABI is just over a third of the premium price for drivers aged between 18 and 20 years old. The following chart, created by the ABI in 2021, highlights the relationship between the age of drivers, car insurance cost, claim frequency and claim costs. Those with higher claims costs and more frequent claims experience higher car insurance premiums.

How age affects the cost of car insurance

(Source: ABI)

Address

Where you live will affect the cost of your car insurance policy and it is important that you let your insurer know if your address changes. Your insurer considers the number of claims in your area including accidents and thefts as well as what the traffic is like where you live. These factors, amongst others, are all considered when calculating your car insurance premium. As a result, if you live in a highly populated area you may experience more expensive car insurance costs because there is a greater chance of an accident where there is a higher number of cars on the road.

Occupation

Your occupation also affects how much you pay for your car insurance. As with the other factors listed in this article, the type of job you do determines the risk and some job titles carry greater risk than others. As a result, if you change jobs, you may see an increase in your car insurance premium. There are ways, however, that you can save money by tweaking your job title when applying for car insurance. We explain more in our article, 'Does your job title affect the cost of car insurance?'

Car type

The type of car you drive will affect the cost of your car insurance premium so this is something to consider if you are looking to change your vehicle. Typically the larger the engine in the car, the more expensive it will be to insure. This is because it is likely to be in a higher insurance group which can make your car insurance costs increase. What insurance group your car is in will vary depending on additional factors such as the car parts, the car's repair cost and the car's security features, read our article 'Cheapest car to insure in the UK' to learn more.

If you make any modifications to your car, this is also likely to increase the cost of your insurance premium because modified cars are usually more expensive to repair in the event of an accident.

Claims

If you need to make a claim on your car insurance policy for an accident or damage to your vehicle you are likely to see an increase in the cost of your insurance premium, and this can also be the case even if you were not at fault. This is because having an accident or making a claim means that insurers consider you as more likely to make a claim in the future and this in turn increases your level of risk.

It is wise to declare all accidents to your insurer, even if you do not wish to make a claim, as it could invalidate your policy at a later date if you were found to have not declared a previous accident.

Criminal convictions/Points on your licence

If you have a criminal record you are likely to see an increase in your car insurance policy as you are considered higher risk than those who have no convictions. It is important that you declare any unspent criminal convictions you have as not doing so could invalidate your insurance premium. In most cases, you can declare any unspent criminal convictions once you renew your policy but it is best to check with your insurer in case this varies as it could affect you getting car insurance. You do not have to declare any spent criminal convictions.

Having penalty points on your licence is also likely to increase the cost of your car insurance premium and penalty points can be given for motoring offences such as speeding or driving carelessly. How many penalty points you accumulate varies depending on the driving offence you have committed but you will need to declare any penalty points before taking out your insurance policy and not doing so could invalidate your policy.

Admiral explains, "Our claims statistics have proven that customers with penalty points and motoring offences in the last five years, have more driving incidents and make more claims. This is why we need to know about them before offering a quote."

Find the right Car Insurance for you

Our partner Quotezone will compare quotes from over 120 UK insurance providers

- You could save up to £523**

How to reduce the cost of car insurance

When the time comes to buy or renew your car insurance you may be wondering why the car insurance quote is so high but there are a few steps that you can take to try and save money on your car insurance renewal quote. We list some money-saving tips below, but for more ways to save on your car insurance premium, read our article 'How to get cheaper car insurance'.

Shop around

While it can be time-consuming to shop around for a cheaper car insurance quote, it can save you money on your premium each year. While insurers are not allowed to penalise customers' loyalty with higher premiums than equivalent new customers, it can still be beneficial to shop around. We have partnered with Quotezone*so you can compare quotes and find the best insurance policy for you.

Increase the policy excess

Choosing to pay a higher policy excess can help to reduce the cost of your insurance premium. The excess is the amount that you agree to pay in the event of a claim so you need to ensure that you don't make this too high in case you do need to claim. Most insurers have a compulsory excess amount that needs to be paid and this can be higher depending on your age. The voluntary excess amount can be increased or decreased and will usually affect the policy price.

Pay annually

Paying your car insurance premium annually will save you money as some insurers include a credit charge on monthly payments, but it can be expensive to cover these costs upfront. If you have just renewed your car insurance policy monthly you could always try to budget for the annual cost when it comes to renewing. Read our article 'How to budget for beginners' for our top budgeting tips. You could try using a budgeting app or the free Money to the Masses budget planner to help.

Check your insurance group rating

The cost of your insurance can be affected by the insurance group rating of your vehicle and the group rating helps insurers to categorise the risk associated with each vehicle. There are numerous factors that affect the group rating including the cost of replacement parts, the engine size and car security features.

Consider telematics insurance

Telematics insurance fits a 'black box' to your vehicle and monitors your driving in a bid to reduce your premium if you are a careful driver. Telematics insurance is popular amongst younger drivers and can help to reduce high car insurance premiums.

How to buy cheap car insurance

One of the quickest ways to save time and money when buying your car insurance policy is via a comparison site as you can compare multiple providers at once. We have partnered with Quotezone* so that you can search and compare quotes from over 120 UK car insurance providers. One thing to consider, however, is that you may be able to find a better deal with an insurer that is not featured on comparison sites, such as Direct Line. Ensure that you are comparing similar policies when looking for a car insurance quote to ensure you are making a fair comparison and getting the best deal.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses - Quotezone