The cost of life insurance has steadily decreased over the past few years thanks to increased competition amongst insurance companies and advances in medical science (which have helped to improve life expectancy). One thing that continues to keep life insurance quotes high however is admitting that you smoke.

The cost of life insurance has steadily decreased over the past few years thanks to increased competition amongst insurance companies and advances in medical science (which have helped to improve life expectancy). One thing that continues to keep life insurance quotes high however is admitting that you smoke.

In this article, we have compared over 500 life insurance quotes and provided heatmaps to help understand which insurers may offer the most cost-effective cover if you smoke. It is important to understand, however, that insurance companies regularly adjust life insurance premiums and life insurance quotes are specific to your own unique circumstances and so it is always best to seek advice from an independent life insurance specialist*.

Life insurance providers will automatically apply an increase to your life insurance premium if you smoke, but it can be incredibly hard to understand which insurer provides the most cost-effective life insurance for smokers.

Life insurance for smokers

Four key factors can affect the cost of life insurance at the quote stage (assuming there are no other health complications) and they are:

- Amount of cover required

- Length of cover required (often referred to as the 'term')

- Age

- Smoker status

Out of the four key cost factors mentioned above, smoker status has the biggest impact on the overall cost of life insurance and in fact, is often the only factor that you have any control over. Try as you might, it is impossible to make yourself younger and it is likely that the amount of cover and length of time it is needed for is dictated by a mortgage or loan and so cannot be adjusted.

Up to £100 cashback on life insurance

Our partner LifeSearch will help you get the best and cheapest life insurance.

- Search the market and all the leading insurers

- Free advice with no obligation to purchase

- Up to £100 cashback for new customers

Will my life insurance cost less if I have given up smoking?

Most insurance companies will class you as a non-smoker if you have not used any tobacco or nicotine replacement products for 12 months or more, so if you have given up or are thinking of giving up then you can make significant savings on your life insurance. Check out our article 'How to get the best deal on life insurance if you smoke or vape'.

How much extra will I pay for my life insurance if I smoke?

Depending on your age and the amount of cover you are applying for, the increase applied to life insurance premiums if you smoke can range anywhere from 30% to 200%. A 35-year-old applying for life insurance cover of £200,000 would expect to see premium increases of between 70% and 120%, depending on which insurer they choose. We have provided an example below.

| Example | Non Smoker | Smoker | Increase % |

| £200,000 life insurance over 20 years for a 35-year-old | £8.80 | £16.04 | 82% |

Prices are correct as of 5th August 2024

Which life insurance provider is best for smokers?

We already know that smoking has a big impact on the cost of life insurance quotes and so we have provided some heatmaps below to demonstrate which insurers offer the most cost-effective premiums (compared to their competitors) for a variety of scenarios. Remember that the heatmaps below are for guidance only and the cost will be based on your own unique circumstances. When applying for life insurance you are required to answer questions about your health, family history, occupation and lifestyle, all of which can have an impact on the overall cost of the cover.

How to use our life insurance heatmaps

Our life insurance heatmaps have been built from extensive research, originally carried out in 2020 and so we would recommend that you use the heatmaps below for guidance only. If you are considering a life insurance policy you should speak to an independent life insurance specialist as there may be other factors that affect the cost of your life cover, such as your health and lifestyle. An independent specialist* can recommend the best policy for your own unique circumstances and even help you complete the application forms and chase the insurance company on your behalf, something an online comparison site can't do.

We have personally vetted an independent specialist that has received over 20,000 reviews on Trustpilot with an average score of 4.9 out of 5.0. I used them recently to insure my family and not only was it the cheapest price I was quoted, the cover was in place within two hours of calling them. Get in touch with them by completing this simple form* to get a tailored quote based on your current circumstances. They will even pay up to £100 cashback when you buy a recommended policy.

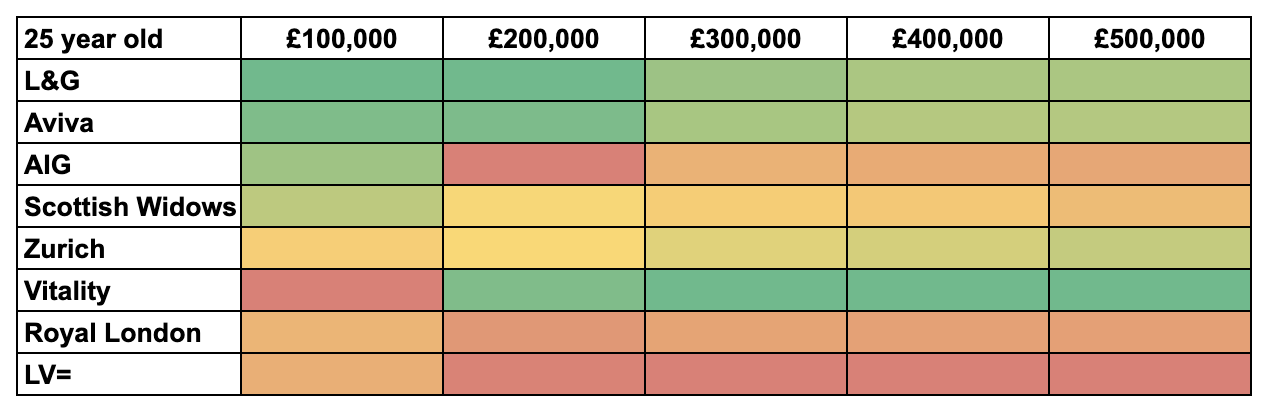

25-year-old smoker (25-year term)

Our research suggests that L&G and Aviva are a good choice for smokers (aged around 25) who require a lower amount of cover. Zurich and Vitality are better options if you require a larger amount of cover.

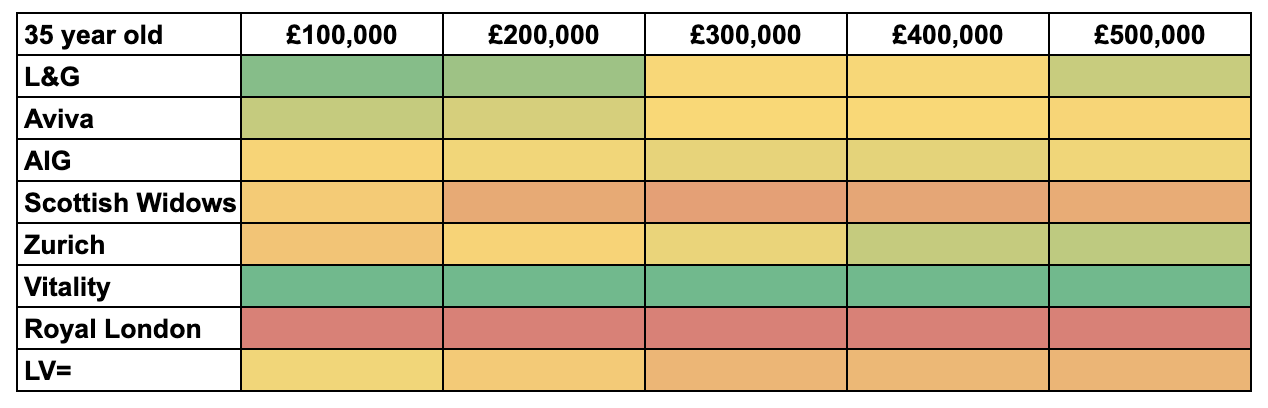

35-year-old smoker (25-year term)

L&G and Vitality are the cheaper providers for smokers around 35 years old and who require a lower amount of cover. Vitality and Zurich are good options if you require a larger amount of cover.

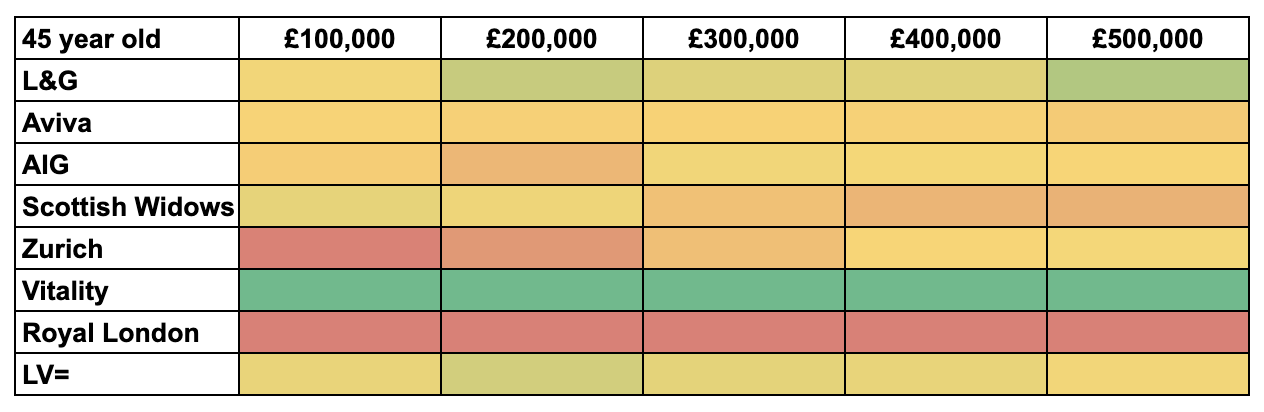

45-year-old smoker (20-year term)

Vitality and LV= are the better options is you are a smoker around 45 years old, assuming a lower amount of cover is required. Those wanting a larger amount of cover should look at Vitality and L&G.

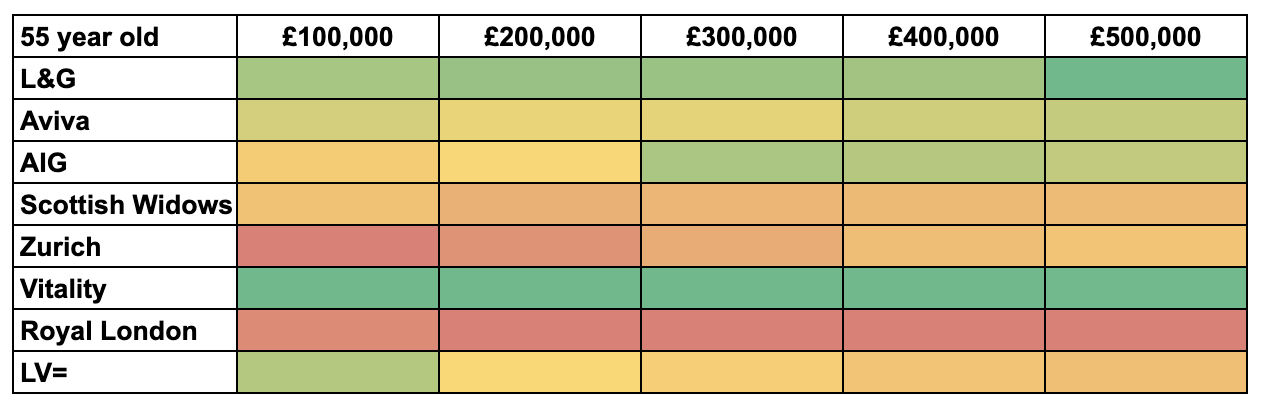

55-year-old smoker (10-year term)

Our research suggests that Vitality, LV= and AIG are the better options for smokers aged around 55 and that they remain competitive no matter the level of cover required.

Summary

The key message is that smoking dramatically increases life insurance premiums and so the simplest way to cut the cost of life cover is to give up smoking (most insurers will class you as a non-smoker if you go 12 months without using any tobacco or nicotine replacement products). Remember there are lots of other factors that can impact your life insurance quote and so it is often better to speak to an independent specialist*. Click the link to request a callback from a qualified life insurance expert at a time that is convenient for you. You'll receive up to £100 cashback should you take out a policy with them.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following links can be used if you do not wish to help Money to the Masses and do not wish to take advantage of the cashback referred to in the article - LifeSearch