Coinbase is an American cryptocurrency exchange platform. Founded in San Francisco in 2012, Coinbase has grown rapidly to become one of the largest exchanges in the world. In April 2021, Coinbase became the first cryptocurrency platform to list on a US stock exchange, with a valuation of around $86 billion. Coinbase is the leading mainstream exchange in the US, and currently boasts more than 56 million customers across more than 100 countries, with an estimated $230 billion in assets to its name.

What does Coinbase do?

Coinbase is an online cryptocurrency exchange platform that enables users to buy, sell, spend, earn, save, and use cryptocurrencies. Its services can be accessed via a browser as well as on iOS and Android mobile devices. Coinbase offers two different subscription services; Coinbase, which enables customers to buy or sell cryptocurrency; and Coinbase Advanced, which allows users to buy, sell, and make crypto-to-crypto transactions.

Coinbase also offers a range of products, including an integrated digital wallet called Coinbase Wallet which can be downloaded onto a browser or device for customers to store their public and private keys. It also has a debit Visa card called Coinbase Card, its own stablecoin called USD Coin, which is pinned to the value of the US dollar, as well as more than 500 tokens and non-fungible tokens (NFTs).

Coinbase's main features:

- Available on browser, iOS and Android

- Three account types - Coinbase, Coinbase One and Coinbase Advanced

- Integrated digital wallet - Coinbase Wallet

- Debit Visa card - Coinbase Card

- Own US dollar-backed stablecoin - USD Coin

- More than 250 different cryptocurrencies

- More than 500 different tokens and NFTs

Coinbase pros and cons

| Pros | Cons |

Coinbase vs Coinbase One vs Coinbase Advanced

Coinbase

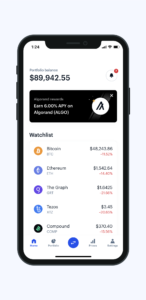

When you log in to your Coinbase account, you are immediately shown your portfolio balance (how much the cryptocurrency you have purchased is worth), and how it has performed across a selection of time frames. You can adjust these to your preferences, such as: 1 hour, 24 hours, 1 week,1 month, or 1 year. There is a banner above your portfolio balance which has a "Buy crypto" button, where you can enter a dollar value and place an order to purchase whichever cryptocurrency you choose that Coinbase offers. This button also brings up the options to sell or convert your existing cryptocurrency, or even set up standing orders – daily, weekly, on the 1st and 15th, or once a month. On the top right of the home page, there are options to send and receive cryptocurrency.

It is important to note that when a user purchases cryptocurrency on Coinbase, their keys are stored in a wallet that Coinbase has control over, which means that the user does not have autonomous control over their holdings. Although Coinbase has never reported being hacked, cryptocurrency keys stored in an online wallet are theoretically more vulnerable to theft and hacks than those stored offline.

The accounts of about 6,000 customers were hacked in October 2021 after hackers exploited a flaw in the Coinbase SMS account recovery procedure. The hackers would still have required users' personal information, which was likely phished from those affected. This is the only incidence of a hack at Coinbase and the users whose funds were stolen were reimbursed.

Coinbase One

The Coinbase One level is a subscription service that charges £19.99 a month. In exchange, customers get all of the features of a standard Coinbase account, but pay zero trading fees on hundreds of assets. They can also access boosted rewards and priority support.

Keep in mind that limits and spread fees do apply, so transactions may still not be completely free even after paying the subscription.

Coinbase Advanced

The interface on a Coinbase Advanced account is sleek and detailed, but the advanced charts and corporate colour scheme could be intimidating for beginners. Users can track the market, view their trade history, and monitor open orders. One of the main benefits of using Coinbase Advanced instead of a regular Coinbase account is the fact that the fees on Coinbase Advanced can be significantly reduced to as low as 0%, depending on the value of the order. Coinbase Advanced also allows buy or sell orders, which means you can wait for the market value of the cryptocurrency to reach your chosen price before you trade, as opposed to being limited to the current market value.

While the regular Coinbase account is a great way for amateur investors to begin investing in cryptocurrency, Coinbase Advanced is a more suitable platform for those who wish to actively trade or invest with lower fees and more sophisticated features. Similar to a regular Coinbase account, users automatically use a Coinbase Wallet to store their keys, but you can opt to use a private wallet to maximise your security.

Coinbase fees

Regular Coinbase accounts have a relatively complex and expensive fee structure compared to other cryptocurrency exchange platforms, which can significantly chip away at smaller transactions. There are 2 tiers to its fee system: a spread and Coinbase's own fee, which differs depending on the amount, payment method, and which country you are in.

Coinbase fees reduce in proportion to the total amount of the transaction, so a larger purchase will saddle you with lower fees than a smaller one. This is important to keep in mind if you are only intending to purchase a small amount of cryptocurrency, as you could end up spending a significant proportion of your investment solely on usage fees.

Coinbase spread

Coinbase initially charges a spread across most transactions. This is essentially the difference between the price Coinbase pays to get a cryptocurrency and the price it resells it to you for, which typically sits at around 0.50%, but can fluctuate depending on the market value of the cryptocurrency in question. Coinbase includes the spread in the quoted price when you place simple buy and sell orders.

No spread is included for Coinbase Advanced because you are interacting directly with the order book, but Coinbase One members may still have spread included in their quoted prices.

Coinbase fee

There is also a Coinbase fee in addition to the spread. The Coinbase fee is whichever is the greater of either (a) the flat fee or (b) the variable percentage fee, which is determined by region, product feature, and payment type. So each transaction on Coinbase is subject to the initial spread (around 0.5%) plus whichever is the greatest of either the flat fee or variable percentage fee applicable to the transaction.

Flat fees in the UK:

| Total Transaction Amount | Fee |

| $10 or less | $0.99 |

| More than $10 but less than or equal to $25 | $1.49 |

| More than $25 but less than or equal to $50 | $1.99 |

| More than $50 but less than or equal to $200 | $2.99 |

| More than $200 | Variable percentage fee applies |

Variable percentage fees in the UK:

| Bank Transfer | Debit/Credit Card | SEPA Bank Transfers - in/out | Faster Payments | Instant Card Withdrawals |

| 1.49% | 3.99% | Free/€0.15 | Free | Up to 2% of any transaction and a minimum fee of £0.55 |

Coinbase Advanced fees

Coinbase Advanced has a comparatively simple fee structure, which often works out significantly cheaper than a regular Coinbase account. The fees are calculated using your trading volume, which is determined by how much you have traded over the previous 30 days, and is shown in US dollars.

A "taker fee" applies when you place a cryptocurrency order at the market price which gets filled immediately. A "maker fee" applies when you place an order which is not immediately matched by an existing order, so your order gets placed on an order book. If another customer places an order that matches yours, you are then considered the maker. When you place an order that gets partially matched immediately, you pay a taker fee for that portion, while the remainder placed on the order book is considered a maker order. Therefore, your order could be split, and you could end up paying a different fee for different portions of your order. However, usually Coinbase Advanced fees are considerably less expensive than regular Coinbase fees.

You can read more about the definition of maker and taker fees in our article 'Cryptocurrency: What are maker and taker fees?'.

| Total Trading Volume | Taker Fee | Maker Fee |

| Up to $10,000 | 0.50% | 0.50% |

| $10,000 - $50,000 | 0.35% | 0.35% |

| $50,000 - $100,000 | 0.25% | 0.15% |

| $100,000 - $1 million | 0.20% | 0.10% |

| $1 million - $10 million | 0.18% | 0.18% |

| $10 million - $50 million | 0.15% | 0.05% |

| $50 million - $100 million | 0.10% | 0% |

| $100 million - $300 million | 0.07% | 0% |

| $300 million - $500 million | 0.05% | 0% |

| $500 million - $1 billion | 0.04% | 0% |

| More than $1 billion | 0.04% | 0% |

Coinbase One fees

Coinbase One users pay a monthly subscription of £19.99 a month in order to access 'fee-free' buying and selling of cryptocurrencies. This means Coinbase will not charge its usual transaction fee. There are still some limitations to this product though, as members may still have a spread included in the quoted prices they see when they make a transaction.

Which payment methods does Coinbase accept in the UK?

Coinbase accepts a number of different payment methods in the UK. Not only is each one subject to different fees, the payment method you choose can affect how quickly your payment is processed and which kinds of transactions you can perform on Coinbase.

Check out the table below to determine which payment method would be best suited to your needs.

| Best For | Buy | Sell | Deposit | Withdraw | Speed | |

| Bank Transfer | Large amounts, GBP deposits, withdrawing | ✔ | ✘ | ✔ | ✔ | Within 1 business day |

| Debit/Credit Card | Instant cryptocurrency purchases | ✔ | ✘ | ✘ | ✘ | Instant |

| SEPA Transfer | Large amounts, EUR deposits, withdrawing | ✘ | ✘ | ✔ | ✔ | 1-3 business days |

| Faster Payments | Large amounts, GBP deposits, withdrawing | ✘ | ✘ | ✔ | ✔ | 1-3 business days |

| Instant Card Withdrawals | Withdrawals | ✘ | ✘ | ✘ | ✔ | Instant |

Which cryptocurrencies can you trade on Coinbase?

Coinbase supports more than 250 different cryptocurrencies to buy, sell and trade in the UK, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Aave (AAVE)

- Litecoin (LTC)

- Quant (QNT)

- Dogecoin (DOGE)

- Cardano (ADA)

The full list of cryptocurrencies which Coinbase supports in the UK, and which kinds of transaction are permitted for each, can be found here.

Coinbase security

Coinbase is one of the most secure cryptocurrency exchange platforms in the world. It has 2-step verification, biometric fingerprint logins, and insurance in the event that Coinbase itself is breached (this insurance does not apply if your account is breached due to your own lack of security measures). It also claims to store “up to 97%” of users' funds in offline cold storage to minimise the risk of interference from online cybercriminals.

Many users' public and private keys, however, are stored on Coinbase’s server. Whenever a user purchases cryptocurrency using the integrated Coinbase Wallet, their keys are stored on Coinbase's own system, which means the user does not actually have autonomous control over their assets. There is a simple solution: You could simply withdraw your holdings into your own personal wallet – preferably a cold wallet for maximum security. Visit our explainer on cryptocurrency wallets for more information.

It is crucial to note that even though Coinbase itself is insured in the event of a hack, an individual's assets are not. Should your holdings on Coinbase become compromised (for example, through someone hacking your laptop and gaining access to your keys), you would be unable to recoup your losses because cryptoassets are not regulated by the Financial Conduct Authority (FCA). This means that users are not covered by the Financial Services Compensation Scheme (FSCS), which insures most financial products for up to £85,000. Without this insurance, if your Coinbase account was breached and your money was withdrawn, you would have no way of getting compensation.

The only publicised incidence of a Coinbase hack involved 6,000 customer accounts being accessed in October 2021 through a flaw in the Coinbase SMS account recovery procedure. However, the hackers would still have required personal information to get into the accounts, which Coinbase has said there was no evidence to suggest was obtained from the company. This suggests responsibility for the breaches therefore lies at least partly with the individual users' failure to protect their devices, as opposed to a flaw in Coinbase's own security system. Users whose funds were stolen were reimbursed.

While it is never 100% safe to use any online cryptocurrency exchange, Coinbase is still considered one of the safest web exchanges and digital wallets that you can use, and offers more security than many of the smaller, start-up exchanges.

Coinbase customer reviews

Coinbase has 3.8 stars out of 5 on Trustpilot over more than 12,000 reviews. At first glance, this is a rather high rating, though a quick scroll through the comments reveals that many recent positive reviews appear to be "invited" customers. However, there are still a number of customer service complaints highlighting the inability to speak to a human about their concerns, most likely due to the fact that Coinbase currently does not offer telephone support from a live agent. Users looking to contact customer service are limited to submitting a request for email support, which can be a time-consuming process and potentially inconvenient for straightforward enquiries. This is not unusual for cryptocurrency exchanges, however, with some major competitors such as Gemini only offering email support. There are some which offer telephone customer service, such as Kraken, but the vast majority have a long-winded and largely automated help system like Coinbase.

Coinbase compared to the competition

| Exchange Platform | Coinbase | CEX.IO | Kraken | Gemini | Uphold |

| Transaction Fees | 0.00-0.50% | 0.00-0.25% | 0.00-0.26% | 0.00-0.35% | 0% (but charges a spread between 0.85-1.25%) |

| No. of cryptocurrencies | 250+ | 200+ | 200+ | 150+ | 35+ |

| Wallet | Yes | Yes | No | Yes | Yes |

| Trustpilot Rating | 3.8/5 | 4.2/5 | 1.4/5 | 1.2/5 | 3.0/5 |

The verdict

Overall, Coinbase is one of the most popular and secure cryptocurrency exchanges in the world, with a large variety of currencies and tokens to trade with. However, it has a complex and relatively expensive fee structure unless you opt for a Coinbase One or Coinbase Advanced account, and many Trustpilot reviews point to its poor customer service record. Other exchanges, such as Kraken and CEX.IO, offer cheaper transaction rates. Users should also make sure that they keep their devices and accounts as secure as possible to minimise the chances of their holdings becoming compromised, and think carefully about the ratio of Coinbase's fees to smaller transactions before making any purchases.

Finally, it is worth pointing out that cryptocurrencies can be highly volatile and as such, it is likely to be better suited to sophisticated investors who understand the associated risks and are prepared to lose all the money they invest if they buy crypto-assets.

For more information on cryptocurrencies, read our articles 'A beginner's guide to investing in bitcoin and cryptocurrency' or 'The best cryptocurrency exchange platforms in the UK'.