Bitcoin is essentially an online version of cash. It is a form of entirely digital currency known as cryptocurrency, which has taken the world by storm in recent years. As a type of money that exists solely in digital form, it has grown in popularity as a modern, technology-focused alternative to centralised banking and traditional currency. Instead of a central bank to regulate bitcoin, maintenance of the transaction record and generation of new units is done through the computational solution of mathematical problems. In this article we will explain how this actually works, how safe bitcoin is and break down the jargon-heavy cryptocurrency sphere.

Bitcoin is essentially an online version of cash. It is a form of entirely digital currency known as cryptocurrency, which has taken the world by storm in recent years. As a type of money that exists solely in digital form, it has grown in popularity as a modern, technology-focused alternative to centralised banking and traditional currency. Instead of a central bank to regulate bitcoin, maintenance of the transaction record and generation of new units is done through the computational solution of mathematical problems. In this article we will explain how this actually works, how safe bitcoin is and break down the jargon-heavy cryptocurrency sphere.

What is bitcoin?

Bitcoin is a type of cryptocurrency, essentially a digital token that you can use to buy, sell or trade goods and services. It does not have any physical form – so you cannot touch or hold bitcoin – as it exists only digitally. Not only is bitcoin used as a unit of virtual currency, but its own value can make it a desirable option for those looking to make a profit by trading the coins themselves, although it is infamously volatile.

Bitcoin was created by an anonymous individual or group, known only as 'Satoshi Nakamoto', in 2008. Beyond this, the details of bitcoin’s inventor(s) and origins are sparse. It was first used in 2009, when bitcoin was released as open-source software, which meant that although Satoshi Nakamoto held its copyright, bitcoin users were granted the right to use, alter, and distribute it to anyone for any purpose. Since then, bitcoin has grown in popularity around the world at least partly due to its collaborative nature and the compelling mystery of its background.

How does bitcoin work?

Bitcoin can be used as a digital currency – similarly to traditional currency, such as pounds or dollars – except that it is solely virtual. The virtual home for bitcoins is known as the blockchain, which is run by a vast network of advanced computers around the world, creating and keeping track of all the bitcoins in existence. One of bitcoin’s key features is that it is decentralised, meaning that there is no overarching bank, institution or authority which can control it, unlike traditional currencies. Instead, it is managed using 'peer-to-peer' technology across this huge number of computers.

Bitcoins are often described as being stored in a digital 'wallet', but the reality is that bitcoins never leave the blockchain. Each bitcoin investor has their own public and private keys, which function like the username and password to an account, that they use to interact with their bitcoins on the blockchain. These keys are crucial, as anyone that has access to both of them can therefore access that individual’s bitcoin holdings, so the 'wallet' that they are stored in must be as secure as possible. You can read more about what a cryptocurrency wallet is, and the different types available, in our article 'What is a cryptocurrency wallet?'.

In addition, bitcoin ownership and trading is completely anonymous. Transactions are identified using only the enactors’ public and private keys. This has made bitcoin a popular avenue for criminals, who take advantage of its anonymity to carry out illegal activity that then cannot be traced back to them.

Why is bitcoin so popular?

As well as being used as a unit of currency, bitcoins themselves are often traded, as investors seek to take advantage of its rapid price movement to make a profit. In recent years, bitcoin has rocketed in value, from around $1,000 at the start of 2017 to almost $100,000 in 2024. These figures can be misleading, however, as bitcoin prices are susceptible to extreme peaks and troughs. Though a single bitcoin’s value reached over $64,000 in May 2021, by July it had come crashing down to $31,006 – a decrease of over 51.5% in less than 8 weeks.

Some people have made vast amounts of money from buying bitcoin while its value was low, and then selling it off once its price had gone up. These individuals have had a great deal of exposure on social media, and some promote bitcoin investing as a get-rich-quick scheme. However, many more people have lost money from investing in bitcoin and selling it off at the wrong time. These are the stories that are less likely to reach the headlines, so it can seem as if bitcoin is a foolproof way of making money, but there have been plenty of real-life examples of investors losing tens and even thousands of dollars from trading bitcoin.

For this reason, bitcoin is considered an extremely risky investment, and should only be undertaken by those who fully understand the associated risks.

How to mine bitcoin

Individual bitcoins are created by a process known as “mining”, which is the act of maintaining and adding to the worldwide record of bitcoin transactions – known as the “ledger” – by using computer processing power to solve complex mathematical equations. Computers which solve the equations and contribute to this ledger are rewarded in fractions of bitcoin, in what is called a “proof-of-work” scheme. People with access to computers powerful enough to undertake bitcoin mining, known as “rigs”, can therefore be rewarded with some newly-generated coins.

There are four different ways that you can use computers to mine bitcoin:

- GPU mining - Using a computer's in-built graphics processing unit in order to perform the mathematical equations. The most widespread and well-known method of crypto mining.

- CPU mining - A slow, older version of crypto mining utilising advanced computer processors to solve the equations cryptocurrency. Used to be a popular option several years ago, but now considered time-consuming and electricity-intensive.

- ASIC mining - Application-Specific Integrated Circuits, computers designed specifically to mine crypto, known for being more productive than alternative methods.

- Cloud mining - Either paying someone (usually a large corporation) to rent out their “rig” or using a cloud mining service to rent the computing power from a mining farm for your own device.

However, each of these are extremely complicated processes which demand huge amounts of electricity. Recent data revealed that bitcoin mining alone had reached an all-time high of 149 terawatt-hours (TWh) during 2020, while Google used just 12.2 TWh over the same period. Indeed, analysts have warned that if bitcoin was a country, it would use around the same amount of electricity for mining each year as the entirety of Switzerland.

You can read more about bitcoin mining, the different ways you can do it, and why it’s so bad for the environment in our article 'Cryptocurrency mining: What it is, how it works and how to mine bitcoin'.

How many bitcoins are there?

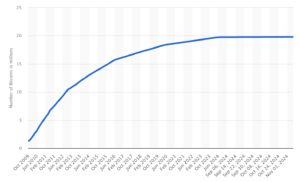

There are currently around 19,780,000 bitcoins in circulation on the blockchain. This figure has been increasing gradually since 2009, when bitcoin was first released to the public, and changes every 10 minutes or so as the mining process generates more bitcoins.

As part of bitcoin’s core coding, Satoshi Nakamoto stipulated that there can over ever be 21 million bitcoins in existence. This helps to keep bitcoins desirable, and valuable, as there will always be a limited supply. Therefore, over 83% of all the bitcoins that will ever exist are already in circulation. The more bitcoins that are in circulation, however, the less bitcoins are generated as part of the mining process. At the moment, each miner’s contribution to the global blockchain – called a “block” – is rewarded in 3.125 bitcoins.

This number will reduce over time as the total number of bitcoins approaches its final cap, so the more bitcoins there are, the longer it takes to create new ones. At the moment, 144 blocks per day are mined on average, so as 144 x 3.125, the average amount of new bitcoins mined per day is 450. It will still take a long time for all bitcoins to be mined, however, as it is estimated that the final bitcoin will be mined in the year 2140.

The following graph demonstrates how the number of bitcoins has grown over time to reach the November 2024 level of 19.78 million:

Is bitcoin safe?

There is no straightforward answer to whether or not bitcoin is safe. In many ways it is not because not only does bitcoin’s value tend to swing to extremes at short notice – leaving investors vulnerable to large losses without much warning – but there is no regulatory body or framework in the UK to monitor it. Crucially, bitcoin investments are not protected under the Financial Services Compensation Scheme (FSCS), which usually covers investors’ assets up to £85,000 in the event that something goes wrong. This does not apply to bitcoin, so if you invest in it and your holdings are compromised or lost entirely, there is no way of reclaiming your money and it would effectively be gone forever. Additionally, the Financial Ombudsman Service (FOS) is unable to provide help with complaints, unless the complaint is a result of a bank refusing to reimburse a customer who has been the victim of fraud.

Some cryptocurrency exchange platforms – where you go to buy, sell or trade bitcoin – are registered or pending registration with the UK’s Financial Conduct Authority (FCA). Although this can seem like a guarantee that your bitcoin will be secure if you purchase it through one of these exchanges, the FCA’s role involves only anti-money laundering and terrorism financing monitoring, so your assets are still not actually protected if they are lost or compromised.

However, millions of people around the world invest in bitcoin on a daily basis, and as long as you are informed and prepared for the associated risk to your capital, bitcoin investing is not dissimilar from other high-risk asset classes. You can read more about the safety of bitcoin and other cryptocurrencies in our article 'How are cryptocurrencies regulated in the UK?'.

How much is bitcoin worth?

The value of bitcoin is infamous for swinging from major highs to extreme lows at short notice, so it is always advised to keep an eye on bitcoin’s current and recent price before you invest to get an idea of what you’re getting into. A useful website for tracking the price of bitcoin is CoinMarketCap, which not only has live price data, but also sophisticated charting technology, statistics and analysis for investors to develop a thorough understanding of what is happening – and what is going to happen – in the cryptocurrency sphere. Alternatively, CoinDesk offers a similar service with a sleek, professional interface.

How to invest in bitcoin

Investing in cryptocurrency isn't for everyone. It can be an extremely volatile investment and it is unregulated, meaning your money isn't covered by the Financial Services Compensation Scheme. It is likely therefore to be more suited to an experienced investor who is comfortable that they may get less back than they put in. Before you invest, you need to understand the volatile nature of investing in cryptocurrency For those that have done their research and concluded that they are still interested in investing in bitcoin, it can be bought, sold and traded on cryptocurrency exchange platforms such as Coinbase or Gemini. These platforms each have their own fees for buying or selling bitcoin, which often differ depending on the method of payment, the amount being purchased, and where you are in the world.

Bitcoin investing is not just limited to buying or selling, however, as many exchanges offer other trading options such as margin trading, futures trading, and stop-limit orders. Do bear in mind that these more advanced trades are sometimes behind a subscription paywall. In addition, do familiarise yourself with the fee model for whichever exchange platform you pick, as transaction fees can become expensive for smaller investments.

To help you choose the best one for you, we’ve rounded up our list of the best cryptocurrency exchange platforms in the UK and you can also check out our independent reviews of Coinbase, Gemini, Kraken and more for information on their fees and security credentials. Finally, head over to our step-by-step guide on how to buy bitcoin, to take you from setting up your digital wallet to owning your own bitcoins.