Whether you're interested in buying shares in leading Artificial Intelligence companies or looking for investment funds to gain exposure to the growth and power of AI technology, we cover all the essentials in this article. Remember, that as with all investing, your money is at risk. The value of your portfolio can go down as well as up and you could get back less than you put in. None of the investments in this article are investment recommendations and do not constitute investment advice.

Whether you're interested in buying shares in leading Artificial Intelligence companies or looking for investment funds to gain exposure to the growth and power of AI technology, we cover all the essentials in this article. Remember, that as with all investing, your money is at risk. The value of your portfolio can go down as well as up and you could get back less than you put in. None of the investments in this article are investment recommendations and do not constitute investment advice.

What is Artificial Intelligence

Artificial Intelligence (AI) describes the creation of software machines that exhibit cognitive functions akin to humans, such as learning, problem-solving and decision-making. Or in other words software or machines that appear to think like humans. By harnessing huge datasets, AI algorithms can quickly identify patterns and provide insights at superhuman speeds. It means that AI can be used to increase efficiency and allow smarter decision-making via machine learning. For example, AI could be used to make better and more accurate healthcare diagnosis. The potential human, economic and social impact of Artificial Intelligence is being likened to the creation of the internet and even the industrial revolution. AI has the potential to disrupt established industries but also redefine the way we live or work.

In November 2022 the launch of ChatGPT by OpenAI brought Artificial Intelligence to the mainstream by allowing the general public to interact with AI via a chatbot interface. It was a defining moment in the evolution of AI and its wider adoption. ChatGPT was developed in part thanks to a multi-billion dollar partnership with Microsoft, placing the US tech giant at the forefront of the AI revolution. Since the launch of ChatGPT there has been a surge of investment by other large US tech companies into products and services that take advantage of AI or support its growing use. We've also seen investors clamour to invest in companies that are developing or taking advantage of AI solutions that will give them a competitive edge.

The chart below shows the performance of the so-called "Magnificent 7" stocks which have seen their share prices rally thanks largely to investor enthusiasm for artificial intelligence. The Magnificent 7 comprises Nvidia, Meta Platforms, Tesla, Amazon, Alphabet, Microsoft and Apple. These seven stocks account for 27.3% of the S&P 500 and have been the driving force behind the rally in the index, both in 2023 and 2024.

How to invest in AI (Artificial Intelligence)?

Investing in Artificial Intelligence has surged in popularity and there are a number of ways in which you can gain exposure to the theme. Which option suits you will depend on how involved you want to be in the investment selection process as well as your knowledge and experience.

Ready-made AI portfolios (thematic investing)

If you want to invest in AI but don't want to pick the investments yourself, a number of so-called robo-advisers offer ready-made portfolios you can invest in. Thematic investing is one of the simplest hands-off approaches to investing in AI through a portfolio managed by professionals on your behalf at low-cost.

For example, Moneyfarm* offers a thematic investing option, with its Technology theme giving exposure to investing in AI. Moneyfarm will also manage your money fee-FREE for a year* if you open a Stocks and Shares ISA, Junior ISA, Pension or general investment account.

Alternatively Nutmeg offers three thematic investment styles, namely Technological Innovation, Resource transformation and Evolving Consumer. Nutmeg's thematic investment style provides a globally diversified, risk-adjusted portfolio with a tilt (up to 20% of equity exposure) towards your chosen theme. The Technological Innovation theme gives exposure to the growing use of semiconductors and artificial intelligence. The majority of the portfolio is actively managed by Nutmeg's investment team, whilst the 'tilted' part of the portfolio is made up of ETFs which are unlikely to change that often. You can find out more in our Nutmeg review.

Direct share dealing

One high risk option is to invest directly in the shares of those companies that may benefit from the rise of AI. In order to do this you will need to use an investment platform or broker through which to buy the shares. If you are looking to invest inside an ISA then read our roundup of the best and cheapest Stocks and Shares ISAs. Alternatively, if you are looking to invest via a pension then here is our round-up of the cheapest SIPPs. Either way Freetrade ranks highly and you can claim a free share worth between £10 and £100* when investing.

Then you need to identify companies that are either developing AI technology, leveraging AI in their businesses or are integral in providing the infrastructure needed for AI to operate at scale.

Below is a brief synopsis of a number of companies that may benefit from the rise of AI. These are deliberately large companies whose shares are readily traded on global stock exchanges. They are not personal recommendations.

Nvidia

NVIDIA Corporation is a leading provider of graphics processing units (GPUs) that are used in a wide range of applications, including AI. NVIDIA's GPUs are optimised for deep learning, a subfield of AI that involves training machines to recognise patterns in large datasets. With the growing demand for deep learning technology, NVIDIA is well-positioned to benefit from the rise of AI given that it commands an 80% share of the artificial intelligence (AI) chip market.

Alphabet

Google's parent company, Alphabet Inc has been at the forefront of AI research and development for a number of years and is now scrambling to boost its AI capabilities, with the Wall Street Journal reporting that Alphabet will combine its AI Research Units Brain and DeepMind to accelerate its AI progress. Google's AI technology is already being used in a wide range of applications, including self-driving cars, healthcare and education.

Microsoft

Microsoft has been investing heavily in AI research and development while its Azure AI platform is one of the most advanced AI systems available. Microsoft's AI technology is being used in a wide range of applications, including virtual assistants, chatbots and predictive analytics. Microsoft has been in partnership with OpenAI (the creators of ChatGPT) since 2019 and in January 2023 announced a further multi-billion dollar investment. Microsoft has stated that it will deploy OpenAI’s models across its consumer and enterprise products and introduce new categories of digital experiences built on OpenAI’s technology. In addition, AI technology requires a huge amount of processing and that will inevitably increase the demand for Microsoft's Azure AI platform.

Salesforce.com

Salesforce has been investing heavily in AI-powered solutions for customer relationship management (CRM). Its Einstein AI platform is one of the most advanced AI systems in the CRM space, capable of analysing vast amounts of customer data and providing personalised insights.

Alibaba

Alibaba has released a chatbot product called Tongyi Qianwen, similar to the AI-powered language model ChatGPT. According to the cloud computing unit of the company, the chatbot will be integrated across Alibaba's businesses in the "near future," although no specific timeline was given. However, China's Cyberspace Administration proposed new regulations that require AI chatbot providers to submit their products for security reviews before public release, which could be a headwind for any company developing AI technology in China.

Baidu

Baidu is one of the leading providers of search engine services in China and has also been investing heavily in AI research and development. Its AI technology is being used in a variety of applications, including speech recognition, natural language processing and autonomous vehicles.

Tencent

Another Chinese tech giant that is also reported to be developing its own ChatGPT equivalent with online reports suggesting that it could be called HunyuanAide.

Amazon

Amazon has been investing heavily in AI-powered solutions, particularly in areas such as natural language processing, computer vision and robotics. Amazon's AI technology is being used in a variety of applications, including voice-powered assistants, warehouse automation and fraud detection. In addition, Amazon is a leading player in cloud computing and this week announced it's launching AI services through its cloud computing platform, targeting corporate customers looking to integrate AI into their businesses. This is in contrast to most other tech giants that are focused on delivering consumer focused services.

How to invest in ChatGPT and OpenAI

Chat GPT was built by OpenAI which is not a publicly-traded company. As such it is not possible to directly invest in ChatGPT or OpenAI, however, Microsoft remains in strategic partnership with OpenAI and so provides one route to gain exposure to success of the AI chatbot.

Investment funds with AI exposure

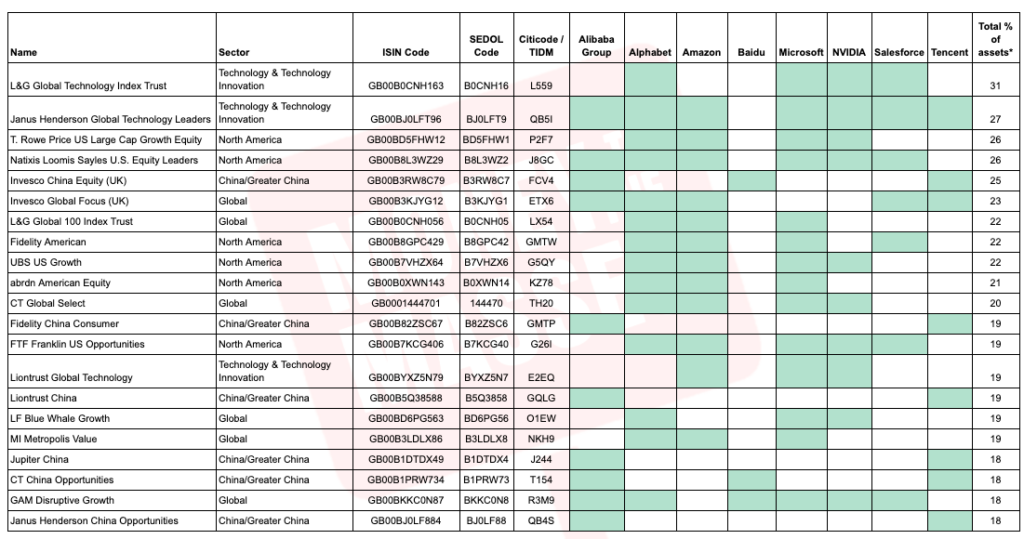

An alternative option to thematic investing or direct share holding would be to invest in a diversified fund that has some exposure to AI stocks. In that way your portfolio may benefit from the rise of AI but not be overly exposed to the theme. As part of a research article for our 80-20 Investor service I determined which unit trust funds had exposure to the companies mentioned above. The table below summarises those funds that have a significant exposure to any of the stated companies at the time when the research was carried out in April 2023. It still provides a good starting point for you to carry out your own research. If you click on the image below you can download a larger two page pdf table. Where a square is coloured green it shows that the company is in the top 10 holdings of the fund. A white square signifies that there is no (or minimal) exposure to the relevant company. The final column shows the total percentage of the funds assets that are exposed to the 8 companies above.

ETFs - Exchange traded funds

There are a few unit trusts and ETFs that have AI or "artificial intelligence" in their names. Expect a lot more to launch in the future. But as with any theme you want to bring into your portfolio, look beyond the fund name and look at what the fund actually invests in. Two example ETFs available to UK investors are L&G Artificial Intelligence UCITS ETF and the Wisdom Tree Artificial Intelligence UCITS ETF. The latter tracks the NASDAQ CTA Artificial Intelligence Index.

What are the risks of investing in AI?

AI is rapidly changing the landscape of the business world from chatbots and virtual assistants to autonomous vehicles and predictive analytics. The potential impact of AI is being compared to other great technological revolutions in history, such as the invention of the printing press by Johannes Gutenberg in the 15th century, the industrial revolution in the 18th century and both the creation of the computer and the birth of the internet in the 20th century.

As a result, investors are keenly watching the AI space and money is already flowing into the AI theme in search of potential profit. However, one issue with many of the companies working on AI is that they are often private, meaning it's not possible to invest in their shares. OpenAI (the creator of ChatGPT) is one such example.

There is also danger that investors race to invest in almost anything that claims to be associated with developing AI. Indeed, you need only look at the rapid increase in tech start-ups that are clearly jumping on the AI bandwagon. It means that investing in AI, just like any other new theme or technology is fraught with risk. The valuation of AI companies tends to be highly speculative, often based on growth expectations far into the future, making them sensitive to changes in market sentiment and macroeconomic factors such as interest rates.

The regulatory landscape for AI is also still evolving, with potential for increased oversight and restrictions that could impact the profitability and operational freedom of AI-focused companies. Moreover, ethical and societal concerns surrounding AI, such as privacy, security and the displacement of jobs, could lead to public backlash and stricter controls. This would potentially hit profits and ultimately share prices.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following links can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Moneyfarm, Freetrade