Which is the cheapest fund platform or discount broker?

Fund platforms (also known as fund supermarkets) allow you to hold funds from a variety of fund managers in one place. This simplifies the holding and trading of a wide range of funds, particularly within ISAs and pensions. Some platforms (in particular the discount brokers) also allow you to hold and trade in shares.

Because you are holding your investments on a single platform, all the administration is carried out in one place, rather than with several fund managers. As all your investments are in one place, obtaining a valuation and switching between funds is simpler and quicker.

However, an additional benefit of using a fund platform is that it is often cheaper due to economies of scale, however, some investment platforms have more clout than others and have negotiated better deals than their rivals.

What fees do fund platforms and discount brokers charge?

The overall fee that you will pay a fund platform or discount broker depends on a number of factors, including:

- what you want to invest in (funds, shares, investment trusts etc)

- how much you have to invest

- the value of all your assets with the platform and discount broker

- the frequency which you wish to trade

- and the cost of other ancillary services (such as valuations)

- whether you invest via a Stocks and Shares ISA or SIPP (i.e. a pension)

Plus there is a host of hidden costs beyond the headline rates quoted in the press. The upshot is that there is no one size fits all solution as one platform may be cheap for one investor but not another. For example, some platforms charge fixed annual fees of £100+ every year while others charge a small percentage of the value of your assets held with them. Clearly the former is better value for someone with a portfolio of £100,000 than it is for someone with an ISA of £10,000. For the latter, the percentage platform charge would be better.

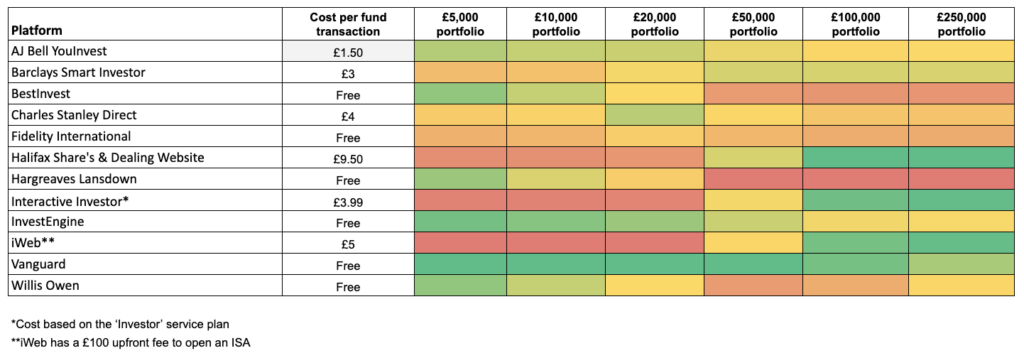

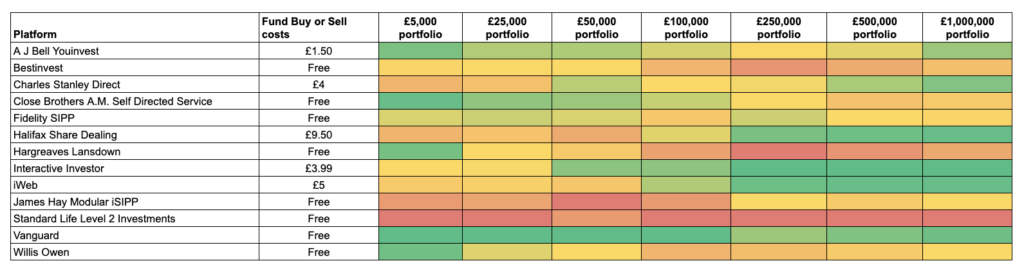

We've crunched the numbers and worked out the annual cost of each fund platform and produced platform comparison heatmaps (below) assuming that you invest via a Stocks and Shares ISA or a SIPP. Two things to note 1) this is a simple cost comparison so does not take into account service levels or value added (i.e. from guides) and 2) it is only indicative.

To use the table, find your portfolio size in the first row and then look down the column comparing the annual charges. As a quick guide green is cheap and red is expensive by comparison.

Cheapest fund platform

Stocks and Shares ISA platform cost comparison

The charges used do not include those charges by the fund manager for the funds you invest in. The table only covers the platform charges and assumes you invest in funds and make 10 fund switches a year.

SIPP platform comparison

FURTHER READING:

- Compare the cheapest (and best) investment ISA platforms

- The best stocks and shares ISA (and the cheapest fund platform)

- Best and cheapest investment ISAs for beginners

- Which are the best ethical Stocks and Shares ISAs

- How to choose an investment fund - 5 key statistics to check

- How to become a DIY investor