Trussle was one of the first online mortgage brokers on the scene, launching in December 2015. It was started by former Merrill Lynch mortgage and real estate analyst Ishaan Malhi who believed the sector needed a shakeup when he felt his own experience of applying for a home loan was outdated.

So how is Trussle modernising mortgage broking?

What is Trussle and what does it do?

Trussle has its own manifesto that promises better service, no hidden fees, help for those on low incomes and pricing transparency. The idea is to speed up applications and your mortgage comparison by removing the need for paperwork and a stuffy bank branch or mortgage-adviser office. The application is fully managed online and over the phone, often in around 20 minutes.

Borrowers can apply for a mortgage or remortgage either for a residential property or buy-to-let by providing their income, expenses and details of the property they are purchasing. An algorithm then scans 12,000 different products from 90 lenders matching the underwriting criteria to their risk profile.

Applicants will then be sent a recommendation, accompanied by an explanation from a qualified mortgage broker who can be contacted for more information before an application is submitted.

Everything from uploading documents (such as proof of income and identity) to tracking the progress of your application is managed securely online.

Trussle also offers a free mortgage monitoring service for homeowners that stores details of their existing home loan and tracks the market to inform them when there is a cheaper deal they could remortgage to.

How does Trussle work?

You can either use Trussle to apply for a mortgage in principle, which lets you have an idea of what you can borrow as a basis for finding a property, or you can make a full application to secure an offer.

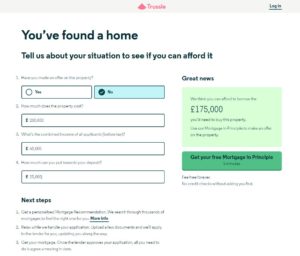

The first step in applying for a mortgage with Trussle is to decide whether you are looking to buy or remortgage. You will then need to enter income, property details, how much you can put towards a deposit and whether or not you have made an offer. The website will then tell you if you can afford to borrow the necessary amount and how much more you may need to put down as a deposit to make up any shortfall in income.

The next step is to sign up. Before entering your email and password, you are asked to click to confirm that you have read and understood the terms of business and privacy policy. It is important to read this information carefully so you understand how the process works and how Trussle is paid. While a traditional mortgage broker would be able to explain their terms of business face-to-face, with an online broker you are responsible for reading the information yourself and so it is easy to miss key information.

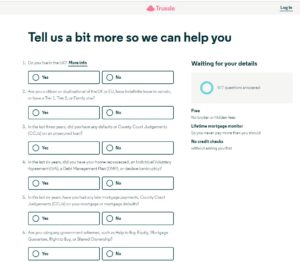

Once registered, Trussle goes into a bit more detail, asking your name, address, citizenship and whether you have had any County Court Judgements against you or been made bankrupt. There are several pages of clearly set out multiple-choice questions that help to compile your application, covering the property you want to buy or remortgage, your income, employment details, any expenses and credit commitments and when you want to retire. These can be reviewed at each stage and it is important to be honest about this as it could impact your application.

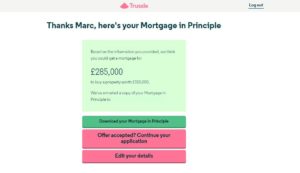

If you are applying for a mortgage in principle, the system will then take a few seconds to compare your details with its underwriting information to tell you how much you can borrow. You can also see what the typical monthly repayments would be and how it changes if you were offered different terms, as well as other costs such as legal fees and stamp duty. The mortgage in principle can then be downloaded and provided to an estate agent as proof that you can afford to buy a property.

The process for making a full mortgage application is similar but you will need to provide more specific information on your employment and salary, as well as the property you want to buy, how long you plan to live there for and any anticipated changes in your income.

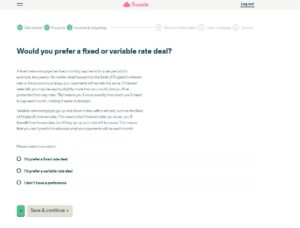

The questionnaire also tries to get a sense of the type of mortgage product you would prefer, asking if you want flexibility or stability, meaning a fixed rate or a tracker mortgage. There is a brief explanation of the difference between the two, but for more details read our articles on fixed rate mortgages and tracker mortgages.

Similarly, applicants are asked if they want lower monthly repayments that may significantly increase after two years or higher repayments that are fixed for longer. These questions help to get a sense of how long you want to fix for.

A soft search of your credit file will then be completed to clarify the information entered. This is important as it won’t leave a footprint. Typically, lenders can be nervous about lending to someone if they have made several applications for credit or if there is evidence of multiple searches, so it is always best if a soft search can be completed before an application is made.

Applicants are then sent a recommendation that they can accept or reject and discuss with a broker on the phone. If the application proceeds, all documents such as payslips and proof of ID need to be uploaded to Trussle’s online portal. It is there where you can track and manage the application until the loan is either approved or rejected. If approved, you continue to use the online portal until the mortgage application or remortgage completes.

What are Trussle’s fees and charges?

Unlike some mortgage brokers or bank advisers, Trussle doesn’t charge a fee. The advice they provide is free to the end customer but Trussle's advisers are paid a procurement fee by the lender, which is an agreed amount paid for selling that mortgage. The amount of money that Trussle is paid by the lender should be disclosed in the key facts document you receive when making an application.

Although Trussle does not charge a fee, there may be additional fees associated with your application. The lender you proceed with may still charge a product fee and there will be additional charges to pay, such as valuation and conveyancing fees, as well as stamp duty.

Is Trussle safe to use?

Trussle is registered and regulated as part of an established network called the Mortgage Advice Bureau. This means it follows rules set out by the Financial Conduct Authority on treating customers fairly and being transparent about products and pricing. Customers also have a right to complain to the Financial Ombudsman Service if they are unhappy with the service. It is also covered under the Financial Services Compensation Scheme for mortgage advising and arranging, which protects claims of up to £50,000 if the company goes bust.

Additionally, behind all the algorithms are fully qualified and experienced mortgage brokers who have to follow set professional standards or risk industry bans or fines.

Pros & Cons of Trussle

Trussle takes a lot of the hassle out of applying for a mortgage. You can apply at any time of day, rather than needing to make an appointment during business hours with an adviser. This is more convenient and means you don’t have to take unnecessary time out of your own working day. Trussle is also quick, promising a product recommendation within 20 minutes in some cases. You don’t need to wait for items in the post and there is an environmentally friendly aspect as you can manage everything online, cutting out the need for piles of paperwork to complete.

Applicants benefit from the experience of Trussle’s brokers so they can be instantly matched with products that the systems know best fits their criteria, rather than wasting time on an application with a bank that could be rejected and leave a mark on their credit report.

Trussle can advise on most types of mortgages, although it will only work with lenders that pay procurement fees and that have relationships with brokers. Most lenders do work with brokers, so you will be getting access to most of the market, but Trussle highlights several that don’t, including Chelsea Building Society, Co-operative Bank, Cumberland Building Society, First Direct, Lloyds Bank and Yorkshire Building Society.

Trussle's service is quick and the process is smooth, but often speaking to someone face-to-face can be more beneficial. A mortgage adviser could pick up on uncertainties or elements that need more clarification, these may be missed if everything is done solely online, which may later lead to rejection. Also, while the application process is faster, there is no guarantee of how speedy the legal and conveyancing side will be as that is unfortunately out of the broker's hands, whether they are a robot or a human.

Alternatives to Trussle

Trussle vs traditional mortgage brokers

There are two main types of mortgage adviser. There are bank advisers who will promote their own products, or mortgage brokers, who will search the market for the most suitable deal. Trussle sits in the mortgage broker camp, but it is slightly different as it doesn’t have the overheads of an office, which helps it to keep costs down meaning it doesn't have to charge for advice, something that brokers will often do. As everything is conducted online, Trussle is set up to be faster than a traditional mortgage broker as you don’t need to worry about attending meetings or providing paperwork and everything can be done from the comfort of your computer.

There is a downside compared with a high street broker, as elements of your application may be missed if you do everything online yourself, however you can still speak to an adviser at Trussle, either through live chat or on the phone if you aren’t sure of anything. Using a traditional mortgage broker can sometimes mean that errors can be spotted quicker and it could be argued that an adviser can assess your understanding better if they meet with you face-to-face.

Trussle vs Habito

Habito* was launched a year later than Trussle. It offers a similar service but claims to have access to more products, at more than 20,000 rather than Trussle’s 12,000. It has its own algorithm that matches products to an applicant’s personal details to generate a mortgage recommendation. This, Habito says, can be done within 15 minutes.

Habito, unlike Trussle, will recommend a lender that they do not partner with, so long as they believe it to be the best deal. Habito's website says 'if we find that the perfect mortgage for you is from one of the few lenders we don’t currently partner with, we’ll do our best to let you know, so you can go direct to them'.

Trussle has almost 6,000 reviews on Trustpilot, with 91% ranking the company as "excellent". Habito. meanwhile, has 7,500, with 90% as "excellent".

Check out our recent Habito review for more information.

Trussle vs MortgageGym

MortgageGym provides a similar service to Trussle, with its application process taking around 15 minutes, plus it also has a partnership with credit reference agency Experian, giving it access to your financial information and therefore a better idea of the deals you would be approved for. Rather than recommending one product, MortgageGym presents applicants with four that can then be discussed with one of its brokers.

Trussle customer reviews

As the oldest online mortgage broker on the block, Trussle has a bank of customers who can provide real-life experience. Trussle is rated as 'Excellent' from almost 5,500 reviews on independent customer review site Trustpilot. 91% of the reviews rate it as excellent with only 2% rating it as 'Bad'. The excellent reviews cite great communication and a smooth application process. Of the few poor reviews, some have commented that the service can be a little slow.

Conclusion - should you use Trussle?

Getting a mortgage or remortgage is often the biggest financial commitment a person can make and so it is important to get it right. A speedy application does sound good, but it is equally important to be thorough as any missed information could lead to rejection and wasted time.

Trussle has experience in the market so is definitely reliable and worth considering as long as you share all the correct information and aren’t scared to get in touch with one of its human mortgage advisers if you need extra clarification. Trussle’s online portal is also attractive as you will be able to follow the application in real-time, removing any stress of not knowing what’s going on.

If you are keen to try an online mortgage broker, check out our Habito review as they provide a similar service to Trussle with the added benefit of providing recommendations for all lenders, irrespective of whether they have a partnership or not.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Habito