The Bank of England (BOE) has raised interest rates by 0.75% meaning the Bank of England base rate now stands 3.00% - the biggest single interest rate rise in over three decades. An increase in interest rates can affect everyone's finances with some mortgage borrowers seeing an increase in monthly repayments and savers recouping better interest rates on their cash.

In this article, we look at what the latest rise in the Bank of England's base rate means for your money. We recommend that you read the article in full, however, if you just want to see how the latest rise to the Bank of England base rate is likely to impact your mortgage repayments, check out our mortgage repayment calculator.

What is the Bank of England base rate?

The Bank of England base rate - also known as the 'Bank rate' or 'the interest rate' - is the rate that the Bank of England charges commercial banks and other lenders when they borrow money. This then has a knock-on effect because to ensure they cover their costs, banks and other lenders will tend to raise the interest rate for borrowers in line with the increase to the Bank of England base rate. Savers should also see interest rates increase, but the rate is typically lower than the rate charged to borrowers to ensure they make a profit.

Why has the Bank of England base rate increased?

The Bank of England tries to control inflation rates by reducing and increasing interest rates. The Bank of England has an inflation target of 2% set by the government, however, inflation currently sits at 10.1% and is predicted to rise to around 11% in the final quarter of 2022. Looking further forward, the BOE predicts that inflation is likely to fall sharply from the middle part of 2023.

Inflation is the rate that measures how prices have increased over a period of time. Inflation can be measured by comparing the cost of goods and services now to 12 months prior. Using this comparison - and the current inflation rate - this would mean that goods and services now cost 10.1% more than they did a year ago. The Bank of England has an inflation calculator that allows you to check how the prices of goods and services have changed over time.

So, why has the Bank of England base rate increased? The Bank of England has chosen to raise the base rate in a bid to quell inflation and get closer to the ultimate target of 2%. By increasing the base rate of interest the BOE hopes to discourage spending and borrowing and further encourage saving.

Bank of England base rates

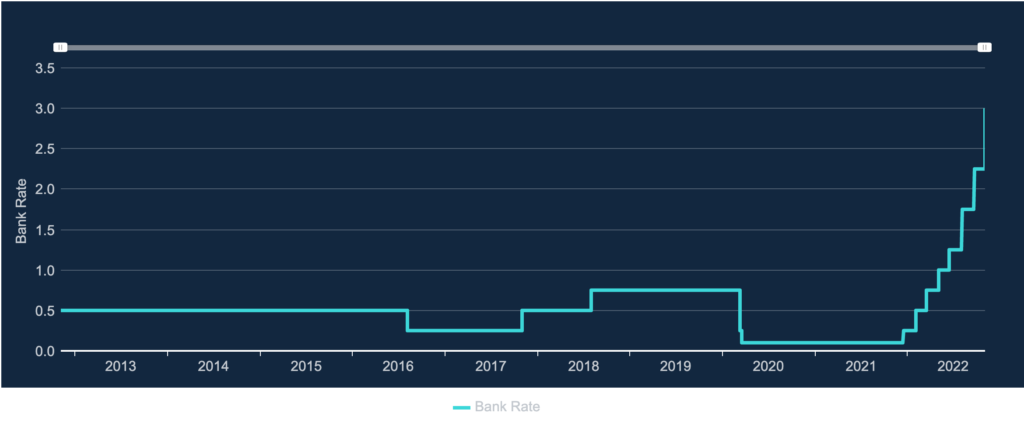

The following graph by the Bank of England shows how the Bank Rate has changed over time.

Source: Bank of England

How does the rise in the Bank of England base rate affect you?

An increase in the Bank of England's base rate affects both borrowers and savers. We share how an increase in interest rates can affect different areas of your finances below.

How does the BOE interest rate rise affect you if you have a mortgage?

If you have a mortgage an increase in the Bank of England's base rate is likely to affect your mortgage repayments. Whether you will be affected right away or later down the line depends on your current mortgage deal. Use our mortgage repayment calculator to calculate the cost of your mortgage repayments if there is a change in your interest rate.

If you are worried about the increase in interest rates you should speak to a mortgage broker who will be able to offer help and advice regarding the options available to you. Habito* is an online independent whole-of-market mortgage broker that does not charge a fee. For more information read our 'Habito review'.

Fixed-rate mortgage customers

If you are on a fixed-rate mortgage deal you will not be impacted by the current interest rate rise until your current deal expires, and by then interest rates may be different to what they are now. However, if you are considering remortgaging or your deal is due to expire soon, read our article 'Remortgaging in 2022 - is now the right time to fix & for how long?'

Variable rate or tracker mortgage customers

If you are on a variable rate or tracker mortgage you will be affected by the increase in the BOE base rate and you are likely to see an increase in your monthly mortgage payments. Exactly when you can expect to see an increase will vary depending on your individual mortgage provider. Use our mortgage repayment calculator to find out how much you can expect your repayments to increase by.

How does the BOE interest rate rise affect you if you have credit cards or loans?

Credit cards

If you have a credit card with a pre-agreed interest-free period or promotional interest rate you will not see an increase in the interest payable on the balance. However, if the promotional period is set to end, or you are a new applicant, it is likely that you will see higher Annual Percentage Rates (APR) on offer. One way to avoid a hike in interest rate payments is by transferring your existing balance to a 0% balance transfer credit card, but remember, in order to benefit from low-interest rates the balance needs to be repaid within the interest-free timeframe and you may be subject to a balance transfer fee. Find out more in our article, 'Best 0% balance transfer credit cards'.

Loans

If you have an existing loan with a fixed interest rate you are unlikely to be affected by the rise in the BOE base rate however if you are looking for a new loan you may notice higher APR deals.

How does the BOE interest rate rise affect you if you have an overdraft?

Your overdraft interest rate may be affected by the rise in the Bank of England's base rate. Banks and building societies usually notify overdraft customers of any interest rate changes in advance so you should be notified of the new rate before it is implemented.

How does the BOE interest rate rise affect you if you have savings?

If you have money in savings accounts it is likely you will be positively impacted by the rise in the Bank of England's base rate, however, this may not be immediate as it can take time for the new rates to be filtered down to consumers. To stay on top of the latest savings rates and make the most of your money, bookmark our article 'Best savings accounts in the UK' and our savings best buy tables.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this in no way influences our editorial integrity. The following link can be used if you do not wish to help Money to the Masses however you will not receive any stated offers - Habito