Arranging a mortgage can be a tricky and stressful task that many homebuyers find challenging, so it is no surprise that many opt to use a mortgage broker to find the best mortgage deals and increase the chances of a successful mortgage application. However, it can be equally tricky trying to find the best mortgage broker for your needs, so in this article, we provide a comprehensive summary of the best mortgage brokers in the UK.

Arranging a mortgage can be a tricky and stressful task that many homebuyers find challenging, so it is no surprise that many opt to use a mortgage broker to find the best mortgage deals and increase the chances of a successful mortgage application. However, it can be equally tricky trying to find the best mortgage broker for your needs, so in this article, we provide a comprehensive summary of the best mortgage brokers in the UK.

Best UK mortgage brokers

For simplicity, we have split our best mortgage broker lists into a number of categories including best fee-free mortgage broker, best online mortgage broker and best mortgage broker for first-time buyers.

If you are searching for the best mortgage deals in the market, you can get started by using our mortgage rate comparison tool which allows you to find mortgage deals based on your specific requirements easily.

Get a FREE mortgage review

Our partner Vouchedfor will help you get the best mortgage rate with a free mortgage review

- From a 5-star rated mortgage adviser

- Typically save £80 per month per £100,000 of your mortgage

- No obligation

Best fee-free mortgage brokers

Fee-free mortgage brokers won’t charge you for the services that they provide, either upfront or once your mortgage has been completed. Some mortgage brokers, on the other hand, will provide an initial consultation free of charge but if you choose to proceed then there may be a charge. So, it is important to check the terms of business when you engage with a mortgage broker for the full costs.

London & Country

London & Country

One of the largest mortgage brokers in the country that accesses over 90 lenders' mortgage deals and is rated 4.6 out of 5.0 stars on independent customer review website Trustpilot. The overall rating is based on over 13,000 reviews and more than 80% of the reviews gave L&C Mortgages 5 stars citing a fuss-free and fast process.

Habito*

Habito*

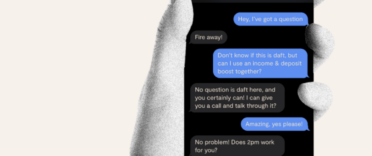

An online mortgage broker that offers a fee-free option that will cover the full mortgage process including application, advice and ongoing customer service. It is rated 4.9 out of 5.0 stars by customers on Trustpilot with over 90% of the reviews awarding it 5 stars. Habito's rating is based on over 8,000 customer reviews that enjoyed the telephone and live chat communications used to arrange mortgages efficiently. You will find more information about this mortgage broker in our full review of Habito.

Better.co.uk

Better.co.uk

This mortgage broker has the benefit of being fee-free and offers an online service that is simple and easy to use. This is reflected in its Trustpilot customer review ranking that deems it 'excellent' and awards it 4.8 stars out of 5.0 based on over 8,000 reviews.

Best online mortgage broker

Online mortgage brokers can make the process of finding a mortgage convenient and stress-free. Rather than having to attend a lengthy appointment in person, an online mortgage broker can provide advice and guidance from the comfort of your own home using online portals and user-friendly online chat services. Many still provide a telephone service that you can use to talk things through if you need to but do check if switching offline will change the cost of the advice you receive.

Habito*

Habito*

One of the first fee-free online mortgage broking services that gives you access to a digital application service, expert mortgage advice, personalised recommendation and tracking until your mortgage offer is received. It also offers a fee-based service that includes the provision of a conveyancing solicitor, building survey report, personal case manager and tracking until you have completed the purchase of your property.

Better.co.uk

Better.co.uk

As an online mortgage broking service, Better.co.uk stands out for its simple and comprehensive online mortgage journey. You can arrange a mortgage in principle, complete an online profile, upload documents to support your application and get the benefits of a case manager who will chase the progress of your application.

Best first-time buyer mortgage broker

First-time buyers usually have high loan-to-value (LTV) ratios as they will often start with a smaller deposit as they do not have the benefit of transferring the equity from their existing home. First-time buyers can usually benefit from speaking to specialist first-time mortgage brokers as they have the expertise to advise on products such as guarantor mortgages, shared ownership and also high LTV mortgages (including 100% LTV). It may even take a combination of mortgage solutions to successfully get your first step onto the property ladder.

Tembo*

Tembo*

Specialising in first-time buyer solutions, Tembo offers bespoke mortgage solutions that can help boost your deposit or your income in order to get the amount of mortgage loan that you need to secure your house. It is one of the few mortgage brokers that provides comprehensive solutions for shared ownership schemes. It charges a fee of £499 for a standard mortgage or remortgage which increases to £749 if you require a complex purchase where you have to boost your income or deposit or you want to transfer equity.

Reviews of Tembo Mortgage on the consumer review website, Trustpilot rate it as 5 out of 5 stars and 'excellent' based on over 750 reviews. You can read more about this specialist mortgage broker in our full review of Tembo.

John Charcol

John Charcol

Known for finding specialist mortgage solutions, John Charcol accesses over 100 lenders in the mortgage market and offers advice where the buyer is being helped by family. It also provides advice on mortgages that utilise home-buying schemes and mortgage products that do not require a deposit, such as Skipton's Track Record Mortgage.

It is rated 4.9 out of 5 stars based on over 800 customer reviews on Trustpilot where over 95% of the reviews awarded it 5 stars.

Best bad credit mortgage broker

Bad or adverse credit can make it difficult to arrange a mortgage as some mortgage deals are simply not available to you unless you have a squeaky-clean credit file. This doesn't mean that there aren't mortgage solutions available to homebuyers who have adverse events such as missed payments on their credit files. However, it does mean that you will need to find a mortgage broker that is willing and equipped to find these deals for you.

Simply Adverse

Simply Adverse

This mortgage broker can help homebuyers who have had debt management plans, CCJ mortgages or IVAs, missed/late payments or defaults and bankruptcy. It is backed up by a 5-star ranking on Trustpilot which is based on over 1,800 independent customer reviews. Reviewers find that Simply Adverse not only provide solutions for difficult scenarios but the communication and support provided is excellent too.

John Charcol

John Charcol

Finding mortgage solutions for complex cases is one of John Charcol's strengths including homebuyers with a history of bad credit. It searches the mortgage market to source mortgage products that may still be available for those with an adverse credit history.

Best buy-to-let mortgage broker

Landlords looking for the best buy-to-let mortgage deals have to work a little harder than residential homebuyers when it comes to finding a good mortgage rate as the lending criteria and mortgage products differ from residential mortgages. There are also other factors to weigh up such as whether you are a portfolio landlord with numerous rental properties.

First Mortgage

First Mortgage

This mortgage broker will give you £500 if you find a better mortgage deal elsewhere and has a customer rating of 5.0 out of 5.0 stars on Trustpilot based on over 23,000 independent customer reviews. Customers largely reflect a great service from knowledgeable advisers who find the best mortgage deals, with less than 1% of reviews detailing a poor experience.

Alexander Hall

Alexander Hall

Offering in-branch, telephone and online mortgage broking services this mortgage broker covers many areas of specialist mortgage advice including bridging loans, commercial loans, portfolio landlord buy-to-lets and limited company buy-to-lets. Trustpilot customer reviews rank it as 'Excellent' with 4.9 out of 5.0 stars based on over 4,900 customers' experiences.

How to find the best mortgage broker

Some people prefer to go on word of mouth and it could be that you know someone who has had a good experience with their mortgage broker - this can be a good way to engage a mortgage broker. However, do bear in mind that your financial circumstances will be different and a different mortgage broker may better serve your needs.

You can choose to use any of the mortgage brokers we mention in this article as we have checked customers' reviews to ensure that they provide a good service. However, you can also source an independent mortgage broker near you if you prefer a face-to-face or telephone consultation. You can find a mortgage broker in your area through the professional directory services provided by VouchedFor*. It costs nothing and you can read a summary of the services that each mortgage broker provides as well as ratings given by recent customers who have used the service before you contact them.

You can also find more information in our article, "How to find a mortgage broker you can trust".

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Habito, Vouchedfor, Tembo