On the 25th March 2019 Apple announced the launch of Apple Card and having waited patiently for four months, CEO Tim Cook has confirmed that the card will arrive in August 2019. Speaking during Apple’s 2019 third fiscal quarter earnings call, Cook said “Thousands of Apple employees are using the Apple Card every day in a beta test and we will begin to roll out the Apple Card in August.”

Apple has joined forces with Goldman Sachs and Apple Card is its first foray into the consumer credit card market. Apple claims that they are 'open to doing things in a whole new way.'

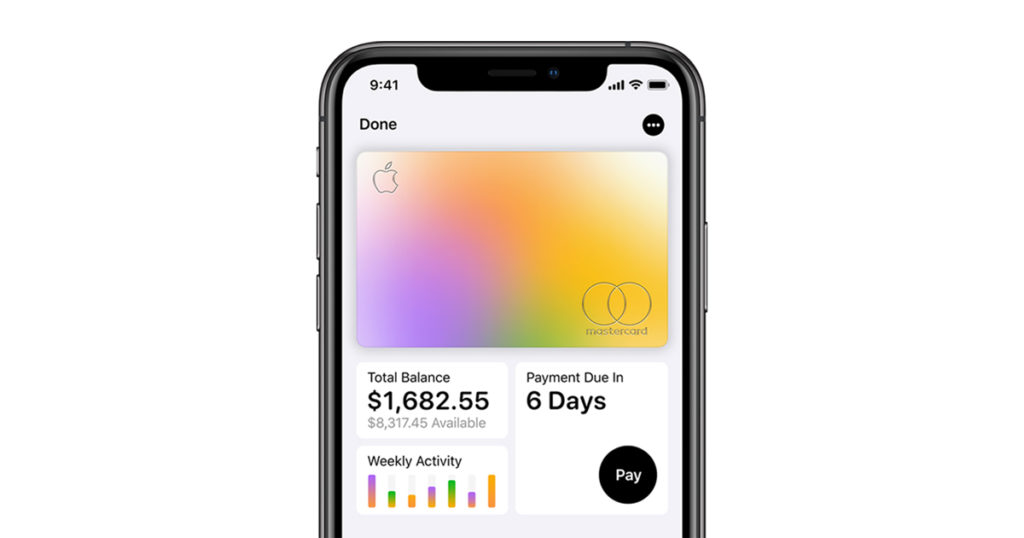

Apple Card is designed to be used with ApplePay alongside the iPhone and is stored within the Wallet app, but it can also be used Worldwide via a simply designed metal card. Apple has linked with Mastercard which will enable users to use the 'titanium, laser-etched, Apple-designed credit card' worldwide.

Apple card features

- 2% cash back on all purchases, 3% on any apple product purchased and 1% on purchases from anywhere that doesn't accept ApplePay

- Analytical spending notifications with transactions categorised by colour

- A map feature allowing you to see where unrecognised transactions were made

- No fees

- Low interest rates

- Make a payment without being charged interest

- Top notch level security - using Face ID/Touch ID technologies and unique transaction codes

- 24/7 Help & Support via text message

- Payment due date reminder notifications

- Freeze feature if the card is lost or stolen

Will Apple Card be launching in the UK?

Currently Apple has only announced a release in the US but it is highly likely it will be an international product; especially with its offer of worldwide spending. It will be interesting to see if Apple will offer the same features in the UK, such as 2% cash back which would be a big draw over the current app only UK banks that already offer a lot of the features Apple has announced.

In the UK Revolut currently offerS 0.1% cash back for purchases inside of Europe and 1% outside of Europe but this is only with their metal card which you have to pay £12.99 a month for. Curve also has an offer on cash back but it is restricted to 1% on transactions for the first three months.

Ultimately the announcement of an Apple Card is an exciting development in the FinTech world and I am curious to see how it progresses. Time will tell if any other tech giants, such as Amazon or Android follow closely behind. If I was a bank I would be worried.