The Bank of England (BoE) base rate remains at 4.75%, with the Monetary Policy Committee voting 6-3 in favour of making no change to the current rate. Six of the committee's nine members voted to keep the rate as it is with three members voting for a cut of 0.25%, which would have seen the base rate drop to 4.50%.

The Bank of England (BoE) base rate remains at 4.75%, with the Monetary Policy Committee voting 6-3 in favour of making no change to the current rate. Six of the committee's nine members voted to keep the rate as it is with three members voting for a cut of 0.25%, which would have seen the base rate drop to 4.50%.

The decision to hold follows the comprehensive choice to cut rates last month. The change of stance is in part down to what the Bank calls "additional uncertainties around the economic outlook" triggered by the 2024 Autumn Budget and "the risk of inflation persistence".

What is the Bank of England base rate?

The base rate determines how much the Bank of England pays commercial banks for holding money with it. This then influences how much those banks charge customers to borrow money or pay customers to hold savings. If the base rate goes down, it usually triggers a drop in the rate that banks and other lenders charge the public to take out loans, mortgages and credit cards, and the rate they pay out on savings.

Why has the Bank of England base rate remained the same?

Changing the base rate is the Bank of England's way of controlling inflation and influencing UK economic growth.

The Bank of England increased the base rate 14 consecutive times between December 2021 and August 2023, in a bid to reduce inflation and bring it back towards its 2% target. The UK inflation rate, as measured by the consumer price index (CPI), hit a peak of 11.1% in October 2022 but now sits at 2.6%, having returned to the Bank of England target rate of 2% in June 2024.

With its target inflation rate met, in August the Bank of England monetary policy committee (MPC) voted to cut the base rate by 0.25% and did so again in November. However, a slight rise in inflation and pay growth accelerating to 5.2% (as of October 2024) has likely influenced the Bank's decision to keep the base rate on hold at its December meeting.

Andrew Bailey, the Bank’s governor, took a cautious view on the state of the economy, but remained open to further cuts next year, saying: "We think a gradual approach to future interest rate cuts remains right, but with the heightened uncertainty in the economy we can’t commit to when or by how much we will cut rates in the coming year".

This follows the US Federal Reserve deciding to cut interest rates on Wednesday by 0.25%, then suggesting it would make fewer rate cuts than expected next year, triggering a sell-off in financial markets.

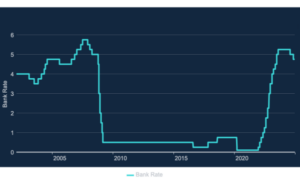

How has the bank rate changed over time?

The graph below shows how the Bank of England base rate has dramatically dipped and soared over time, either side of long periods of stability.

(Source: Bank of England)

Rate rises and how they impact you: December 2021 - December 2024

The table below shows the impact of the base rate rises and cuts, by the Bank of England, since December 2021 on a £100,000 mortgage borrowed over 25 years:

| Date | Interest rate change | Previous interest rate | New interest rate | Change to average monthly mortgage repayments per £100k borrowed* |

| 16th December 2021 | +0.15% | 0.10% | 0.25% | +£8 |

| 2nd February 2022 | +0.25% | 0.25% | 0.50% | +£13 |

| 17th March 2022 | +0.25% | 0.50% | 0.75% | +£13 |

| 5th May 2022 | +0.25% | 0.75% | 1.00% | +£13 |

| 16th June 2022 | +0.25% | 1.00% | 1.25% | +£13 |

| 4th August 2022 | +0.50% | 1.25% | 1.75% | +£26 |

| 22nd September 2022 | +0.50% | 1.75% | 2.25% | +£26 |

| 2nd November 2022 | +0.75% | 2.25% | 3.00% | +£39 |

| 15th December 2022 | +0.50% | 3.00% | 3.50% | +£26 |

| 2nd February 2023 | +0.50% | 3.50% | 4.00% | +£26 |

| 23rd March 2023 | +0.25% | 4.00% | 4.25% | +£13 |

| 11th May 2023 | +0.25% | 4.25% | 4.50% | +£13 |

| 22nd June 2023 | +0.50% | 4.50% | 5.00% | +£26 |

| 3rd August 2023 | +0.25% | 5.00% | 5.25% | +£13 |

| 21st September 2023 | +0.00% | 5.25% | 5.25% | £0 |

| 2nd November 2023 | +0.00% | 5.25% | 5.25% | £0 |

| 13th Decmeber 2023 | +0.00% | 5.25% | 5.25% | £0 |

| 1st February 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 21st March 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 9th May 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 20th June 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 1st August 2024 | -0.25% | 5.25% | 5.00% | -£13 |

| 19th September 2024 | +0.00% | 5.00% | 5.00% | £0 |

| 7th November 2024 | -0.25% | 5.00% | 4.75% | -£13 |

| 19th December 2024 | +0.00% | 4.75% | 4.75% | £0 |

| TOTAL | £242 |

*assumed mortgage term is 25 years

How does the Bank of England interest rate decision affect mortgages?

Fixed-rate mortgage customers

Anyone with a fixed-rate mortgage will not see a change to their rate or monthly repayments until the mortgage deal term ends. If your deal is due to end soon, you should consider how mortgage rates might change in the coming months. Our article 'Will interest rates continue to fall in 2025 & how low will they go?' provides some insight into remortgaging and what to do if you are due to remortgage soon.

It is worth remembering that, if your current fixed-rate deal was in place prior to December 2021 (when rates first started going up), then you should factor in all of the interest rate rises in order to budget for the likely increase in your monthly mortgage repayments after you remortgage. As shown in the table above, this equates to a rise of around £242 per month, per £100,000 borrowed, based on a 25-year mortgage term.

Variable rate or tracker mortgage customers

Those with tracker or variable rate mortgages will be unlikely to see any change to their monthly mortgage payments after the latest Bank of England decision. If you wish to see what a rate cut at the Bank of England's would do to your monthly mortgage payment, you can use our interest rate calculator. You'll need to know your initial mortgage term, the amount borrowed at the start of the deal and your current mortgage rate.

Anyone wanting to know more about how rate rises and cuts impact their finances should speak with an independent mortgage adviser* as they can provide specialist advice. When considering remortgaging, always check to see if there are any Early Repayment Charges (ERC) and check to see how long is left on your current mortgage deal. Take a look at the best mortgage deals by using our mortgage rate comparison tool or checking out our article 'Best mortgage rates in the UK'.

Help if you're unable to afford your mortgage payments

Many mortgage holders continue to be faced with increasing mortgage costs due to the rise in mortgage interest rates since 2021. If you are worried about how you will afford your mortgage, then you should get in touch with your lender as soon as possible. Your lender should be able to find a solution that can help ensure no repayments are missed.

Potential solutions can include extending the length of your mortgage, converting part or all of your repayment mortgage to an interest-only mortgage or allowing you to take a mortgage payment holiday.

Check out our article 7 tips for dealing with mortgage arrears, or alternatively, you may find additional support from the following organisations helpful:

How does the Bank of England base rate decision affect you if you have credit cards, loans or overdrafts?

Credit cards

If you have an existing credit card with an agreed interest-free period or promotional interest rate you shouldn't notice any impact from Bank of England base rate announcements.

Keep in mind that 0% credit cards are the best way to avoid any base rate fluctuations, by not paying interest at all. For example, by moving your existing credit card balance to a 0% balance transfer credit card, you ensure you pay no interest on your repayments if the balance is repaid within the promotional interest-free period. Be aware that most (not all) balance transfer credit cards charge a balance transfer fee, usually somewhere between 2% and 5%. Find out more in our article, 'Best 0% balance transfer credit cards'.

Loans

If you already have a loan with a fixed interest rate then you are unlikely to be affected whether the base rate is changed or not. If you are looking for a new loan then you can compare the best loan deals in our article, 'Best personal loans'.

Overdrafts

The interest rate charged on your overdraft is unlikely to be affected by the Bank of England's decision to keep the base rate at 4.75%. If your bank or building society is going to change the rate of interest charged, you should receive a notification in advance, giving you time to consider your options.

How does the Bank of England base rate decision affect you if you have savings?

Although interest rates on savings accounts may have fallen after the last Bank of England base rate cut in November, your bank may have not passed this onto you yet and you may still see falling interest rates on savings over the coming weeks and months.

This means that it is possible that we may have already hit the peak of high interest rates on savings accounts, so now might be a good time to secure the best rate on your savings. Our article, 'How to get more than 5% interest on your savings' summarises some of the best rates on the market and our regularly updated article, 'Best savings accounts in the UK' provides a summary of the best savings rates for personal and business accounts.

Looking for the best savings rates should always involve shopping around for the best deal. You can check out the best savings rates using our Savings Best Buy tables. Right now you can get as much as 8.00% interest on a Regular Saver account.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - VouchedFor