Monzo, one of the UK's largest digital banks has announced the launch of 'Monzo Pension', a pension tool designed to help customers combine their old workplace and personal pensions into one pot. Additionally, the Monzo Pension tool can be used to help locate old pensions that may have been lost or forgotten. In this article, we explain how the Monzo pension tool works, how much it costs and how it compares to similar products on the market.

Monzo, one of the UK's largest digital banks has announced the launch of 'Monzo Pension', a pension tool designed to help customers combine their old workplace and personal pensions into one pot. Additionally, the Monzo Pension tool can be used to help locate old pensions that may have been lost or forgotten. In this article, we explain how the Monzo pension tool works, how much it costs and how it compares to similar products on the market.

What is Monzo Pension?

Monzo Pension is a tool within the Monzo banking app that will allow you to find and combine most workplace and personal pensions using just a few personal details. Customers can 'register for updates' from the 24th July 2024 with the tool being fully rolled out to customers in the coming weeks and months.

Dani Shipp, content marketer for Monzo Pension said: "When we spoke to customers, having enough money to retire comfortably was one of their top goals, but less than half (41%) were confident that they were on track to hit that goal. And although most of them wanted to take action with their pension, they were overwhelmed by either the admin involved, or the enormity of the decision. To solve these problems, we wanted to give customers an achievable next step they could take with their pension"

How does Monzo Pension work?

To access Monzo Pension, you first need to be a Monzo customer. You can apply for a Monzo account by downloading the Monzo app on your smartphone. You'll need to be 18-70 years old and a UK resident. If you are already a Monzo customer you'll need to register your interest and once done, Monzo will update you on the product launch date and exactly how to get started. Once you've received confirmation that the product is live, you can start the process of finding and combining your old pensions. We explain the steps in more detail below.

Step 1 - Provide Monzo with some basic information

The first step is to provide Monzo with some basic information. To get started, you'll need to provide details of where you have worked and the dates you were there. The more details you can provide the quicker the service will be.

Step 2 - Submit your details and wait

Monzo has partnered with Raindrop, which it describes as a 'pension-finding specialist' in order to carry out the detective work, contacting your old employers and providers, helping to uncover your lost pension pots.

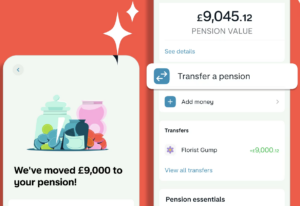

Step 3 - See all of your pensions in one 'combined' pot

Once Monzo has found and combined all of your pensions you'll be able to view them in one combined 'Monzo Pension' pot. The Monzo Pension is a self invested personal pension (SIPP) which invests in the LifePath target date fund range managed by BlackRock. It is not yet clear whether customers will be able to set up additional pension contributions, however, we will update this article as and when more information is provided.

Can I choose my own investments with Monzo Pension?

No. Monzo Pension invests in BlackRock's LifePath target date funds, funds designed to shift from higher-risk investments to lower-risk investments as you get closer to retirement.

How much does Monzo Pension cost?

Monzo's pension fees are straightforward. There are no fees for using the 'find and combine' service and no fees for transferring your pension to Monzo. Once your pension pots are combined, it charges a flat platform fee of 0.45%, plus a fund fee of 0.18%. Monzo Plus, Premium, Perks and Max customers will pay a reduced platform fee of 0.35%. Fees accrue daily and are charged monthly. We summarise the fees in the table below:

| Monzo Pension Fees | Monzo Pension Fees for Monzo Plus customers | Monzo Pension Fees for Monzo Premium customers | Monzo Pension Fees for Monzo Perks customers | Monzo Pension Fees for Monzo Max customers | |

| Platform fee | 0.45% | 0.35% | 0.35% | 0.35% | 0.35% |

| Fund fee | 0.18% | 0.18% | 0.18% | 0.18% | 0.18% |

| Total fee | 0.63% | 0.53% | 0.53% | 0.53% | 0.53% |

What are the alternatives?

Monzo is not the only digital bank that provides a 'find and combine' pension tool. Starling customers can access these services via the Marketplace feature in the app, where they can choose pension consolidation services through PensionBee or Penfold. We provide detailed reviews of both services, simply click on the links for more information.

While the fees for Monzo Pension are straightforward, there are cheaper alternatives, particularly for those with larger pension pots. Many SIPP providers offer tiered fees, meaning you pay less as your pot grows. Some providers, such as Interactive Investor and Freetrade, charge a flat subscription fee which can work out far cheaper, again, depending on the size of your pot. Another consideration is investment choice; Monzo Pension invests in just one pension fund. If you prefer to have a little more control over where your money is invested, you may want to look at alternative SIPP providers. Check out our article where we provide a comparison table of the Best pension providers in the UK.