Episode 401 - In this week's episode I discuss how to use a fund's Active share and tracking error to find fund managers that are investing with conviction. I also react to the Chancellor's inflation video released on social media this week before Andy discusses how to find the best money saving deals easily.

Join the MTTM Community group, a friendly community that allows like-minded listeners to ask questions and chat.

You can also listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Summary - Episode 401

Finding truly actively managed funds

Past performance of funds can be analysed over different time periods to give insight int how a fund is managed and the biases in the manager's portfolio However it may not give a complete picture.

Alternatively Active Share can be useful in finding funds that are backing their convictions. Active Share measures the disparity between a fund's holdings and its benchmark index. A higher active share means a more actively managed fund. However, calculating Active Share can be difficult as it's not widely available and not all funds publicise their holdings.

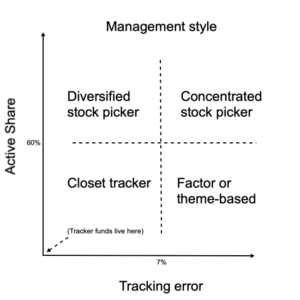

Finally tracking error, which is a measure of the deviation of a fund's performance from its benchmark, can also provide insight into a fund manager's management style, especially when combined with the Active Share measurement as summarised in the chart below.

Inflation truths

Highlights:

- Inflation is a measure of the rate of change of prices over time, not how high prices are

- The Consumer Price Index (CPI) is calculated by the Office of National Statistics (ONS) from a notional a basket of goods and services. The price of these items is used to calculate the percentage increase in prices over time. Currently the annual inflation rate is over 10%

- Inflation can appear to decrease without prices actually falling, due to the mathematical calculation of comparing prices to a previous period.

- High inflation can be controlled through monetary policy, such as raising interest rates

- Merely reducing the rate of inflation does not guarantee lower prices, it can be a result of mathematics.

- Government taxation and policy decisions (such as the energy price guarantee) can impact inflation, both positively and negatively