Aviva has around 22,000 staff and provides insurance and financial products to approximately 33 million customers worldwide, making it the UK's largest insurance company. It can be traced as far back as 1696 with the name we know today being adopted in 2002 following a successful merger of Norwich Union and CGU plc. Aviva offers a number of insurance products including car, home, life and health insurance, as well as other investment products including a Stocks and Shares ISA and pension.

1 minute summary - Aviva health insurance review

- Cancer cover included as standard

- Optional benefits include dental and optical cover, mental health treatment and access to an extended hospital list

- Easily add a partner or children to the policy

- Multiple excess options – can be as little as £100 or as much as £5,000

- Get an instant online quote* and receive £100 cashback when you take out any private healthcare policy – offer ends 31st January 2025 (See how Aviva compares to the likes of Axa Health, Bupa and Vitality).

What is Aviva health insurance?

Aviva health insurance is an insurance policy that pays for your private healthcare costs if you require treatment for an injury or condition. Depending on the level of cover you choose, it can provide cover for diagnostic tests including scans and x-rays, inpatient and day patient treatment, ongoing care including physiotherapy and even access to specialist drugs that may not be available on the NHS.

Aviva health insurance key benefits

- Access to hundreds of hospitals including Circle Health, Nuffield, Spire, Ramsay and NHS private units

- Optional benefits include dental and optical cover, mental health treatment and access to an extended hospital list

- Option to reduce the list of hospitals to bring down the cost of cover

- Option to reduce outpatient cover to bring down the cost of cover

- Multiple excess options

- Savings on fitness products and gym services at over 3,000 locations nationwide

- Savings when combining cover with family members

- 24-hour stress counselling helpline

What is included when you buy Aviva health insurance?

Health care cover for all acute conditions where no treatment or advice has been sought in the last two years

Cancer care cover

Diagnostics including x-rays and scans

Specialist treatment and aftercare

Outpatient care including consultations and treatment

Aviva's total well-being service including 24-hour counselling and Virtual GP

What is not included when you buy Aviva health insurance?

Pre-existing health conditions that you have sought medication, treatment, diagnostic tests or advice in the last two years

Pregnancy and childbirth-related conditions or complications

Chronic conditions such as epilepsy, diabetes and asthma

How does Aviva health insurance work?

Aviva offers two main types of private health insurance; ‘limited' cover and ‘full' cover and we explain each type in more detail below. Aviva also offers a ‘diagnostics' policy that covers the costs of tests to find out what’s wrong, however, this type of policy isn't strictly a private medical insurance policy as it only helps you to avoid waiting lists and doesn’t pay for any treatment.

Aviva ‘limited' health insurance cover

Aviva's ‘limited' health insurance policy provides core cover for acute conditions, hospital charges and specialist fees as well as cancer cover. It also provides a limited number of outpatient benefits including CT, MRI and PET scans, pre-admission tests prior to surgery and cancer treatment including radiotherapy and chemotherapy. It doesn't cover additional outpatient benefits such as diagnostic tests and physiotherapy. Aviva's ‘limited' health insurance policy is the cheapest type of health insurance policy it offers and is good for those on a tighter budget and who are only concerned with getting treatment for major conditions.

Aviva ‘full' health insurance cover

Aviva's ‘full' health insurance policy is a comprehensive policy that provides both core cover and the full list of outpatient benefits including specialist consultations, diagnostic tests and additional physiotherapy. Aviva's ‘full' health insurance policy is more expensive than its ‘limited' policy and is good for those who wish to be seen quickly and receive continuity of care.

Aviva ‘limited' vs ‘full' health insurance comparison

Below we compare the two main types of Aviva health insurance policy.

| Benefits | Aviva ‘limited' health insurance | Aviva ‘full' health insurance |

| Acute conditions | ||

| Hospital fees including specialists fees | ||

| Cancer care cover | ||

| Scans (MRI, CT & PET) | ||

| Pre-admission tests prior to surgery | ||

| Surgical procedures by a specialist | ||

| Chemotherapy & Radiotherapy | ||

| Diagnostic tests | ||

| Specialist consultations | ||

| Non-surgical treatment as an outpatient | ||

| Physiotherapy | ||

| Treatment by a chiropractor | ||

| Treatment by an osteopath |

Aviva diagnostic insurance

Aviva offers a ‘speedy diagnostics' insurance policy that will cover the cost of tests and can help to avoid NHS waiting lists. This type of policy is not to be confused with a health insurance policy as it only covers the referral and initial tests. Once you have received a diagnosis and test results you will be expected to cover the cost of any treatment yourself or you could, of course, opt to be treated by the NHS.

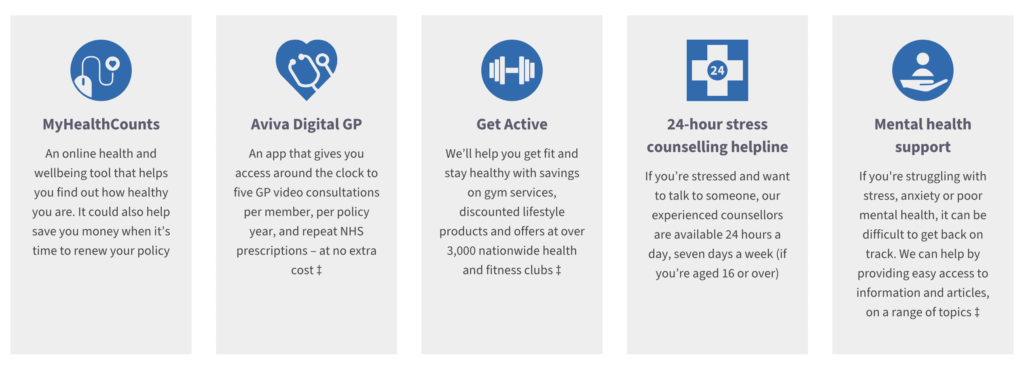

Aviva total well-being services

Aviva Health insurance includes a number of well-being services that can help customers stay fit and healthy, both mentally and physically. Services include access to the Aviva digital GP, discounts on health products and gym services as well as access to a stress counselling helpline and mental support services.

Aviva health insurance policy optional benefits explained

There are a number of optional benefits that can be added to your Aviva Health insurance policy, each at an additional cost. We explain each of the benefits below.

Dental and optical cover

Dental and optical cover provides cover for routine dental treatment as well as optical expenses. There is a £50 excess meaning if you claim for any of the benefits listed below you will pay the first £50 yourself.

- £150 towards the cost of optical treatment (£50 excess applies)

- £250 towards the cost of routine dental treatment (£50 excess applies)

- £600 towards the cost of accidental dental injury (£50 excess applies)

Mental health treatment

Mental health treatment cover boosts cover by adding day patient and inpatient mental health care to your core outpatient cover for acute psychiatric conditions. The mental health treatment add-on provides up to 28 days of combined in-patient and day-patient care.

Extended hospital list

Extended hospital list: increase the number of hospitals you can use, mostly in the Greater London area. This is instead of Expert Select, the core route to treatment or the standard Key hospital list

Other treatments and therapies

You can choose to add ‘other treatment and therapies' to your policy which gives you access to GP-referred treatment from specialists including physiotherapists, osteopaths, chiropractors and acupuncturists. This cover is especially useful if you have a sports injury or if you need treatment for recovery from whiplash after an accident. You can claim for up to a total of 10 sessions per condition, every policy year. Minor GP surgery is also covered under the policy, up to £100 per procedure.

Get the best value health insurance

Our partner Howden Life & Health will help tailor cover for you and your family.

- Compare all the top UK providers

- Up to £100 cashback for new customers

- Free Will available

- Quick free quotations

No claim discount protection

Aviva automatically applies a no-claim discount at renewal for every year that you don't make a claim, however, making a claim can significantly impact this discount making the cover much more expensive at the next renewal. Purchasing an additional no-claim discount protection policy will protect your no-claims discount meaning you won't lose it at renewal if you have made a claim.

Adding a partner and/or children

Aviva guarantees that you'll pay less if you add your partner to your policy, rather than taking out two individual policies. The discount will depend on individual circumstances. You can also add two or more children aged 19 or under and you'll only pay for the eldest child until they turn 20.

How much does Aviva health insurance cost?

The cost of Aviva health insurance will depend on a number of factors, including your age, where you live, the excess you choose, the type of cover you choose and any additional benefits you may wish to add to your policy. To give you a rough idea of the costs we have provided a table below that lists the monthly premiums for both types of Aviva health insurance, including the cost of adding a number of optional extras. The quotes are based on a 30-year-old male living in England and with a £200 excess selected.

| Cover Type | Limited cover | Full cover |

| Core Cover | £18.31 | £31.38 |

| Other treatment & therapies | +£1.38 | +£2.35 |

| Mental health treatment | +£0.49 | +£0.84 |

| Dental & optical benefit | +£4.58 | +£4.56 |

| Protected no claim discount | +£2.00 | +£3.46 |

| Total | £26.76 | £42.59 |

Prices correct as of March 2023

Ways to bring down the cost of Aviva health insurance

Aviva allows customers to tailor their policy to their individual needs and there are 5 different ways in which customers can bring down the cost of their cover, including:

- Reduced out-patient options – customers can select reduced out-patient cover

- 6-week option – when selected, customers will be expected to use the NHS if it can deliver the healthcare required within 6 weeks of the referral

- Choosing a higher excess – customers can choose a higher level of excess to help bring down the cost of the cover. Customers can choose an excess of £100, £200, £500, £1,000, £3,000 or £5,000

- Healthy discount option – by answering three questions about your smoker status, diabetes and body mass index (BMI), you can get up to a 15% discount on your first year premium

- Choosing the ‘signature' hospital list – customers can reduce their costs by choosing a list with fewer hospitals. It is a good option for customers that live in Scotland or Northern Ireland as the signature list automatically excludes all hospitals in England and Wales.

- Choosing the ‘trust' hospital list – Selecting the trust hospital list gives customers access to the private patient units of NHS Trust and partnership hospitals, reducing the overall cost of the cover.

Aviva health insurance customer reviews

Aviva is rated 4.0 out of 5.0 from over 30,000 reviews on independent review site Trustpilot, giving it an overall rating of ‘Great'.

Aviva's ‘Healthier solutions' health insurance policy receives the highest possible rating of 5 stars from the independent financial product rating service Defaqto.

Aviva health insurance pros and cons

Pros

- Cancer cover included as standard

- Virtual/Digital GP service

- Option to cover your whole family

Cons

- No overseas treatment option

Aviva health insurance vs Bupa health insurance vs Axa health insurance

The health insurance policies provided by Aviva, Axa and Bupa are very similar in terms of the benefits they offer and so the decision is likely to come down to cost for most people. It is worth remembering to check the hospital lists for each provider as the decision could come down to the provider that can offer a hospital closest to you. Customer service is also an important consideration for some and so make sure you do your research. Comparing health insurance companies is tricky and so make sure you read the following section on the best way to apply for Aviva health insurance.

What is the best way to apply for Aviva health insurance?

Applying for Aviva health insurance is relatively straightforward and you can apply via Aviva's online system in around 10 minutes. However, we would always recommend speaking to an independent health insurance expert before applying for cover, as they can check that the policy is best for your needs as well as check to see if there is a better or cheaper policy available. Often you will find that your medical history is covered by one insurer but not another and a health insurance expert can navigate you to the insurers that will offer a fair level of cover.

A specialist health insurance adviser* can talk you through all of the available options while comparing every health insurance policy on the market as well as tailoring a policy to your specific budget. There is no obligation to take things further, but customers who take out a policy through the health insurance adviser* we have vetted will qualify for £100 cashback – Offer ends 31st January 2025.

Summary

Aviva health insurance is a 5-star Defaqto-rated product, ranking it among the top health insurance products in the UK. Other top-rated health insurance providers include Axa, Bupa and Vitality. Aviva offers a number of optional benefits ensuring that the core cover is affordable and any extra requirements can be met by paying an additional amount, increasing the standard monthly premium.

Aviva also offers a number of ways to cut down the cost of monthly premiums including a reduced hospital choices list and a 6-week option where customers will be seen by the NHS if treatment is available within 6 weeks of the initial referral. Aviva has attracted some criticism with regards to its claims handling process, however, many of the rejected claims were as a result of the customer not realising the type of cover they had, so make sure you know exactly what policy you have before purchasing cover. Speak to an independent health insurance expert* if you are ever unsure as they will be able to offer free advice on the best health insurance policy for your circumstances.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses – Howden Life & Helath