Grow it

Grow it - Week1

Day 1 - Is investing right for you?

| Task: | 1 - Watch the 'Is investing right for me? video below

2 - The world of investing is full of jargon. To help make sense of it all we have put together our free Money to the Masses - A-Z Jargon Buster Guide. |

| Key Takeaway: | Investing isn't for everyone and there are some people for whom investing is not a good idea, which I explain in the video below.

But assuming that you are in a position to begin investing (and assuming you have completed the Own it and Fix it phases already) then it's important to understand why you might consider investing. A key investing principle to understand is the power of compounding. Listen to the podcast clip below to learn more. |

| Time Required: | 9 mins |

| Click to listen: | The Power of Compounding |

| Click to watch: | |

| Resources | Money to the Masses - A-Z Jargon Buster Guide |

Day 2 - Understanding investment risk & volatility

| Task: | 1 - For those new to investing read our article "The difference between risk and volatility".

2 - For those who are already investing then listen to the podcast episodes below on dealing with and using stock market volatility. 3 - Assess your own attitude to risk by either: a) using myrisktolerance.com which is a paid-for service (costing £30) or b) you can register with an online investment manager such as Wealthify* and use their risk profile questionnaire for free. They will provide you with a portfolio recommendation but there is no obligation to invest. |

| Key Takeaway: | A common mistake amongst new investors is the incorrect assumption that risk and volatility are the same which is not true. It is important that investors understand these terms and the differences between them and that volatility is not necessarily a bad thing.

It is also vital that anyone wishing to invest understands the risk involved and their attitude to it. Determining your own attitude to risk will dictate the kind of assets you invest in. |

| Time Required: | 24 mins |

| Click to play: | For more advanced investors:

How To Deal With Stock Market Volatility: Using volatility as a warning sign: |

| Click to watch: | Why diversification is important when investing |

Day 3 - Setting goals & deciding investing timeframes

| Task: | 1 - Read our article "How to set investment goals and timeframes"

2 - Listen to the podcast clip below on how to achieve financial goals |

| Key Takeaway: | Setting financial goals is an important early step when investing. These goals should cover a range of time horizons from short-term (1 to 3 years), medium-term (3 to 10 years) to long-term (10+ years) and should be realistic and achievable. |

| Time Required: | 20 mins |

| Click to play: | How to achieve financial goals |

Day 4 - Investing in different types of assets

| Task: | 1 - Read our article "What is an asset class and what are the different types?"

2 - Watch the video below on "Building an investment portfolio: choosing different assets" |

| Key Takeaway: | It is important to understand not only what an asset is, but also the different types of assets available. Asset classes behave differently depending on market conditions and it is prudent to diversify your portfolio by investing in a number of different asset types. |

| Time Required: | 15 mins |

| Click to play: | Building an investment portfolio: choosing different assets |

| Additional Reading: | The complete buy to let guide |

Day 5 - Cash as a destination - Improving cash returns

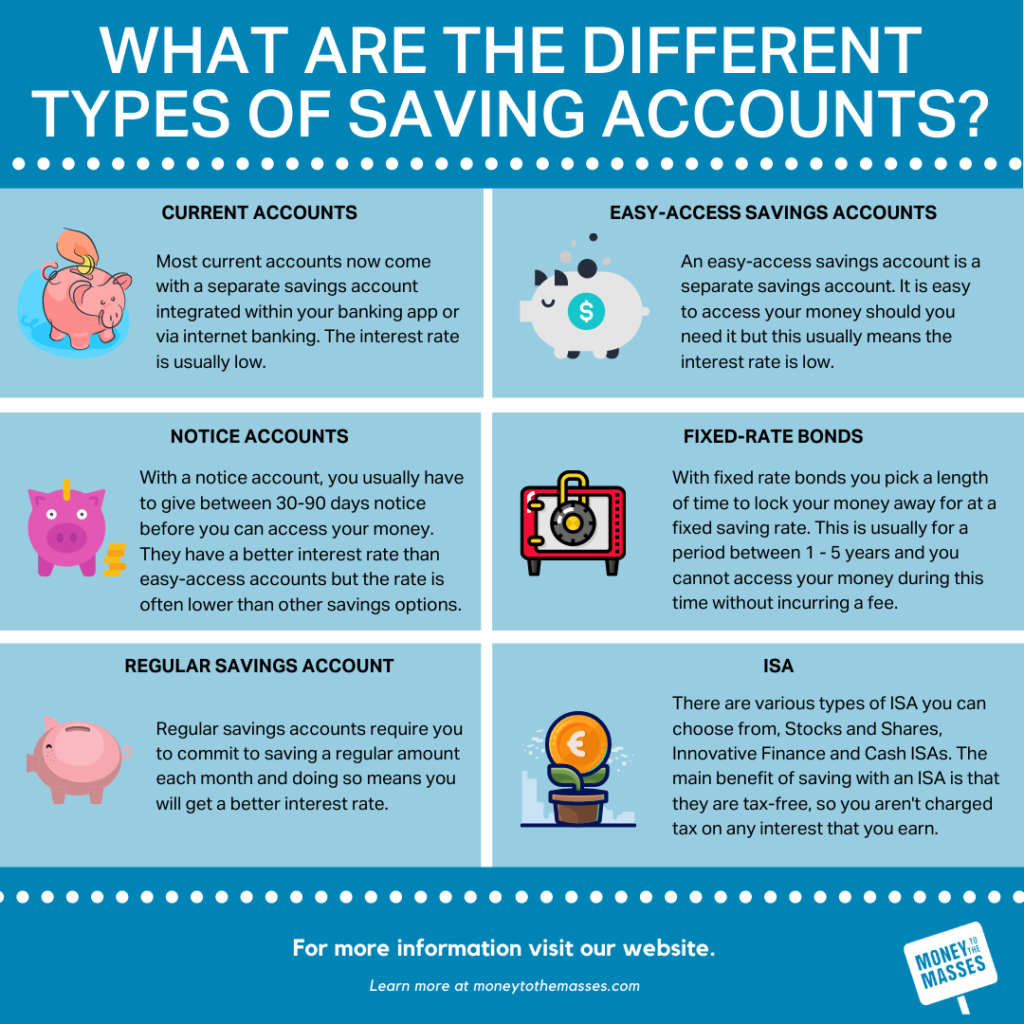

| Task: | 1 - If investing is not for you, or if it is and you have large cash holdings, you may prefer the safety of cash. Take a look at our best-buy savings accounts tables covering the whole market.

2 - Listen to the podcasts below to learn about how to build a cash ladder and find out what a cash savings platform is and how to use them 3 - Read the articles in the additional reading section to understand:

|

| Time Required: | 20 mins |

| Click to play: | Savings platforms explained

Building a cash ladder |

| Infographic | What are the different types of savings accounts |

| Additional Reading: | What is the FSCS? |

Day 6 - Tax basics

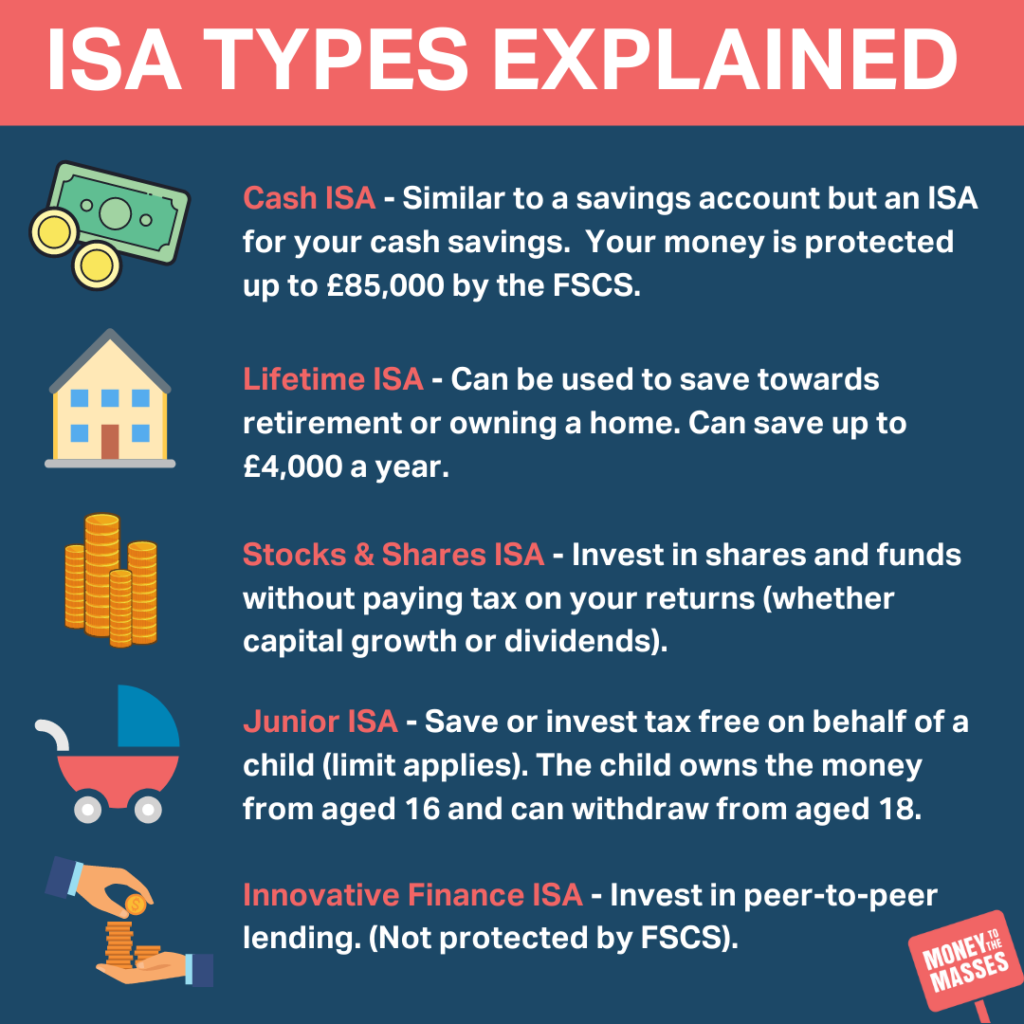

| Task: | Your investments are liable to income tax and capital gains tax. However you can mitigate this by placing them within tax wrappers such as ISAs and pensions

Watch the two videos below to understand the tax benefits of ISAs and pensions We will cover pensions vs ISAs in the coming days |

| Time Required: | 10 mins |

| Click to play: | Tax benefits of ISAs

Tax benefits of Pensions |

| Infographic | ISA Types Explained

(click image to enlarge) |

| Additional Reading: | Where should you invest your ISA allowance?

Lifetime ISAs explained - are they the best way to save? What is the difference between a Cash ISA and a savings account? |

Day 7 - Rest day - Understanding how investment markets work

| Task: | Use today to finish off any Week 1 tasks that you have not had a chance to complete. Why not also subscribe to our midweek markets podcast published every Wednesday where Damien Fahy discusses what is happening in investment markets and what to look out for in the coming days. The podcast is very popular with DIY investors seeking contemporary analysis to help them understand how investment markets work. |

Now that you have completed Week 1 of GROW IT, make sure to continue with Week 2.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Wealthify

I live in Ireland which is in the Eurozone. How do I buy and sell shares? Is there a way of using your investment portfolio using Euro in Ireland?

Hi Martin,

You will need to find a broker/platform in Irelan that allows you to buy shares. But yes it is possible.

Damien