What is BlockFi?

BlockFi is a cryptocurrency exchange platform boasting over 1 million customers and $10bn+ in assets around the world. It allows users to buy, sell and trade different crypto assets through three products available to retail investors in the UK: a standard Trading Account, an Interest Account, and Crypto-Backed Loans. BlockFi states its aim is “to bridge the worlds of traditional finance and blockchain technology to bring financial empowerment to clients on a global scale”. It offers a range of services which blend the evolving cryptocurrency industry with typical financial products, such as trading accounts, loans, and interest-building accounts.

What does BlockFi do?

BlockFi main features

- Available on browser, iOS and Android

- 12 different crypto assets to choose from

- No transaction fees

- Crypto trading account

- Interest-building account

- Crypto-backed loans

BlockFi pros and cons

| Pros | Cons |

BlockFi Trading Account

A BlockFi Trading Account allows you to buy, sell and trade crypto assets all in one place. Customers can purchase crypto instantaneously directly from their bank account via ACH, starting from as little as $20 (around £15), and set up a number of trading features such as repeat buying or buying in instalments.

Trading Account Fees

BlockFi does not charge any commission fees and only charges for withdrawals. This sets it apart from many of its competitors, such as Coinbase, which typically charge relatively high fees on transactions.

However, note that BlockFi’s stablecoin withdrawal fees can take up a significant proportion of your trade - particularly if you are only dealing in small amounts - as there is a standardised charge. For example, withdrawing any amount of USD Coin would cost you 50 USD, which could eat up large chunks of a smaller investment.

If you are planning to make a long-term investment or minimal withdrawals, then BlockFi is a fantastic option as you will incur very little - if any - charges. However, anyone looking to make frequent stablecoin withdrawals may find the charges too costly. Below is a table which outlines BlockFi’s fee schedule, including the charges and weekly withdrawal limits for different crypto assets.

| Currency | Withdrawal Limit Per 7-Day Period | Fees |

| Stablecoins | 1,000,000 | 50 USD |

| BTC | 100 BTC | 0.00075 BTC |

| LTC | 10,000 LTC | 0.001 LTC |

| ETH | 5,000 ETH | 0.015 ETH |

| LINK | 65,000 LINK | 2 LINK |

| PAXG | 500 PAXG | 0.035 PAXG |

| UNI | 5,500 UNI | 2.5 UNI |

| BAT | 2,000,000 BAT | 60 BAT |

*BTC withdrawals are subject to a maximum withdrawal amount of 100 per rolling 7-day period. ETH withdrawals are subject to a maximum withdrawal amount of 5K per rolling 7-day period. Stablecoin withdrawals are subject to a maximum withdrawal amount of 1M per rolling 7-day period.

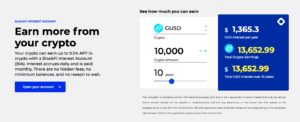

BlockFi Interest Account

A BlockFi Interest Account allows users to build interest on their crypto assets. Customers store their crypto in an account that pays monthly compound interest, which begins accruing the day after you open your account, with payments going out by the last business day of each month. There are no withdrawal restrictions.

Interest Account Rates

BlockFi Interest Accounts are able to generate interest, but the rates differ depending on the choice and amount of crypto asset involved. Below is a table which outlines the tiered structure in which interest is applied.

| Crypto Asset | Amount | Annual Percentage Yield

(APY)* |

| BTC (Tier 1) | 0 - 0.10 BTC | 4.50% |

| BTC (Tier 2) | 0.10 - 0.35 BTC | 1.00% |

| BTC (Tier 3) | > 0.35 BTC | 0.10% |

| ETH (Tier 1) | 0 - 1.5 ETH | 5% |

| ETH (Tier 2) | 1.5 - 50 ETH | 1.50% |

| ETH (Tier 3) | > 50 ETH | 0.25% |

| LTC (Tier 1) | 0 - 20 LTC | 4.75% |

| LTC (Tier 2) | > 20 - 100 LTC | 1% |

| LTC (Tier 3) | > 100 LTC | 0.10% |

| LINK (Tier 1) | 0 - 100 LINK | 3.50% |

| LINK (Tier 2) | 100 - 500 LINK | 0.50% |

| LINK (Tier 3) | > 500 LINK | 0.10% |

| USDC (Tier 1) | 0 - 40,000 USDC | 9% |

| USDC (Tier 2) | > 40,000 USDC | 8% |

| GUSD (Tier 1) | 0 - 40,000 GUSD | 9% |

| GUSD (Tier 2) | > 40,000 GUSD | 8% |

| PAX (Tier 1) | 0 - 40,000 PAX | 9% |

| PAX (Tier 2) | > 40,000 PAX | 8% |

| PAXG (Tier 1) | 0 - 1.5 PAXG | 3.25% |

| PAXG (Tier 2) | 1.5 - 5 PAXG | 0.20% |

| PAXG (Tier 3) | > 5 PAXG | 0.10% |

| USDT (Tier 1) | 0 - 40,000 USDT | 9.50% |

| USDT (Tier 2) | > 40,000 USDT | 8.50% |

| BUSD (Tier 1) | 0 - 40,000 BUSD | 9% |

| BUSD (Tier 2) | > 40,000 BUSD | 8% |

| DAI (Tier 1) | 0 - 40,000 DAI | 9% |

| DAI (Tier 2) | > 40,000 DAI | 8% |

| UNI (Tier 1) | 0 - 100 | 3.25% |

| UNI (Tier 2) | 100 - 500 UNI | 0.20% |

| UNI (Tier 3) | > 500 UNI | 0.10% |

| BAT (Tier 1) | 0 - 4,000 BAT | 3.25% |

| BAT (Tier 2) | 4,000 - 20,000 BAT | 0.20% |

| BAT (Tier 3) | > 20,000 BAT | 0.10% |

*BlockFi states that APYs “reflect effective yield based on monthly compounding. Actual yield will vary based on account activity and compliance with BlockFi’s terms and conditions. Rates are largely dictated by market conditions”.

Crypto-Backed Loans

Crypto-Backed Loans enable users to borrow cash and use their crypto assets for collateral. Users can borrow up to 50% of the value of their existing holdings, starting from a minimum of $10,000 (around £7,554), with funds transferred into customer accounts within just one working day.

Crypto-Backed Loan Rates

The rates on Crypto-Backed Loans from BlockFi differ depending on the amount of collateral posted against the loan and which loan-to-value (LTV) ratio is secured. The LTV is determined by the total amount of the loan divided by the value of the collateral for that loan. The Origination Fee is the upfront fee charged by BlockFi for processing the loan.

| LTV | Interest Rate | Origination Fee |

| 50% | 9.75% | 2% |

| 35% | 7.90% | 2% |

| 20% | 4.50% | 2% |

*Note that the table above applies only to customers in the US, and that different terms may apply to UK investors. Additionally, 20% LTV is only eligible for BTC-backed loans of up to $20k.

Which cryptocurrencies can you trade on BlockFi?

Compared to alternative cryptocurrency exchange platforms on the market, BlockFi offers a limited range of supported cryptocurrencies - only 7, in fact, which pales in comparison to the dozens offered by Coinbase, Bittrex Global and others.

The cryptocurrencies which you can trade on BlockFi are:

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Chainlink (LINK)

- Pax Gold (PAXG)

- Uniswap (UNI)

- Basic Attention Token (BAT)

BlockFi also enables customers to trade stablecoins, including:

- USD Coin (USDC)

- Tether (USDT)

- Gemini Dollar (GUSD)

- Pax Dollar (USDP)

- Binance USD (BUSD)

BlockFi security

BlockFi employs a range of security measures to protect users’ funds, including the use of Two-Factor Authentication (2FA), keeping reserves with third-party providers (such as Gemini, its main custodian), buying only investments regulated by the US government, and backing loans by up to 50% collateral. In addition, BlockFi has never reported a security breach, and even lets you enable a setting called ‘allowlisting’. This is a security feature that allows you to ban withdrawals or restrict them to specific addresses, helping to protect against theft.

Additionally, cryptocurrency trading is not regulated by the Financial Conduct Authority (FCA) and so users are not protected under the Financial Services Compensation Scheme (FSCS) should their assets become compromised, so anyone using an exchange platform to trade or store cryptocurrency should take care to protect their public and private keys to prevent their cryptocurrency being lost or stolen.

BlockFi customer reviews

BlockFi has a rating of 3.6 out of 5 stars from nearly 250 reviews on Trustpilot. Many of the negative reviews point to the length of time it takes for customers to withdraw their funds, though the positive comments are complimentary of BlockFi’s customer service record. Indeed, BlockFi has an extensive ‘Help Center’ on its website, covering solutions to a large number of common queries. There is also the opportunity to live chat with a member of BlockFi staff, or even to call their customer support team directly on weekdays, giving far more flexibility than alternatives such as Gemini or Coinbase.

Alternatives to BlockFi

Investors looking for alternatives to BlockFi should consider their primary concern. Those seeking an easy-to-use exchange may find that Coinbase, with its simple and straightforward interface, is well suited to beginner and intermediate cryptocurrency traders. If low charges are especially high on your priority list, London-based CEX.IO offers a competitive fee schedule, whereas more advanced investors looking for complex trading mechanisms such as futures and margin trading may find Kraken most suitable. You can also check out our independent reviews of Bittrex Global and Gemini.

BlockFi compared to the competition

| Exchange Platform | BlockFi | Coinbase | CEX.IO | Kraken | Bittrex Global | Gemini | Uphold |

| Transaction Fees | 0% (but charges for withdrawals) | 0.00-0.50% | 0.00-0.25% | 0.00-0.26% | 0.00-0.75% | 0.00-0.35% | 0% (but charges a spread between 0.85-1.25%) |

| No. of cryptocurrencies | 7 | 50+ | 80+ | 80+ | 250+ | 40+ | 35+ |

| Wallet | Yes | Yes | Yes | No | Yes | Yes | Yes |

| Trustpilot Rating | 3.6/5 | 1.6/5 | 4.7/5 | 2.1/5 | 1.4/5 | 1.5/5 | 2.6/5 |

The verdict

Overall, BlockFi offers a range of digital services which deliver a comprehensive and investing experience, from conventional crypto asset trading to innovative new interest-building accounts, helping to bridge the gap between traditional finance and the fledgling cryptocurrency sector. Its lack of transaction fees sets it apart from many comparable exchange platforms, but investors looking to withdraw stablecoins may find the withdrawal fees take up a significant proportion of their profit, so those so inclined would be better off using an alternative platform such as CEX.IO. Overall, however, the typical cryptocurrency investor will appreciate the lack of transaction fees, the opportunity to earn interest, and even the novel option to secure a crypto-backed loan.

Finally, it is worth pointing out that cryptocurrencies can be highly volatile and as such, it is better suited to sophisticated investors who understand the associated risks and are prepared to lose all the money they invest if they buy crypto-assets.