How do I qualify for the New State Pension?

You'll usually need at least 10 qualifying National Insurance contribution years to get some form of New State Pension but you'll likely need around 35 full qualifying years to get the full New State Pension. The actual number of years you'll need is based on your age and NI record and so those who started their NI contributions prior to 2016 could ultimately need 40 National Insurance years or more. We explain this in a little more detail in our article 'Will I get a State Pension?'.

There is a system in place where people can plug gaps in their National Insurance record, however, the rules on how far back you can go are changing in April 2025. 'Transitional arrangements' currently allow workers to pay missing National Insurance years dating back to 2006, yet from 6th April 2025, you will only be able to fill gaps going back six tax years. Paying to plug the gaps in your National Insurance record won't be right for everyone and we explain how to work out whether it will benefit you later in this article.

Check your State Pension

Firstly, go and check the government's State Pension forecast calculator. Log in using your Government Gateway user ID and if you don't have one then you can simply sign up. You'll need your name, email address, National Insurance number and date of birth and you'll be sent an authorisation code which you need to enter in order to complete the signup.

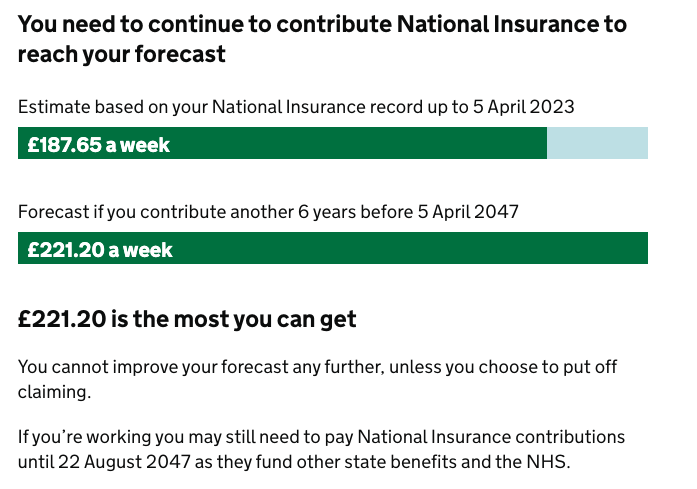

The calculator will provide you with two key pieces of information:

- The amount of State Pension you have qualified for based on your National Insurance contributions to date

- The amount of State Pension you're likely to get if you work up to your State Pension age

If you're not predicted to get the full amount of £221.20 a week you need to check for gaps in your NI record. There's a link in your forecast to do this - click on the words 'View your National Insurance record'

Check if you qualify for National Insurance credits

It's not only paid work that earns you National Insurance years on your NI record. There are a number of ways that you may have earned NI credits over the years and not all of these are applied to your National Insurance record automatically.

Check to see if any of the scenarios below apply to you as you can apply for credits to be added to your NI record manually, helping to plug the gap for missing years.

You can apply for NI credits to be manually added to your record if any of the following applied/applies to you:

- Unemployed and actively seeking employment - No requirement to have been claiming Jobseeker's Allowance but you'll have to prove you were actively seeking work

- Statutory Sick Pay (SSP) - You are either receiving or were receiving SSP and were not earning enough money for a qualifying year

- Employment and Support Allowance (ESA) - If you were eligible for ESA but were not claiming it

- Caring for a family member - You'll need to be between 16 and State Pension age. Your family member must not be your child and must have been under 12 at the time (since 6th April 2011). This is often referred to as 'Grandparent Credit'

- Caring for a sick or disabled person - Must have been for at least 20 hours per week on average

- Foster Carer - Foster carers qualify for NI credits but you'll need to check the dates as you cannot claim for NI years prior to 2010

- Statutory Maternity Pay - Receiving the benefit but not earning enough for a qualifying NI year

- Statutory Paternity Pay - Receiving the benefit but not earning enough for a qualifying NI year

- Statutory Adoption Leave - Receiving the benefit but not earning enough for a qualifying NI year

- Jury service - Does not apply if you were self-employed at the time

- Wrongly imprisoned - Your conviction must have been overturned

- Spouse of a member of HM Armed Forces - You're married to, or a civil partner of, a member of the armed forces and went with them on an overseas posting (additional eligibility rules apply)

- Attended a government-approved training course - Must have been over 18 and does not apply if you were sent on the course by Jobcentre Plus

If you have identified a gap in your National Insurance record and any of the above applies to you, visit the government website which explains how you can apply to have National Insurance credits manually added.

It is worth remembering that only full qualifying NI years count towards your State Pension. So even if you’ve paid some of your contributions for a particular year (either through paid work or National Insurance credits), it will not count towards your State Pension unless it is a full year. The good news is that you can simply top it up and it is cheaper than paying for a full year.

Is it worth paying to boost your State Pension?

At the time of writing, you can buy National Insurance years to fill gaps in your NI record going back to 2006. This will change after 5th April 2025 when the transitional arrangements end. From then on you'll only be able to go back 6 tax years.

Those at or near State Pension age are more likely to benefit from topping up their National Insurance record and it is relatively easy to work out whether topping up is worth it. Essentially, if your State Pension is, or is forecast to be, less than £221.20 a week (and you've checked that you can't plug gaps using credits), then topping up is likely to be worth it and we provide an example later in this article.

If you are in your forties or fifties then you'll need to work out what is best for you as you may still be able to fill any gaps naturally throughout your working life. Essentially, the younger you are, the more time you have to earn the maximum years through paid work or NI credits.

If you've identified NI gaps for the years 2006 to 2016 then you'll need to decide by the deadline of 5 April 2025 whether or not to top up and make the necessary payments before the deadline.

Work out what topping up could be worth

It costs £824 to buy a full National Insurance year and what makes this attractive is that it could add up to £303 for every year you receive your New State Pension (pre-tax). That means you'll need to live at least three years after getting your State Pension to make paying a full NI year worthwhile. A full NI year costs less if you are self-employed or if you are topping up a partial year.

To demonstrate the benefit of plugging your National Insurance record, those buying 10 full years of NI would break even after 3 years and if they were to survive an additional 10 years, they would be almost £20k better off.

Remember, one of the key factors is whether you'll live long enough to maximise the gain. Consider your health and expected retirement date to work out whether it is right for you. Also, consider whether you will achieve the maximum number of qualifying years through your natural working life. The State Pension age is expected to rise to 67 by 2028 at the latest and 68 by 2037, although stories have surfaced recently where this may be brought forward. As a point of reference, the average life expectancy for a woman in the UK is around 87 and it is 84 for a man.

Finally

The only way to know for sure whether you are likely to benefit from filling the gaps in your National Insurance record is to seek advice. If you are already claiming your pension or have deferred it then you should speak to the Pension Service and if you have not yet reached State Pension age then you need to speak to the Future Pension Centre.

Speaking to these services will help you to understand whether paying for extra National Insurance years increases your State Pension entitlement. Remember though that the government's services do not look at your wider financial affairs and so you still need to make some personal considerations. For example, those on a low income should take pension credit into consideration, as there is a chance that they could get State Pension top-ups, removing the need to pay. Also, the benefits of buying additional years will be reduced if it ends up pushing you into a higher tax bracket. Paying more tax will mean it takes longer to break even on your voluntary contributions, but it could still be worth it.

For additional tips on other ways to boost your State Pension, check out our article 'How to boost your State Pension'.