In this independent Farewill review I look at the services they offer, how much Farewill costs, its pros and cons and how it compares to other similar services. I recommend you read the full review in order to understand if it may be the right will-writing service for you.

Farewill offer (20% off a single or couples Will)

I feel that Farewill’s services could be suitable for some readers (but not all) and so Money to the Masses and Farewill have teamed up to offer readers 20% off when they complete their will* (RRP £100). Just use the code mttm-20 at checkout to claim your discounted will. In the interests of transparency Money to the Masses will receive a small payment if you do decide to take up the offer and take out a will. However editorial independence is paramount to Money to the Masses and in no way is this review or my views ever influenced by 3rd parties. Therefore I have also included a link to Farewill at the foot of this article which you can use and Money to the Masses will not receive any payment from your referral nor will you receive a discount.

20% off Wills

Farewill have teamed up with Money to the Masses to give our readers:

- 20% off a single or couple's Will.

- Unlimited access to live phone and chat support

What is Farewill and how does it work?

Everyone would like to know that their family will be looked after when they pass away, but many people have not written a will. A will is a legal document that sets out your wishes for how your assets will be distributed once you die. But it's not just about your assets, as your will can also state who will become the legal guardians of your children. Alarmingly, research has shown that around two-thirds of adults have no will in place, which will put their assets and legacy at risk.

Many people think that creating a will is complicated and costly to set up, leading them to steer clear. This is where online will-writing service Farewill* comes in. It aims to simplify the will-writing process, helping people compile their will in less than 15 minutes and get it checked by a qualified solicitor. If you need to talk to an expert you can do so between the hours of 9am and 6pm, Monday to Friday.

Founded by Oxford University graduates Tom Rogers and Dan Garrett, Farewill was launched in 2016 to create “simple and affordable digital wills you can update anytime", and has received financial backing from the founders of property portal Zoopla, newspaper publisher DMGT and SAATCHiNVEST.

Farewill won National Will Writing Firm of the Year in 2019, 2020, 2021 and 2022 at the British Wills and Probate awards. Farewill was also awarded "Low-cost Funeral Provider of the Year" in 2021 and 2022 by Good Funeral Awards. Good Funeral Awards also awarded it Best Direct Cremation Provider in 2022. To add to these, Farewill won the 'Wills & Probate Firm of the Year' and 'Customer Care Excellence' Awards at the SME UK Enterprise Awards in 2024.

What services does Farewill offer?

Wills

Farewill helps you to create an individual will or a couple's will which can also be known as a mirror will if the wishes of the couple are identical. The document is compiled automatically based on your responses to an online questionnaire.

Probate

Farewill also provides a probate service where it can help handle the process of applying for probate over the phone. By calling Farewill and explaining your current situation, Farewill will help you to understand more about probate, its cost and whether you actually need it.

Cremation

Farewill offers a cremation service (also referred to as 'direct cremation'). Farewill takes care of the cremation from start to finish, even hand-delivering the ashes, allowing you to take care of creating a personal memorial more suitable for you and your loved one.

How does Farewill's will service work?

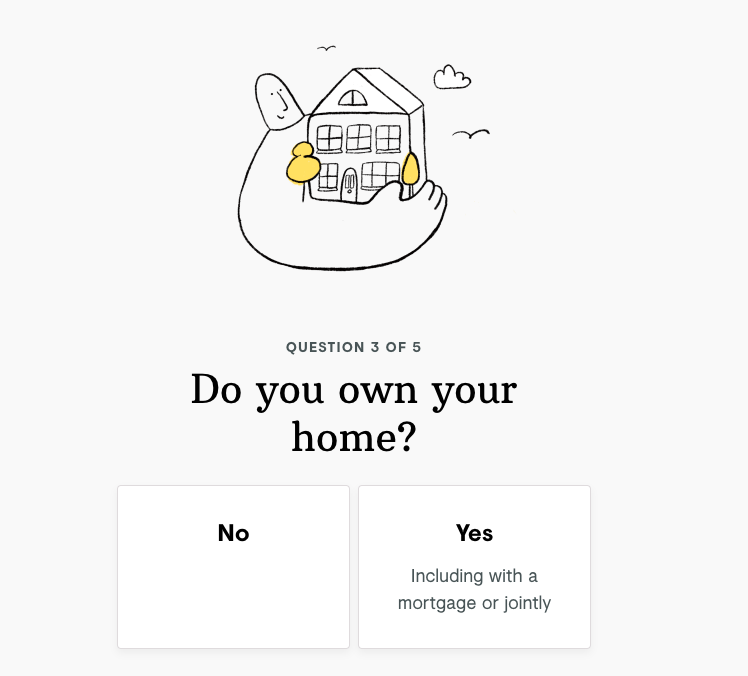

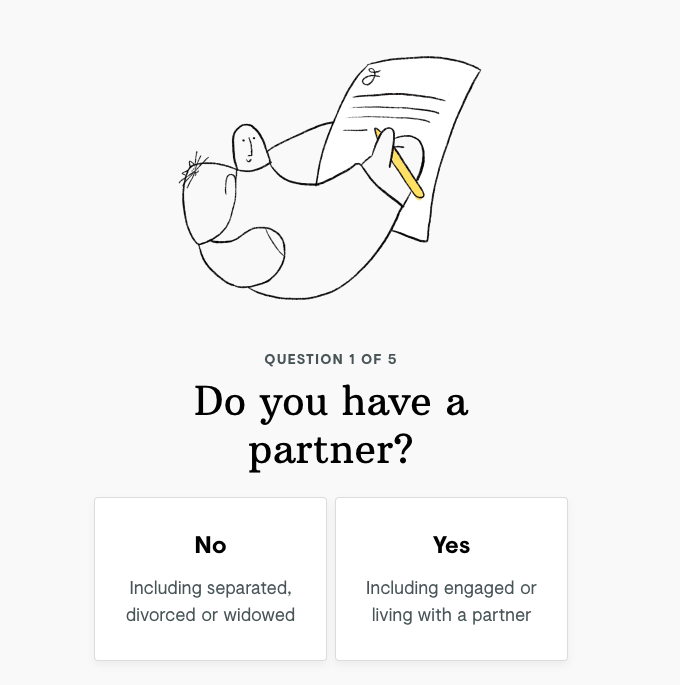

Initially, you are asked 5 questions that concern your personal situation such as marital status, if you have any children and if you own your own home.

Once these details are added you are ready to login and start completing your will. Before you start detailing where your assets should go, Farewill asks if you want the occasional email with special offers or discounts from itself or partners. If you opt into this, it could mean getting lots of emails for other financial services products, which may pay a commission to the company.

It is then time to get into the nitty-gritty of the will. You will see a personalised page that tracks how much of the document has been completed and how long each section will take.

The will is divided into 4 steps with two optional steps at the end.

Step 1 requires you to fill out personal information about yourself including your legal name, address and whether you have any children.

Step 2 requires you to complete a list of where your money is kept including bank accounts, pensions and even life insurance products.

Step 3 is about your estate and distributing your assets. Once you have detailed your assets you need to decide who will receive them (the beneficiaries). This can be your children, a relative, friend or a charity. You need to decide on how assets are split between your beneficiaries and you are also asked to consider where the funds will go if one of the parties dies before you do.

Step 4 is nominating an executor for your will. Once your assets and beneficiaries are outlined you need to choose your executors who will ensure your wishes are followed through and are responsible for making sure debts or taxes are paid. This role can be completed by relatives but can be time-consuming and complicated so you can also use a lawyer to do this.

Farewill offers its own service through Farewill Trustees for a fixed fee of between £595 and £2,750 depending on the complexity of the estate. In comparison, other professional executors can charge a percentage of the value of an estate, which can end up costing a lot of money. You don't need to use either service and most people simply appoint a friend or relative of similar age to them.

There are two remaining optional steps - Gifts and Funeral wishes.

The final stage is paying for the document to be checked by Farewill’s legal team before you can download it. They will spot any errors that could make the will void and promise to raise any issues for you within five days. Farewill even has the option to let you go back and alter the document when necessary, such as if you were to get married, divorced or have children, but this does come with a fee.

At the end of the process, you get a legal document that you can download. It will need to be signed by witnesses for it to be valid and you need to tell your beneficiaries or executors where it is stored.

How much does Farewill's Will service cost?

Farewill pricing is determined by whether the Will is for one or two people and based on whether you arrange your will online or over the phone. Money to the Masses readers will receive a 20% discount on prices using the code - mttm-20 at checkout*.

Farewill price list for Wills

| Type of Will Arrangement | Retail Price | Offer Price for Money to the Masses readers |

| Online Single Person Will | £100 | £80* |

| Online Couple's Will | £160 | £128* |

| Over the phone Single Person Will | £240 | £192* |

| Over the phone Couple's Will | £380 | £304* |

Optional service charges with Farewill:

- Optional annual subscription service (allows you to make any changes and is also updated if there are any law changes) - £10 per year

- Unlimited access to live phone and chat support 7 days a week included

- Farewill Trustees can act as your executor for a fee of between £595 and £2,750 (not mandatory)

How does Farewill's probate service work?

After the initial phone call, Farewill will arrange a follow-up call to discuss more details about the estate. From this conversation, the tax and probate forms can be completed, checked by solicitors and then sent out to you to be signed.

The probate then needs to be approved by the government. Once it has been approved your probate is sent out to you in the post so that you can take charge of the accounts and admin. Farewill offers to take care of this for you by referring you to one of its partners that deals with estate administration.

How much does Farewill's probate service cost?

You can choose between two options when it comes to arranging a probate service with Farewill. The 'Grant of probate application' is the simpler of the two options and will likely suit anyone willing to gather all relevant information and handle most of the administration that goes with settling an estate. Alternatively, you can choose the 'Complete probate service' which means that Farewill's experts will take care of the whole process from assessing the estate to submitting the grant of probate application and then carrying out all the administration needed to settle the estate.

| Probate service | Retail Price |

| Grant of probate application | from £595 |

| Prepare, submit and conclude all probate matters | from £2,000 |

Prices will vary based on the complexity of the estate and include VAT

- Probate registry fee £300

- Probate copies £1.50 each

How does Farewill's cremation service work?

Farewill collects your loved one from any location in England and Wales and takes them to its crematorium. It also deals with any necessary paperwork with the right medical professionals. The team then carries out a private cremation without a funeral service, Farewill says this allows you to 'spend more time planning a memorial with your family'. Farewill then delivers the ashes to you in an urn. You are then able to arrange your own personal memorial before choosing to display or scatter the ashes.

How much does Farewill's cremation service cost?

- Simple cremation fee - from £1,595

You can personalise the service in different ways including the type of urn you would like for the ashes, how you wish for the ashes to be delivered and whether you would like a memorial tree included with the cremation arrangements.

Pros and Cons of Farewill

Pros

- Low cost - 20% discount for Money to the Masses readers

- Quick and easy

- Save money if creating a will as a couple

Cons

- Farewill is not acting as a solicitor and is therefore not liable if things go wrong

- Little support for inheritance tax planning

Farewill offers a low-cost and accessible way to complete a will. People can often be put off by stuffy law offices or legal jargon so producing a will online in under 15 minutes has huge appeal. Farewill simplifies and speeds up the process and makes it as easy as applying for car insurance. It is also cheaper than a lawyer who may charge by the hour or by a flat fee ranging from £200 to £500.

You are getting access to a legal document, but you must be aware that you are not actually getting legal advice and there is no liability, on Farewill's part, if things go wrong.

It is worth checking the terms and conditions and privacy policy of Farewill before you sign up. There is a tick box for both at the sign-up stage to help you understand the type of service you are getting before you pay for it. The terms and conditions highlight that Farewill is not acting as a solicitor and is not regulated by the Solicitors Regulation Authority. This is a quirk of the will-writing sector.

Writing wills isn’t a regulated activity so you don’t need a solicitor to help you write one. However, using one can give you recourse if you have a complaint further down the line as consumers can complain about solicitors to the Legal Ombudsman. Farewill does have a legal team who will check your will, but they are not actually providing legal advice and are not liable for anything in the document that is not legally correct for your situation.

That is part of the reason why Farewill can price its services so low and it also means you won’t get support for more complex estates. For example, there is very little support for inheritance tax planning and the website says it also doesn’t provide an option for including property as a gift in the will as the consequences are complex and require advice. If you are likely to need to make lots of gifts and have a complex estate with lots of potential tax liabilities you may be better off paying for legal advice and a solicitor who can ensure your will is drafted properly and legally sound. You can also source a financial professional to help you with this using the professional directory, Vouchedfor*.

For more information on inheritance tax, check out our article 'The 10 best ways to avoid inheritance tax'.

Farewill customer reviews

Customers seem pretty pleased with Farewill so far. It has a Trustpilot rating of excellent, with an average of 4.9 out of 5.0 from over 17,000 reviews. Most reviewers praise how easy the site is to use. Less than 1% of the reviews describe the service as bad, citing the language used in its popup chatbots while you complete the will or mistakes in the final document.

Farewill vs Solicitor Wills

As mentioned, you don’t need a solicitor to make your will. Farewill* is not a solicitor and is just providing an online template to complete your will plus a legal team who will check it for any errors and anything that could result in it being contested. There are also blogs and articles on its website that explain the legal terms such as what an executor or beneficiary is as well as the importance of different types of will.

In comparison, a solicitor will both help you write the will and provide advice on the legal and tax implications of your decisions. This may be more suitable if your estate is more complex and you don’t have the time to keep up with legal developments. You also get further protections with a solicitor as you can complain to the Legal Ombudsman. Using a solicitor may be more expensive than Farewill but you are at least getting advice and further protection if you need it.

There are other firms such as MyLawyer which provides a range of legal services such as will writing, contracts and tenancy agreements and is run by solicitors and therefore subject to the Solicitors Regulation Authority and Legal Ombudsman rules.

Some insurance companies such as MoreTh>n also offer legal expenses cover, which includes online will-writing, so it is worth also checking your policies for free services.

Farewill vs Which? Wills

Farewill’s closest competitor is Which? Wills. Which? Wills offers online will writing but has more levels of service than Farewill depending on your marital status and if you are doing an individual or joint will. It also lets you draft documents according to the law in England and Wales, Northern Ireland and Scotland, while Farewill currently only offers this in England and Wales.

Which? pricing starts at £80 for an individual Will or £189 for a pair that you just complete and download yourself. This won’t be checked for accuracy but there are prompts throughout the process to make you consider the legal implications of your decisions and you can phone their helpline with queries. Its own legal team will review the document for £119 for an individual or £189 for a pair. There is also a premium service at £169 for an individual and £259 for a pair that Which? prints, binds and delivers to your door but also gives you a year of free storage.

Which? also offers other online templates to compile and purchase such as power of attorney documents which may be as important as your will and also offers storage and a will locator. Which? charges a one-off £20 fee if you want to make a change to your will or £35 if you want it checked. This compares with the £10 annual subscription Farewill charges in case you need to make an alteration. Check out our article 'The best online will writing services in the UK'.

Do you need a will?

Making a will ensures your loved ones are looked after and helps avoid any disputes. If you die without making a will then anyone with a claim on your estate must follow the rules of intestacy. Under these rules, close relatives such as a spouse or civil partner or child can inherit your estate but it can be hard for anyone else. This could cause an issue if there were certain assets you wanted to leave to particular people or if you had separated from a spouse.

It is particularly important to have a will if you share a property with someone who is not your husband, wife or civil partner or if you run a business with others as this can set out how you want your share to be dealt with in the event of your death.

Also, there may be former spouses or children from a previous marriage that you may want looked after in a certain way. The same goes for if you are a parent as you can determine who looks after any children below age 18 and appoint guardians if both you and the other parent die.

Ultimately, setting out your wishes in your will helps ensure your relatives are sure of how you want your estate to be treated and reduces the risk of your memory being spoilt by disputes over what has or hasn’t been left. Check out our article 'What is a will and should I get one?'

Conclusion

No one wants their death to cause family disputes and making a will ensures your final wishes are clearly set out and that your loved ones benefit from assets you built up over your lifetime. Plus you can ensure that your children are looked after by the people you want them to be looked after by. Farewill does a good job of making it low-cost (especially via our offer of 20% off*), accessible and easy enough to complete, especially if your needs are not too complicated. But it is important to understand the service you are getting. This may not be suitable for complex cases where you require legal advice and have lots of assets such as property or children and partners from previous marriages. You do get a legal expert to check your will for any risks but remember the liability lies with you.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Farewill, Vouchedfor