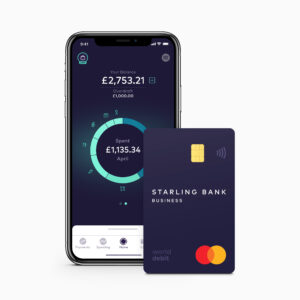

Starling Bank launched its business account in 2018 when it became the first of the mobile banks to offer a business account. Founded by Anne Boden, Starling is a front-runner amongst the app-only banks when it comes to personal accounts, but how does it compare when it comes to business banking?

For more information on Starling's personal account, you can read our review here.

What is Starling business banking?

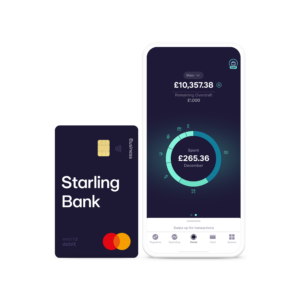

Starling Bank launched a 'free, uncomplicated and quick' business account back in 2018 that promises no fees for opening an account, making payments or withdrawing cash. Business owners can start to manage their accounts entirely from their mobile phones in just 10 minutes.

Anne Boden, Starling Bank's Chief Executive Officer at the time of launch, said:

“In a market with almost no meaningful competition, entrepreneurs and small business owners have for too long been marginalised and taken advantage of by big banks. Having spent the past year building an award-winning bank and personal current account, today we’re happy to announce that we’re launching a business account which offers all of the same great features and more to small businesses and entrepreneurs. “Starling’s mobile business banking solution is free, uncomplicated and quick, taking the effort out of banking so our customers can spend more time growing their business, and less with their bank.”

Is my business eligible?

Sole traders and Limited companies are eligible to open a Starling business bank account. If the company is limited it must be registered at Companies House. Registered business owners must be a UK resident.

How does Starling business banking work?

You don't have to be a Starling Bank customer to apply for a business account with Starling, however, if you already bank with Starling you can easily apply for a business account within the app. Simply go to the home page and click 'Open a new account' and then 'Business account'.

If you don't already have a Starling Bank account you will need to verify your identity using one of the following:

- Passport

- EU/EEA ID card

- UK Residence Card

- UK photo driving licence (full or provisional)

To confirm your business type Starling may also ask for one or more of the following:

- Invoices

- Bank statements

- Accountant's letters

- Signed agreements/contracts

- Qualifications

- Payslips

You can open a Starling business bank account as either a sole trader or a limited company.

Starling 'limited company' business bank account features

- Free business banking - no monthly fees

- Deposit cash and cheques - deposit cash to your account via the Post Office (there is a 0.7% charge with a minimum of £3) and deposit cheques that are £1,000 or less in value via the banking app (there is a daily limit of £5,000 for business accounts)

- Digital receipts - keep track of payments with digital receipts

- Spaces - Manage your money with spaces for costs such as tax and expenses

- 24/7 customer support - contact someone at any time of the day

- Automatically connect to your accounts software - such as Quickbooks, Xero and FreeAgent

- Starling Business marketplace - connect with additional products that can help your business run more smoothly

- Instant payment notifications - get notified as soon as money enters and leaves the account

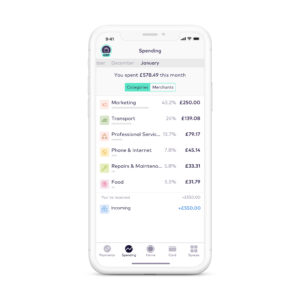

- Automatic expense categorisation - have your expenses categorised for ease of reporting

- Multiple director accounts - have more than one user on your business account

- Fee-free spending abroad - you won't be charged additional transaction fees when spending abroad

- FSCS protection - your account is protected up to £85,000 by the Financial Services Compensation Scheme (FSCS)

- Lending options - it's possible to apply for a Starling Business overdraft (from £1,000 - £50,000) or loan (from £25,001 to £250,000) if you are a limited company or limited liability partnership

Starling 'sole trader' business account features

- Free business account - set up in just a few minutes

- 24/7 customer support - contact someone at any time of the day

- Instant payment notifications - get notified as soon as money enters and leaves the account

- Capture receipts in-app - store them in-app

- Automatic expense categorisation - have your expenses categorised for ease of reporting

- Marketplace - connect to other business tools e.g accounting or insurance

- Spaces - separate money in spaces for different business goals e.g new laptop or business trip

- Deposit cash and cheques - deposit cash to your account via the Post Office (there is a 0.7% charge with a minimum of £3) and deposit up to £2,000 in cheques a day via the app (there is a £1,000 limit per cheque)

- Connect to tools for your business - easily link your account to insurance and accounting software such as Xero and Quickbooks with Marketplace

Starling Bank Business Euro account

- £2 monthly fee

- Hold, send and receive payments in Euros

- Convert money with no hidden fees and a 0.4% conversion fee

- Send money via SWIFT for a flat £5.50 delivery fee or send your payment via a local partner with prices starting from 30p

- Instant payment notifications

- Spaces to separate your money

- Weekend transfers

- One bank card to manage both GBP and EUR accounts

- Unique IBAN number

- -0.5% interest rate on balances over €50,000

- FSCS protection

The Business Toolkit

Starling Bank has created a business toolkit for business accounts that boasts additional accounting and VAT features. Currently FREE for the first month then £7 a month. The business toolkit offers:

- The ability to send and manage invoices

- Automated expenses

- An easier way to manage tax (it estimates how much you should be saving and creates a report to help you complete a self-assessment form)

- Manage bills and schedule payments

- Keep on top of your bookkeeping admin

- Keep track of bills by uploading invoices and scheduling payments

- Record VAT

- Submit your VAT

- The first month FREE then £7 a month

How much does a Starling business bank account cost?

It is currently free to open and manage a Starling business bank account and the costs incurred are outlined in the table below.

| Business | Sole Trader | |

| Account Fee | Free | Free |

| Business Toolkit | £7 (free for the first month) | £7 (free for the first month) |

| Overdraft Interest rate | Rate shown in the app | N/A^ |

| Overdraft fee | 1.75% of overdraft limit or £50 | N/A^ |

| Unarranged overdraft | no annual fee, 15% EAR | no annual fee, 15% EAR |

| Sending money in UK | FREE if sent by faster payments, direct debit or standing order | FREE if sent by faster payments, direct debit or standing order |

| Sending money outside UK | You will be charged the exchange rate (this is shown to you before you make the transfer)^^ plus a 0.4% transfer fee | You will be charged the exchange rate (this is shown to you before you make the transfer)^^ plus a 0.4% transfer fee |

| Receiving money from UK | FREE if receiving £ | FREE if receiving £ |

| Receiving money outside UK | FREE if receiving £ | FREE if receiving £ |

| Depositing money | 0.7% of the amount (£3 minimum) | 0.7% of the amount (£3 minimum) |

| Cash withdrawal in £ | FREE from an ATM £0.50 if withdrawing from the Post Office |

FREE from an ATM £0.50 if withdrawing from the Post Office |

| Cash withdrawal in foreign currency | FREE (subject to the Mastercard exchange rates and you may be charged an ATM fee) | FREE (subject to the Mastercard exchange rates and you may be charged an ATM fee) |

| Debit card payment in £ | FREE | FREE |

| Debit card payment in foreign currency | FREE (this may be subject to exchange rate depending on the currency you wish to pay in) | FREE (this may be subject to exchange rate depending on the currency you wish to pay in) |

| Replacement card | You may be charged £5 if lost or stolen in the UK You may be charged £10 if lost or stolen abroad |

You may be charged £5 if lost or stolen in the UK You may be charged £10 if lost or stolen abroad |

| Certified documents | You may be charged a £20 fee | You may be charged a £20 fee |

^at present, it is not possible to have a business overdraft or loan as a sole trader with Starling Bank. Lending options are currently only available to limited companies and limited liability partnerships

^^you may also be subject to additional fees charged by the receiving banks (Starling is not accountable for these).

Is Starling Bank's business account safe?

Starling says that 'keeping your money and personal details safe is our biggest priority' and it protects business accounts in a number of ways. To open an account you need to verify your identity using a government-issued identity document as well as an additional verification step of video identification.

Your device is also secured by a PIN number and a password is required for setting up and authorising payments. Instant notifications allow you to check for fraudulent activity on your account when payments are sent and received, and the ability to freeze and manage your card in-app allows you to stop anyone from accessing your account should it be lost or stolen.

Starling Bank also uses 3D secure when users are making purchases online. This means authorisation may be required for specific purchases. In addition, Starling Bank is regulated by the FCA and your money is protected up to £85,000 with the Financial Services Compensation Scheme (FSCS).

Starling Bank business vs alternative business accounts

In the following comparison table, we compare Starling Bank to alternative business bank accounts. You can also compare the UK's top business bank accounts in minutes using NerdWallet*.

| Starling Bank | Monzo | Revolut | Tide | Lloyds | NatWest | |

| Monthly fee^ | Free | Free | Free | Free | Free for 12 months then £7 a month | No monthly fee |

|

Registered UK Bank account

|

||||||

| FSCS protected | ||||||

|

Free UK transfers

|

limits apply | Free for 24 months then £0.35 | ||||

|

Free ATM withdrawal

|

Free for the first 12 months | Free for 24 months then £0.35 | ||||

|

24/7 customer support

|

||||||

|

Cash and cheque deposits

|

Cash only | |||||

| Overdraft facility |

^based on basic business accounts or accounts for small businesses/start-ups

Pros and cons of Starling Bank business account

Pros of Starling's business account

- Contactable 24/7

- Safe and secure

- No management fees

- Marketplace feature linking you to other helpful business tools

- Spending insights

- Multi-currency accounts

Cons of Starling's business account

- No branches (everything is done online)

- Unable to earn interest on a positive balance

- Charge to deposit money

Summary

Starling's business account offers the same basic features as a typical high street bank but then surpasses them by offering additional features such as categorised spending, instant notifications and access to its marketplace. Its main mobile bank competitor is Monzo and there is little to choose between the two. Both have almost identical features, however, Starling does have the edge when it comes to depositing cheques. You can cash up to £2,000 in cheques per day via your mobile for personal, joint and sole trader accounts and up to £5,000 for business accounts, so long as each cheque is £1,000 or less. Another alternative is Revolut for business which is more expensive but may suit businesses that trade in multiple countries.

Starling's business account is great for small business owners who want a quick and easy solution to business banking however it may need a longer track record to convince bigger businesses to make the switch.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Starling, Nerdwallet