The Bank of England has cut the base rate from 5.25% to 5%, following a narrow vote among the Bank's Monetary Policy Committee. Five of the committee's nine members voted to trigger a cut to 5.00%, following seven consecutive decisions to hold rates at 5.25%.

The Bank of England has cut the base rate from 5.25% to 5%, following a narrow vote among the Bank's Monetary Policy Committee. Five of the committee's nine members voted to trigger a cut to 5.00%, following seven consecutive decisions to hold rates at 5.25%.

The cut is the first since the start of the COVID-19 pandemic, before borrowing costs first began to rise, signalling 14 consecutive rate rises to tackle soaring inflation. However, with inflation holding at the Bank’s 2% target, the governor Andrew Bailey decided that inflationary pressures had “eased enough” for him to vote in favour of a cut.

What is the Bank of England base rate?

The base rate determines how much the Bank of England pays commercial banks for holding money with it. This then influences how much those banks charge customers to borrow money or pay customers to hold savings. If the base rate goes down, it usually triggers a drop in the rate that banks and other lenders charge the public to take out loans, mortgages and credit cards, and the rate they pay out on savings.

Why has the Bank of England base rate been cut?

Changing the base rate is the Bank of England's way of controlling inflation and stimulating the economy. To tackle levels of inflation that had not been seen for 40 years, households across the country have come under pressure from the dramatic rise in borrowing costs over the last three years. The Bank increased the base rate 14 consecutive times since December 2021, then voted to keep the rate the same a further seven times in a row to ensure inflation stuck at the target rate of 2%. Now that target has been met, the Bank has decided to push ahead with a rate cut to ease the burden on borrowers, though not without warning that the landscape could change quickly.

The Monetary Policy Committee warned that “policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further”.

While the rate of inflation has decreased in recent months, that does not mean anything is getting cheaper. Prices remain much higher than just a few years ago, they are just not rising as quickly as they once were. This is in large part down to a reduction in the cost of energy, as service prices and wage growth continue to trouble the Bank. All this means that while today's cut is cause for optimism and relief for many borrowers, the future path of inflation and interest rates is not certain.

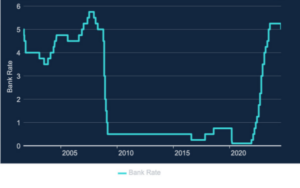

How has the bank rate changed over time?

The graph below shows how the Bank of England base rate has dramatically dipped and soared over recent years, either side of long periods of stability..

(Source: Bank of England)

Rate rises and how they impact you: December 2021 - August 2024

The Bank of England last cut the base rate back in March 2020 before successive rises began in December 2021.

| Date | Interest rate change | Previous interest rate | New interest rate | Change to average monthly mortgage repayments per £100k borrowed* |

| 16th December 2021 | +0.15% | 0.10% | 0.25% | +£8 |

| 2nd February 2022 | +0.25% | 0.25% | 0.50% | +£13 |

| 17th March 2022 | +0.25% | 0.50% | 0.75% | +£13 |

| 5th May 2022 | +0.25% | 0.75% | 1.00% | +£13 |

| 16th June 2022 | +0.25% | 1.00% | 1.25% | +£13 |

| 4th August 2022 | +0.50% | 1.25% | 1.75% | +£26 |

| 22nd September 2022 | +0.50% | 1.75% | 2.25% | +£26 |

| 2nd November 2022 | +0.75% | 2.25% | 3.00% | +£39 |

| 15th December 2022 | +0.50% | 3.00% | 3.50% | +£26 |

| 2nd February 2023 | +0.50% | 3.50% | 4.00% | +£26 |

| 23rd March 2023 | +0.25% | 4.00% | 4.25% | +£13 |

| 11th May 2023 | +0.25% | 4.25% | 4.50% | +£13 |

| 22nd June 2023 | +0.50% | 4.50% | 5.00% | +£26 |

| 3rd August 2023 | +0.25% | 5.00% | 5.25% | +£13 |

| 21st September 2023 | +0.00% | 5.25% | 5.25% | £0 |

| 2nd November 2023 | +0.00% | 5.25% | 5.25% | £0 |

| 13th Decmeber 2023 | +0.00% | 5.25% | 5.25% | £0 |

| 1st February 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 21st March 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 9th May 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 20th June 2024 | +0.00% | 5.25% | 5.25% | £0 |

| 1st August 2024 | -0.25% | 5.25% | 5.00% | -£13 |

| TOTAL | £255 |

*assumed mortgage term is 25 years

How does the Bank of England interest rate cut affect mortgages?

Fixed-rate mortgage customers

Anyone with a fixed-rate mortgage will not see a change to their rate until the mortgage deal term ends. If your deal is due to end soon, you should consider how mortgage rates might change in the coming months. Our article 'Will interest rates continue to fall in 2024 & how low will they go?' provides some insight into remortgaging and what to do if you are due to remortgage soon.

It is worth remembering that although interest rates have been cut, if your current fixed-rate deal was in place prior to December 2021 (when rates first started going up), then you should factor in all of the interest rate rises combined to budget for remortgaging. As shown in the table above, this equates to a rise of around £255 per month, per £100,000 borrowed, based on a 25-year mortgage term.

Variable rate or tracker mortgage customers

Those with tracker or variable rate mortgages should see a change to their monthly mortgage payments. Our interest rate calculator can be used to work out the potential impact that the rate cut will have on your monthly mortgage payments. You'll need to know your initial mortgage term, the amount borrowed at the start of the deal and your current mortgage rate.

Anyone wanting to know more about how rate rises and cuts impact their finances should speak with an independent mortgage adviser* as they can provide specialist advice. When considering remortgaging, always check to see if there are any Early Repayment Charges (ERC) and check to see how long is left on your current mortgage deal. Take a look at the best mortgage deals by using our mortgage rate comparison tool or checking out our article 'Best mortgage rates in the UK'.

Help if you're unable to afford your mortgage payments

Even with today's rate cut, many homeowners will face increased mortgage costs when their current deal comes to an end. If you are worried about how you will afford your mortgage, then you should get in touch with your lender as soon as possible. Your lender should be able to find a solution that can help ensure no repayments are missed.

Potential solutions can range from extending the length of your mortgage, to converting part or all of your repayment mortgage to an interest-only mortgage, to allowing you to take a mortgage payment holiday.

Check out our article 7 tips for dealing with mortgage arrears, or alternatively, you may find additional support from the following organisations helpful:

How does the Bank of England base rate cut affect you if you have credit cards, loans or overdrafts?

Credit cards

If you have an existing credit card with an agreed interest-free period or promotional interest rate you shouldn't notice any impact from the latest Bank of England base rate announcement.

Keep in mind that 0% credit cards are the best way to avoid any base rate fluctuations, by not paying interest at all. For example, by moving your existing credit card balance to a 0% balance transfer credit card, you ensure you pay no interest on your repayments if the balance is repaid within the promotional interest-free period. Be aware that most (not all) balance transfer credit cards charge a balance transfer fee, usually somewhere between 2% and 5%. Find out more in our article, 'Best 0% balance transfer credit cards'.

Loans

If you already have a loan with a fixed interest rate then you are unlikely to be affected by changes to the base rate. If you are looking for a new loan then you can compare the best loan deals in our article, 'Best personal loans'.

Overdrafts

The interest rate charged on your overdraft should go down in line with the Bank of England's base rate cut. If your bank or building society is going to change the rate of interest charged, you should receive a notification in advance, giving you time to consider your options.

How does the Bank of England base rate cut affect you if you have savings?

Interest rates on savings accounts are likely to fall as a result of the base rate cut, and much more quickly than they rose when the base rate was increased. In fact, you may have already received a message from your bank informing you that the rate on your account is going down.

This means that it is possible that we may have already hit the peak of high-interest rates on savings accounts, so now might be a good time to secure the best rate on your savings. Our article, 'How to get over 5% on your savings' summarises some of the best rates on the market and our regularly updated article, 'Best savings accounts in the UK' provides a summary of the best savings rates for personal and business accounts.

Looking for the best savings rates should always involve shopping around for the best deal. You can check out the best savings rates using our Savings Best Buy tables. Right now you can get as much as 8.00% interest on a Regular Saver account.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - VouchedFor