The Bank of England has decided against an increase in the base rate, opting to keep it at 5.25%. The Bank's Monetary Policy Committee (MPC) made the decision by the narrowest possible margin, voting 5-4 to leave borrowing costs unchanged. This breaks a run of 14 consecutive rate rises from the record low of 0.1% in December 2021, though it remains at the highest level since 2008.

The Bank of England has decided against an increase in the base rate, opting to keep it at 5.25%. The Bank's Monetary Policy Committee (MPC) made the decision by the narrowest possible margin, voting 5-4 to leave borrowing costs unchanged. This breaks a run of 14 consecutive rate rises from the record low of 0.1% in December 2021, though it remains at the highest level since 2008.

The decision to hold the rate has gone against expectations, with many commentators predicting a 0.25% rise at the start of the week. However, reports of slowing inflation began to shift some expectations towards a hold. The latest inflation figures had been expected to show a slight increase to 7% from 6.8%, so the published figure of 6.7% brought some surprise. This is still some way from the Bank's inflation target of 2%, but it was enough of a pattern to ease policymakers towards the narrow vote to hold rates.

What is the Bank of England base rate?

The Bank of England base rate is the rate at which the Bank of England lends money to banks, building societies and other lenders. An increase in the base rate usually signals an increase in the rate that banks and other lenders charge, with a decrease leading to cheaper borrowing rates for consumers. Adjusting the base rate should also trigger a change to savings rates, though some providers can be slow to pass on any rise.

Why has inflation gone down?

Inflation slowing has expected has been put down to weak growth in food prices. Soaring supermarket costs have had a huge effect on household budgets in recent years for most people in the UK. While average prices are not coming down, they have not increased as sharply in the last 12 months. The raw numbers are still high and suggest that weekly shops will continue to get more and more expensive for a while yet.

Keep in mind that the rate of inflation going down does not mean the cost of living is getting cheaper. The products and services assessed as part of the CPI calculation are on average still going up in cost, just at a lower rate than they were a month ago.

What does inflation mean for savers?

Inflation erodes the value of cash, so, as the cost of living goes up, your cash in the bank will buy you less. However, this has been mitigated to an extent by record increases in the base rate, which has earned savers more interest on the cash they put away. Unfortunately, banks can take a long time to pass higher rates of interest on to savers, if they do at all.

What does inflation mean for mortgages?

As inflation erodes the value of cash, it also hits the value of debt. £20,000 of savings will be worth less, but so too will £20,000 of mortgage debt. Falling inflation is also expected to eventually reduce mortgage rates. The reason the BoE has raised interest rates in the past is to leave households with less money to spend. The theory is that with reduced spending power, prices will go down and inflation will fall. The BoE is less likely to keep interest rates higher for longer if inflation is falling at a fast enough rate with existing measures in place.

You can check out the best mortgage rates currently available in the UK in our article ‘Best mortgage rates in the UK’.

Why has the Bank of England base rate not changed?

Base rate decisions are made by the nine-member Monetary Policy Committee (MPC) which meets every six weeks. At the latest meeting, four members voted to increase the Bank of England base rate, but five members voted to maintain the existing rate of 5.25%.

A rise had been expected in part because inflation remains a distance from the official target rate of 2%. In theory, increasing interest rates will help to reduce demand and prompt a slowdown in spending, with the ultimate aim of bringing inflation down. However, the unexpected fall in UK inflation in August to 6.7%, published this week, shifted the mood at the Bank. The hope for many is that inflation is now on a downward trajectory, negating the need for any further hikes. However, future rises have not been ruled out.

The Bank of England governor, Andrew Bailey, said: "Inflation has fallen a lot in recent months, and we think it will continue to do so."

"That's welcome news. But there is no room for complacency. We need to be sure inflation returns to normal and we will continue to take the decisions necessary to do just that."

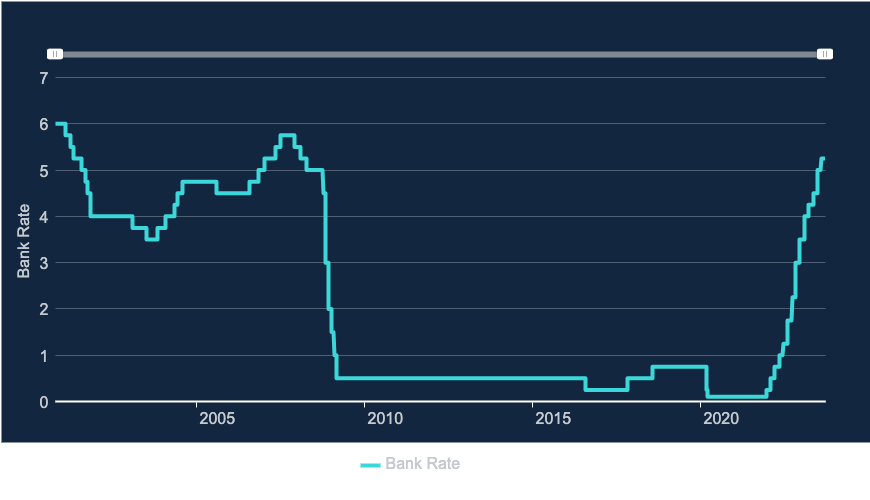

How has the bank rate increased over time?

The following graph shows how the Bank of England base rate has increased over time.

(Source: Bank of England)

Rate changes and how they affect you: December 2021 - September 2023

Below, we provide a summary of the Bank of England base rate rises since December 2021, which was when the series of aggressive increases began.

| Date | Interest rate rise | Previous interest rate | New interest rate | Increase to average monthly mortgage repayments per £100k borrowed* |

| 16th December 2021 | +0.15% | 0.10% | 0.25% | £8 |

| 2nd February 2022 | +0.25% | 0.25% | 0.50% | £13 |

| 17th March 2022 | +0.25% | 0.50% | 0.75% | £13 |

| 5th May 2022 | +0.25% | 0.75% | 1.00% | £13 |

| 16th June 2022 | +0.25% | 1.00% | 1.25% | £13 |

| 4th August 2022 | +0.50% | 1.25% | 1.75% | £26 |

| 22nd September 2022 | +0.50% | 1.75% | 2.25% | £26 |

| 2nd November 2022 | +0.75% | 2.25% | 3.00% | £39 |

| 15th December 2022 | +0.50% | 3.00% | 3.50% | £26 |

| 2nd February 2023 | +0.50% | 3.50% | 4.00% | £26 |

| 23rd March 2023 | +0.25% | 4.00% | 4.25% | £13 |

| 11th May 2023 | +0.25% | 4.25% | 4.50% | £13 |

| 22nd June 2023 | +0.50% | 4.50% | 5.00% | £26 |

| 3rd August 2023 | +0.25% | 5.00% | 5.25% | £13 |

| 21st September 2023 | +0% | 5.25% | 5.25% | £0 |

| TOTAL | £268 |

*assumed mortgage term is 25 years

How does the BoE interest rate rise affect you if you have a mortgage?

Fixed-rate mortgage customers

Around three-quarters of mortgage customers are on a fixed-rate deal, which means that they will be protected from any recent interest rate rises for now. However, if your existing fixed-rate mortgage deal is ending in the next 6 months, you should read our article 'Remortgaging in 2023 – is now the right time to fix & for how long?'.

To provide some basic calculations, a 0.25% rise would mean that your monthly mortgage repayments, based on a 25-year mortgage term, could increase by approximately £13 per month for every £100,000 borrowed. If your existing fixed-rate deal has been in place for several years (such as prior to December 2021 when rates first started to rise), you will need to factor in all of the interest rate rises across that period. This could equate to a rise of around £268 per month per £100,000 borrowed, based on a 25-year mortgage term as shown in the table above.

Variable rate or tracker mortgage customers

Those with tracker or variable rate mortgages would see their mortgage payments increase or decrease in line with any Bank of England base rate announcement, though lenders can take time to implement the change so exactly when you will see the change will depend on your lender. You can work out what the impact will be on your mortgage payments by using our interest rate calculator. You'll need to know your initial mortgage term, the amount borrowed at the start of the deal and your current mortgage rate.

Anyone worried about the impact that the base rate will have on their finances should speak with an independent mortgage adviser* as they can easily explain the likely impact on your finances and also provide advice on remortgaging. They will be able to weigh up your options and compare what mortgage rates and deals are available to you. Always check to see if there are any Early Repayment Charges (ERC) when remortgaging and check to see how long is left on your current deal. Also, you can take a look at the best mortgage deals yourself by using our mortgage best buy calculator.

Help if you're unable to afford your mortgage payments

If you're having trouble paying your mortgage or are worried about how you will afford your mortgage following the interest rate rises this year, then you should get in touch with your lender as soon as possible. Your lender may be able to provide support and it is in their interest to find a solution to ensure that repayments are not missed. Potential solutions could include allowing you to take a mortgage payment holiday or extend the length of your mortgage or convert part of a repayment mortgage to interest-only in order to reduce your monthly repayments.

You may also find additional support from the following organisations helpful:

How does the BoE interest rate affect you if you have credit cards, loans or overdrafts?

Credit cards

It is likely that your credit card provider will change the Annual Percentage Rates (APR) on your credit card in line with a base rate. However, if you have an existing credit card with an agreed interest-free period or promotional interest rate you won't notice any immediate impact from a Bank of England rate change. However, if your promotional period is due to end, or you are applying for a new credit card in the future, you will likely notice that the APR is different.

Loans

If you already have a loan with a fixed interest rate then you are unlikely to be affected by any base rate change. However, if you have a variable-rate loan, this will likely track the base rate.

Overdrafts

The interest rate charged on your overdraft could be impacted by a change in the Bank of England's base rate. However, you should receive advanced notification from your bank or building society, giving you time to consider your options.

How does the BoE interest rate affect you if you have savings?

Savings rates should go up when Bank of England base rate rises, however, it is up to the individual bank or building society as to when or if it increases rates. Some will take weeks or even months to increase rates following an increase announcement, while others may not increase rates at all as they are under no obligation to do so. If you are looking for the best savings rates then you should always shop around for the best deal. Check out the best savings rates using our Savings Best Buy tables.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - VouchedFor