NS&I Chief Executive Ian Ackerley said that "The new interest rates will ensure that our products are priced in line with the broader savings sector. The increase will also help us to meet our annual Net Financing target for 2021-22 of £6 billion".

What are the latest NS&I interest rate changes?

Below is a summary of the changes to 2 NS&I savings products, as well as where they were prior to Christmas 2021.

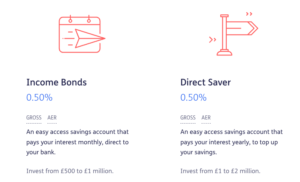

Direct Saver

NS&I’s Direct Saver rate increased from 0.35% to 0.50% on 10 February 2022 (+15 basis points).

| Interest Rate from 10 February 2022 | Interest rate prior to 10 February 2022 | Interest rate prior to 23 December 2021 |

| 0.50% | 0.35% | 0.15% |

Income Bonds

NS&I’s Income Bonds rates will increase from 0.35% to 0.50% on 10 February 2022

| Interest Rate from 10 February 2022 | Interest rate prior to 10 February 2022 | Interest rate prior to 23 December 2021 |

| 0.50% | 0.35% | 0.15% |

Has the interest rate on Premium Bonds changed?

Premium Bonds will not change from their current rate at 1%. In November 2022 it was reduced from 1.40% to the current rate of 1.00%.

| Current Interest Rate | Interest Rate prior to 23 November 2020 |

| 1.00% | 1.40% |

Why is NS&I raising interest rates?

Back in November 2020 NS&I decided to slash interest rates on many of its savings products by as much as 1.75%. The decision was driven by the historically low Bank of England (BoE) base rate and high customer demand.

The Bank of England has since voted to raise rates on two separate occasions, increasing the base rate to 0.25% following its December meeting and subsequently increasing it by a further 0.25% in February. The Bank of England base rate now stands at 0.50% and is a key factor in NS&I's decision to increase savings on its savings products.

Additionally, NS&I’s net financing target for April 2021 to April 2022 is £6 billion, but only 10% of that target had been met by October 2021 as just £600 million had been deposited in NS&I savings accounts by the end of the first half of the financial year.

How do NS&I savings rates compare?

Despite the recent changes to NS&I’s savings rates, its products continue to lag behind many of the savings products available elsewhere on the market and so it would be wise for savers to shop around to ensure they are getting the best deal.

As an example, you can currently secure 0.75% on Aldermore's 'Double Access Account', currently the best Easy Access account on offer. Alternatively, the best Variable Rate ISA is provided by Shawbrook Bank at 0.61%, while OakNorth bank currently provides the best Fixed Rate ISA offering a rate of 1.00%.

Make sure you check out our savings best buy tables for the latest on the best savings rates. We include high interest current accounts, easy access, fixed rate bonds, ISAs, notice accounts, regular savings and even children's savings accounts.

More on saving

Check out the following articles for more on the best ways to save:

- Best cash savings platforms in the UK

- Best savings apps in the UK

- Best savings account for £100,000

- Get the best return on your £50,000 investments