Who is Bestinvest?

Bestinvest is an award-winning online investment service providing a range of support services for the DIY investor.

Bestinvest is an award-winning online investment service providing a range of support services for the DIY investor.

Bestinvest is part of Evelyn Partners (formerly known as Tilney Smith & Williamson) and offers a broad range of financial planning, investment planning and investment advice services and boasts nearly 200 years of experience. Bestinvest has won over 30 industry awards and currently serves over 50,000 clients with more than £3bn assets under administration.

Overview - Bestinvest review - Should you use them?

Whilst not the largest investment platform in the UK - Hargreaves Lansdown* holds that title - Bestinvest's combination of competitive charging, wide investment choice and ease of use has now cemented Bestinvest as a viable option for most investors. In the UK those wanting to invest, generally have three choices: 1) invest using a DIY investment platform and pick your investments yourself 2) buy a cheap ready-made portfolio (usually via one of the robo-advice services such as Nutmeg) or 3) pay for expensive financial advice if they can afford it to receive a personalised portfolio recommendation.

But Bestinvest has reimagined its proposition and is one of the first investment platforms to offer all three services cost-effectively. It, therefore, has cemented itself as a good investment platform not only for beginners or those with smaller portfolios but also for those who want access to low-cost ready-made portfolios (including a ready-made income portfolio), while maintaining the option to pick their own investments (i.e. the full DIY investor route) and having access to a qualified financial planner.

Having also recently slashed its investment charges, Bestinvest is an ideal platform for those who want flexibility and choice at a low cost. Bestinvest's ready-made portfolios have also performed well against its peers (as shown later), particularly in regard to its lower-risk portfolios.

In the rest of this review we look at all aspects of Bestinvests proposition in detail, but the ability to have free coaching/guidance from a qualified financial planner, plus the option to pay a fixed price of up to £495 for full regulated advice and portfolio recommendation really sets it apart from its peers.

If you are looking for an easy-to-use investment platform, especially if you want a SIPP, through which to buy a range of funds then Bestinvest is a good and popular choice.

Bestinvest Pros and Cons

| Pros | Cons |

|

What services and products does Bestinvest offer?

Bestinvest Stocks and Shares ISA

Investments held within the Bestinvest Stocks and Shares ISA can be managed either by Bestinvest via one of the Bestinvest ready-made portfolios (which we explain in more detail below) or you can run your money yourself. The latter means choosing the underlying funds yourself to invest in just as you would with other platforms such as Hargreaves Lansdown, Fidelity, Charles Stanley or AJ Bell.

Bestinvest Junior ISA

The Bestinvest Junior ISA allows parents or grandparents to start investing for their children's future in a tax-free environment. The usual annual contribution limits apply which for the 2024/25 tax year is £9,000. The advantage of investing via a Junior ISA is that any income produced by the investments belongs to the child and therefore does not form part of the parent's taxable income or capital gains. However, once the child reaches the age of 18 the money is legally theirs to do with as they wish and they do not require the consent of their parent or guardian to access the money.

Bestinvest SIPP

The Bestinvest SIPP offers tiered service fees, which we look at in more detail later, and no set-up charges. Just like the Bestinvest ISA and Junior ISA you can choose to invest in a ready-made portfolio or you can choose to manage the investment selection yourself. The Bestinvest SIPP now accepts transfers-in and Bestinvest will pay up to £500 towards your exit fee charges. Bestinvest has recently simplified its SIPP fees, scrapping a number of charges including its £100 + VAT administration charge. It does however carry a minimum charge of £120 per annum.

Bestinvest Junior SIPP

A child's parent or guardian can open a Bestinvest Junior SIPP and contribute up to £2,880 each tax year. Alternatively, Bestinvest also accepts transfers-in. Again, much like the Bestinvest ISA and Junior ISA, you can choose to invest in a ready-made portfolio or you can choose to manage the investment selection yourself.

Bestinvest Investment Account

In addition to the above tax-efficient structures, Bestinvest offers the Bestinvest Investment account. It works in the same way as the aforementioned products (with the ability to invest in shares ETFs, unit trusts and investment trusts), but without the contribution restrictions or the tax-free status. That means that any income or capital gains produced by your investments held in the Bestinvest Investment Account will be liable to income tax and CGT (capital gains tax).

Bestinvest investment ready-made portfolios

As an investor, you have a few choices, you can invest via Bestinvest's ready-made portfolios, choose your funds yourself (possibly with the aid of Bestinvest's onsite research) or you can invest directly in a number of 'direct' portfolios from the likes of BlackRock, Fidelity, L&G and Vanguard. All of these investments can be held in one of the four account types mentioned above (i.e a Stock and Shares ISA). Bestinvest recently reduced its annual service fee on its own ready-made portfolios from 0.40% to 0.20%. The fee is tiered meaning investors will pay 0.20% up to £500,000, 0.10% between £500,000 and £1m and there is no charge on anything over £1m. We explain the fees in more detail later in this article. Bestinvest offers two main types of ready-made portfolio and we explain each of them below:

Bestinvest 'Smart' portfolios

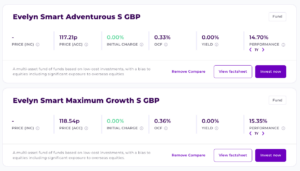

Bestinvest offers 5 'Smart' ready-made portfolios which focus on low-cost investments such as exchange-traded funds (ETFs). They come with 5 varying levels of risk and ongoing charges range from just 0.29% to 0.36% making them an incredibly cheap way to invest. The portfolios are as follows:

| Bestinvest Smart Portfolio | Details | Total Cost (Fee includes admin fees, manager fees, administration costs etc) | 1 Year Performance (as at November 2024) |

| Cautious | A multi-asset fund of funds based on low-cost investments, investing in equity, fixed income and gold | 0.29% | 11.94% |

| Balanced | A multi-asset fund of funds based on low-cost investments, with a bias to equities and fixed interest | 0.31% | 12.95% |

| Growth | A multi-asset fund of funds based on low-cost investments, with a bias to equities. | 0.32% | 13.95% |

| Adventurous | A multi-asset fund of funds based on low-cost investments, with a bias to equities including significant exposure to overseas equities | 0.33% | 14.70% |

| Maximum Growth | A multi-asset fund of funds based on low-cost investments, with a bias to equities including significant exposure to overseas equities | 0.36% | 15.35% |

Updated 12/1124

Bestinvest 'Expert' portfolios

Bestinvest offers 10 'Expert' ready-made portfolios which are actively managed by a team of expert fund managers. They come with varying levels of risk and differing objectives. Ongoing charges range from 1.32% to 1.50%, making them significantly more expensive than the 'Smart' portfolio range. The portfolios are as follows:

| Bestinvest Expert Portfolio | Details | Total Cost (Fee includes admin fees, manager fees, administration costs etc) | 1 Year Performance (as at November 2024) |

| Defensive Clean | A multi-asset fund of funds with a bias to defensive assets such as bonds and absolute return funds | 1.34% | 9.44% |

| Conservative Clean | A multi-asset fund of funds, which uses a mixture of products and asset classes to enhance capital in real terms | 1.39% | 10.57% |

| Cautious Clean | A multi-asset fund of funds investing in equity, fixed income and alternative assets | 1.39% | 11.81% |

| Balanced Clean | A multi-asset fund of funds with a bias to equities and fixed interest | 1.43% | 13.06% |

| Growth Clean | A multi-asset fund of funds with a bias to equities | 1.45% | 14.55% |

| Adventurous Clean | A multi-asset fund of funds with a bias to equities including significant exposure to overseas equities | 1.47% | 15.81% |

| Maximum Growth Clean | A multi-asset fund of funds, with a bias to equities including significant exposure to overseas equities | 1.51% | 17.56% |

| Sustainable Cautious Clean | A balanced multi-asset fund of funds which invests in ESG products | 1.22% | 11.93% |

| Sustainable Adventurous Clean | A multi-asset fund of funds investing in ESG products with a bias to equities | 1.52% | 8.78% |

| Income Clean | An income-focused fund of funds investing in equities, bonds and alternative assets | 1.28% | 15.85% |

Updated 12/11/24

What other services does Bestinvest offer?

Bestinvest is a comprehensive investment platform where investors can purchase a variety of funds, investment trusts, ETFs and shares. Assuming you don't want one of the ready-made portfolios discussed above investors can use the Bestinvest 'Investment Selector' which allows them to research and compare a range of funds prior to selecting where to invest. This, together with the Bestinvest investment guides and research, provides a fairly comprehensive package for most investors.

Bestinvest Investment Search

A key element of the Bestinvest platform is the Bestinvest Investment Search tool which allows investors to research and purchase a wide range of funds, investment trusts ETFs and shares. Just like other platforms such as Hargreaves Lansdown, Fidelity or AJ Bell, by using the search facility, investment choices can be quickly narrowed down to match your criteria. However, there are one or two notable differences in how Bestinvest's Selector works compared to other platforms.

The Bestinvest Investment Search tool allows you to search for specific funds, providers or sector. Filters can be also be applied that can focus the search to specific investment options, charges and yields. Once the search criteria have been selected the investment options are listed in a table and can be sorted alphabetically by the provider. This table shows the ongoing charges, yield together with a 'compare' option and 'invest' button. From a usability perspective, the ability to research funds is far easier than on Fidelity, for example. You can also choose to compare the assets that the funds invest in via the analysis section. The screen isn't busy and the options to explore further only appear as you start making choices.

Bestinvest 'best funds list'

This is Bestinvest's take on the best funds available. The list picks out a number of funds in each sector that Bestinvest believes will do better than their peers and outperform their benchmark. Bestinvest states that a lot of time and effort goes into selecting the funds and that it "looks at the people, process and philosophy behind the funds". It has a list of '10 commandments' to ensure it has a fair and consistent framework when selecting the funds. Some of these commandments include staying away from fund managers that lack conviction, that is to say that they only seem to replicate the index that they're measured against. They also look at whether the fund manager 'tastes their own cooking' and by that, they mean whether they invest their own money. The list is constantly evolving over time but at the time of writing, there are 136 funds to choose from.

Other investment research offered by Bestinvest

Bestinvest does offer a couple of other ways to research funds that you might want to invest in or ones you may want to avoid.

Top ISA investment ideas - An in-depth guide explaining how you can make the most of your ISA allowance.

Spot the Dog - The most widely known piece of research that Bestinvest produces is its 'Spot the Dog' guide which you can download for free. The guide uses statistical fund performance data to identify funds that have performed badly compared to their benchmark. These are referred to as 'dog funds' and are highlighted as funds for the investor to avoid. Whenever this guide is updated it features heavily in the national press money sections.

Top performing funds - In this area of the site Bestinvest provides the top-performing funds and ranks them on their performance over one year. This table is interactive so the list can be refined using certain criteria such as charges.

Does Bestinvest have a minimum investment amount?

Yes. Investments can be made with a minimum of £50 (£100 for some funds) and all portfolios can be used for ISA, Junior ISA or SIPP investments.

Bestinvest fees

Bestinvest has recently made a number of changes in an effort to simplify its service and pricing, as well as bring down the overall cost of investing for its clients. Below we list the fees in full:

Bestinvest ready-made portfolio annual management fees

If you invest in one of Bestinvest's ready-made portfolios you will be charged the following fees:

| Products available | Amount invested in Bestinvest Ready-made portfolio | Bestinvest fee (per annum) | Notes |

| ISA, Junior ISA, SIPP or General Investment Account (GIA) | Up to £500,000 | 0.20% | Minimum charge of £120 for a SIPP |

| ISA, Junior ISA, SIPP or General Investment Account (GIA) | £500,001 to £1m | 0.10% | |

| ISA, Junior ISA, SIPP or General Investment Account (GIA) | Over £1m | No charge |

Bestinvest annual platform fee for other investments

If you invest in any other type of investment (ie not via one of Bestinvest's ready-made portfolios) such as unit trusts, investment trust and ETFs then you will be charged the following platform fee by Bestinvest on top of the underlying fund charge:

| Products available | Amount invested in unit trusts, ETFs & investment trusts | Bestinvest annual fee | Notes |

| ISA, Junior ISA, SIPP or General Investment Account (GIA) | Up to £250,000 | 0.40% | Minimum charge of £120 for a SIPP |

| ISA, Junior ISA, SIPP or General Investment Account (GIA) | £250,001 to £500,000 | 0.20% | |

| ISA, Junior ISA, SIPP or General Investment Account (GIA) | £500,001 to £1m | 0.10% | |

| ISA, Junior ISA, SIPP or General Investment Account (GIA) | Over £1m | No charge |

Bestinvest trading fees

Below we list the fees you will be charged for trading with Bestinvest:

| Type of trade | Fee |

| Online dealing fees for funds (unit trusts) | No charge |

| Online dealing fee for UK shares (including investment trusts and ETFs) | £4.95 |

| Online dealing fee for US shares (including investment trusts and ETFs) | No charge (0.95% foreign exchange fee) |

| High value dealing fee (equity trades over £100,000) | £4.95 |

| Phone transaction | £30 |

Bestinvest coaching and advice fees

Bestinvest offers a number of options to clients who may require extra help and guidance. It offers free coaching sessions which can be booked online with a qualified financial planner. Those that require a little more help with their financial planning can pay to access further advice and we explain the costs of the coaching and advice services below:

| Service | Fee |

| Coaching | Free and unlimited |

| Advice - Investing for your goals | £295 |

| Advice - Portfolio healthcheck | £495 |

Bestinvest customer reviews

Bestinvest is rated 4.4 out of 5.0 stars on independent customer review site Trustpilot from over 1,150 reviews. 61% of reviewers rated it as 'Excellent' while just 12% rated it as 'bad'. Many of the positive reviews mention helpful customer service and excellent advice while some of the negative reviews cite the website as being basic and that it provides a poor user experience, however, it is worth noting that Bestinvest's site has since been revamped.

Bestinvest performance

Below, we have compared 7 of Bestinvest's 'Expert' ready-made portfolios with equivalent portfolios from competitors Moneyfarm* and Nutmeg. As you can see, the portfolios have fared particularly well in a year that was heavily impacted by stock market volatility.

| Portfolio Type | Bestinvest 2023 performance | Nutmeg 2023 performance | Moneyfarm 2023 Performance |

| Defensive | 7.04% | 6.40% (Portfolio 2) | 4.60% (Portfolio 1) |

| Conservative | 7.23% | 6.90% (Portfolio 3) | 6.70% (Portfolio 2) |

| Cautious | 8.07% | 8.20% (Portfolio 4) | 7.60% (Portfolio 3) |

| Balanced | 8.66% | 8.70% (Portfolio 5) | 9.00% (Portfolio 4) |

| Growth | 9.45% | 10.40% (Portfolio 7) | 10.30% (Portfolio 5) |

| Adventurous | 10.11% | 11.30% (Portfolio 8) | 11.50% (Portfolio 6) |

| Maximum Growth | 11.01% | 12.20% (Portfolio 10) | 12.40% (Portfolio 7) |

Updated 22/01/24

Bestinvest alternatives

From an ISA charges perspective, Hargreaves Lansdown* and Bestinvest are on a par. In terms of SIPP charges then Charles Stanley* is on a par, however it charges a SIPP administration fee of £100 + VAT if you hold less than £30,000, a charge that Bestinvest has recently scrapped. So it then comes down to which platform is easiest to use and has the best functionality. Hargreaves Lansdown's popularity is a testimony to its strength in those areas, even if it isn't the cheapest investment platform for everyone.

Interactive Investor* can be a cheaper alternative for sophisticated investors thanks to its subscription charging model. Those wishing to invest in a SIPP might be interested in Interactive Investor's Pension Builder* plan which charges a flat fee of just £12.99 per month or those with smaller pensions may wish to look at Pension Essentials* plan which costs just £5.99 per month.

If you just want to invest in a ready-made portfolio then there are other alternatives from robo-advisers such as Wealthify, Nutmeg and Moneyfarm* (the latter also offers guidance sessions with a financial planner), with Nutmeg also offering a selection of fixed allocation portfolios, similar to the 'Smart' portfolios offered by Bestinvest. Or if you just want an index tracking fund then you could consider one of the Vanguard Lifestrategy funds bought via the Vanguard Investor platform.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Interactive Investor, Moneyfarm,