If you are looking for a low-cost online investment platform, you may be looking to compare Nutmeg and Moneyfarm. In this article we put the two robo-advisers side-by-side, comparing their key features and investing track record to see which is best for you.

If you are looking for a low-cost online investment platform, you may be looking to compare Nutmeg and Moneyfarm. In this article we put the two robo-advisers side-by-side, comparing their key features and investing track record to see which is best for you.

We also show you the offers we have available for our readers for both Nutmeg and Moneyfarm*, which means they will run your money fee-free for a year when you open an account with a minimum of £500 (terms and conditions apply).

Moneyfarm vs Nutmeg - which is better?

| Moneyfarm | Nutmeg Fully Managed | |

| Minimum investment | £500 | £500 (£100 for JISA and LISA) |

| Management fees | Up to £10,000 - 0.75%

£10,001 to £20,000 - 0.70% £20,001 to £50,000 - 0.65% £50,001 to £100,000 - 0.60% £100,001 to £250,000 - 0.45% £250,001 to £500,000 - 0.40% Over £500,000 - 0.35% The fee you pay is based on the total value of your portfolio so if you invest £75,000 you will pay a total fee of 0.60% Additional underlying fund charges |

Up to £100,000 - 0.75%

Over £100,000 - 0.35% Additional underlying fund charges |

| Products | ISA, General Investment Account, Junior ISA, SIPP | ISA, General Investment Account, Junior ISA, Lifetime ISA and SIPP |

| Number of portfolios | 7 | 10 |

| Ethical portfolios | 7 | 10 |

| Other options | Thematic investing, Liquidity Plus (money market funds), Share Investing | Thematic investing |

| Customer reviews (Trustpilot) | 4.3/5.0 | 4.1/5.0 |

| Money to the Masses offer | No management fees for 12 months (terms and conditions apply)* | No management fees for 12 months (terms and conditions apply) |

Moneyfarm vs Nutmeg - minimum investment

Moneyfarm and Nutmeg match up in terms of the minimum investment needed to open an account, with both requiring at least £500 for its ISAs, GIAs and SIPPs. The point of difference is with the JISA and LISA (the latter of which Moneyfarm doesn't currently offer), which require only £100 minimum investment with Nutmeg.

Moneyfarm vs Nutmeg - fees

Nutmeg and Moneyfarm have been engaged in a battle with their fee structures, with Nutmeg changing its fees to its current 0.75% up to £100,000 and 0.35% over £100,000 to bring it in line with Moneyfarm's charges. However, Moneyfarm reworked its own fees in February 2020, with the result that it beats Nutmeg in price up to £100,000 and matches it for pots over £100,000. Moneyfarm then changed its fees once again in May 2022, introducing additional tiers into its fee structure. However, the fee that customers pay is payable across the entire portfolio, meaning customers will pay less as they invest more.

Moneyfarm vs Nutmeg - products

Both Moneyfarm and Nutmeg have stocks and shares ISAs, GIAs, JISAs and a SIPP. However, Nutmeg goes one step further by also offering a lifetime ISA (LISA), which is useful for those looking for different investment options.

For an overview of LISAs, you may find our article "Lifetime ISAs explained - are they the best way to save?" helpful.

Moneyfarm vs Nutmeg - portfolios

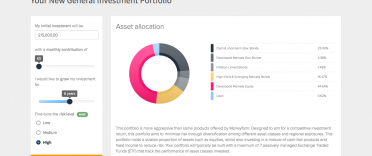

Nutmeg has a greater degree of choice of portfolios than Moneyfarm, with 10 risk-rated portfolios in its Fully Managed range, compared with Moneyfarm's 7 portfolios. Both Nutmeg and Moneyfarm also offer a range of cheaper fixed allocation portfolios as well as access to Thematic investing. Nutmeg also offers a range of actively managed Smart Alpha portfolios, while Moneyfarm has recently launched Moneyfarm Share Investing which gives customers the ability to also invest directly in a range of shares and ETFs.

For this comparison we are focusing on the Nutmeg Fully Managed range, which, like the Moneyfarm portfolios, are ranked according to risk rating, with level 1 being for the most cautious investors for both Nutmeg and Moneyfarm.

Moneyfarm vs Nutmeg - ethical portfolios

With a growing number of people opting for ethical investments, it is perhaps unsurprising that Moneyfarm and Nutmeg have ranges of SRI portfolios, which, like their standard portfolios, are risk-rated. They are constructed using passive funds that adhere to their ethical investment policies.

In terms of extra investment costs associated with these ethical options, there is barely any difference between Moneyfarm's standard and ethical portfolio charges, which stand at an average of 0.29% and 0.30%, respectively. For Nutmeg the investment cost for its Fully Managed portfolio is around 0.25%, while for its SRI range it's around 0.35%.

Moneyfarm vs Nutmeg - performance

Moneyfarm's track record goes back to its launch in 2016, while Nutmeg has over 10 years of past performance data. In addition, Nutmeg has 10 portfolios compared with Moneyfarm's 7 portfolios, which makes drawing a like-for-like comparison of returns challenging. However, to provide an overview, in the table below we have listed the returns of the Moneyfarm portfolios in 2023 alongside the equivalent portfolios Nutmeg offers.

Comparison of Moneyfarm and Nutmeg Returns 2023

| Moneyfarm | Nutmeg Fully Managed | |

| Moneyfarm Portfolio 1/Nutmeg Portfolio 1 | +4.6% | +5.2% |

| Moneyfarm Portfolio 2/Nutmeg Portfolio 3 | +6.7% | +6.9% |

| Moneyfarm Portfolio 3/Nutmeg Portfolio 4 | +7.6% | +8.2% |

| Moneyfarm Portfolio 4/Nutmeg Portfolio 5 | +9% | +8.7% |

| Moneyfarm Portfolio 5/Nutmeg Portfolio 6 | +10.3% | +9.7% |

| Moneyfarm Portfolio 6/Nutmeg Portfolio 7 | +11.5% | +10.4% |

| Moneyfarm Portfolio 7/Nutmeg Portfolio 8 | +12.4% | +11.3% |

Broadly speaking, Nutmeg slightly outperformed Moneyfarm, with its lowest and mid-risk level portfolios. Moneyfarm fares particularly well in terms of its higher-risk portfolios with Portfolios 5,6,7, and 8 slightly outperforming the equivalent portfolios from Nutmeg. It is worth remembering, however, that past performance is not a guarantee of future performance. For a more in-depth comparison of the performance of both Moneyfarm and Nutmeg portfolios over the last three years see our article "Which is the best-performing stocks and shares ISA?"

Moneyfarm vs Nutmeg - customer reviews

In 2024, Moneyfarm is rated 4.3 out of 5.0 on Trustpilot based on around 1,300 reviews. Nutmeg, on the other hand, has a score of 4.1 out of 5.0 based on around 2,100 reviews.

Approximately 68% of customers gave Moneyfarm 5 stars, while only 6% gave the company 1 star. Around 70% of reviewers gave Nutmeg 5 stars, while approximately 15% of customers gave it 1 star.

Summary: Moneyfarm vs Nutmeg

If you are looking for investment portfolio choice, an established track record and good returns over the past two years, Nutmeg is an attractive option as it ticks a lot of those boxes. If, however, you want to keep costs as low as possible, Moneyfarm is cheaper than Nutmeg for those with investments over £10k.

Another difference between the two is the fact Moneyfarm offers the services of an investment consultant and the potential for an investment review. Nutmeg has introduced an advice service, this comes at an additional cost and isn't as seamlessly integrated as with the Moneyfarm proposition. Another differentiator is that Nutmeg offers a Lifetime ISA product, which isn't currently offered by Moneyfarm.

Interestingly, Moneyfarm has just launched its Moneyfarm Share Investing service which allows customers to buy and sell UK shares, ETFs and UK Mutual Funds. Currently, this service is only available via an ISA share trading account or General Investment Account.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Moneyfarm